Evaluating NFT financialization methods

https://medium.com/1kxnetwork/show-me-the-liquidity-evaluating-nft-financialization-methods-f3c30bf8f08c

Nichanan Kesonpat, Feb 2022

Before the advent of DeFi primitives, the only way for users to acquire cryptoassets were through ICOs, OTC trades, or centralized exchanges with stringent listing requirements. For most fungible (ERC-20) tokens that launched into the ICO boom, the market was illiquid. DeFi protocols then came along and reduced time-to-liquidity for the long tail of tokens, resulting in the vibrant trading, lending, and leveraging activities we see in fungible token markets today.

Like the fungible assets of yesteryear, we can expect that DeFi protocols can step in unlock liquidity for the long tail of NFTs as well. We previously wrote about why NFT financialization is important, and outlined early examples of protocols that lie at the intersection of NFT and DeFi. Less than a year later, we now have a suite of financialization protocols to play around with. More importantly, we can also begin to develop frameworks to evaluate the merits of each liquidity mechanism against different “types” of NFTs.

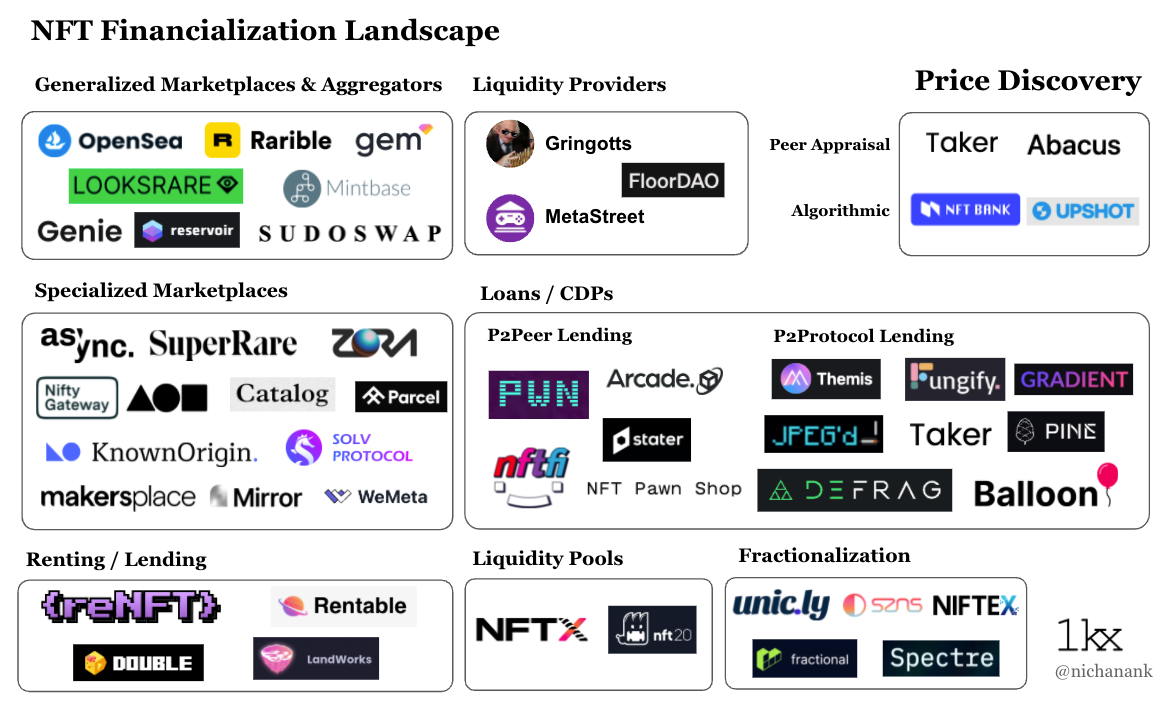

NFT Financialization Landscape — February 2022

Each liquidity mechanism comes with tradeoffs that render it more suitable for NFTs with certain properties over others. The uniqueness and varied properties of NFTs give rise to new challenges in sourcing liquidity. Some have utility, others are mere status symbols. Some have many “classes” or “rarity tiers” of items within a collection, others are completely unique. In evaluating how to best find liquidity for a given NFT, it’s worth defining properties under which to group different NFTs and map these properties against the liquidity method that makes most sense.

An NFT’s pricing property, and its price tier within the collection gives more insight into appropriate liquidity methods than which NFT “category” it belongs to. A common way to categorize NFTs is how they manifest themselves. For example as virtual land, PFPs, game assets, domain names, music, and artwork. However, when evaluating liquidity methods these categories may only give a partial picture because items across collections and NFT categories may behave more similarly than those within the same collection. Instead, properties pertaining to price are key.

In this article I will:

Map the current NFT financialization landscape

Discuss strengths and limitations of existing NFT liquidity methods

Define NFT price tiers, and the typical behavior of assets within those tiers

Map NFT price tiers to liquidity methods and comment on suitability

Existing NFT liquidity methods & their tradeoffs

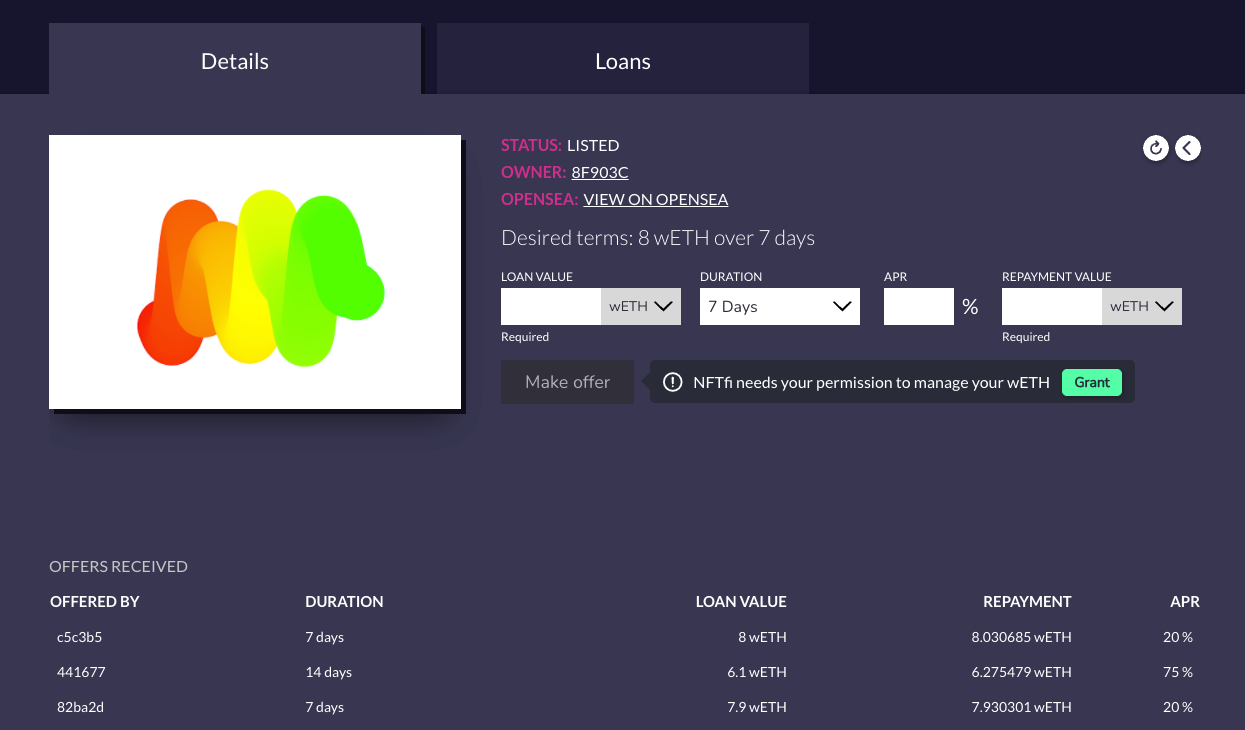

Marketplaces

Marketplaces allow users to find buyers and sellers of NFTs via order books and simple sale or auction mechanisms. They can be generalized (Opensea, Rarible) or specialized (e.g. SuperRare for art, Catalog for music, Parcel for virtual land). Marketplaces command large order books of listings and bids and are the most intuitive way for users to buy and sell NFTs. However, without an active market of participants or PR/marketing efforts, the market ends up illiquid for the long tail of assets.

Sale mechanisms are also a relatively capital inefficient method to do NFT valuation. 100% of its value must be spent to achieve price discovery, and the owner must part ways with their asset for good.

Auctions

Auctions have commanded exuberant profits for creators, and is a great way to get liquidity for assets like 1/1 artworks or rare items in a collection (“grails”). While high-profile bidding wars play no small role in putting NFTs on the map, auctions are even less capital efficient than marketplace sales as a means to price discovery as they require that bidders lock up capital. The capital lockup across multiple bidders always ends up more than or equal to what the asset ends up selling for.

On the sellers’ side, auctions typically require pre-negotiations with potential buyers or wide marketing efforts to bring attention to the sale. Without potential buyers already vying for the NFT, time-to-liquidity may end up taking very long.

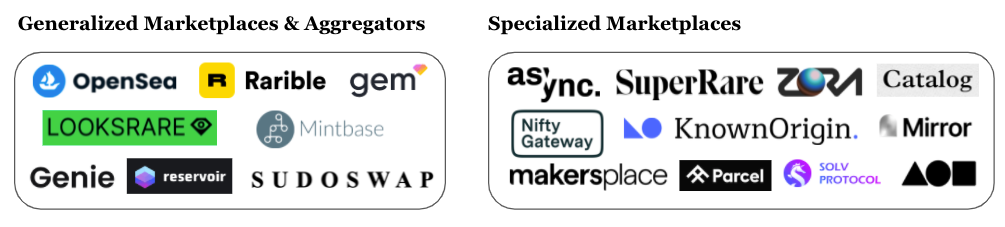

Aggregators

Aggregators such as Genie and Gem source liquidity from different marketplaces and command even bigger order books, thus potentially offer better time-to-liquidity than a single siloed marketplace. Users can also batch trades across marketplaces in one transaction.

Cross-Marketplace listing on Genie

Aggregators are most useful for collections where liquidity is fractured across different marketplaces. Cryptoartists, for example, typically have a presence across multiple art marketplaces. In fact, art marketplaces command the highest user cross-wallet activity compared to other NFT categories, suggesting users follow artists despite the marketplace or are relatively platform-agnostic. Aggregators can enter here and allow users to browse for artists’ work across different art marketplaces.

Source: Nonfungible.com

Loans/CDPs

NFT-collateralised lending protocols come in 2 main flavors, with complementary tradeoffs.

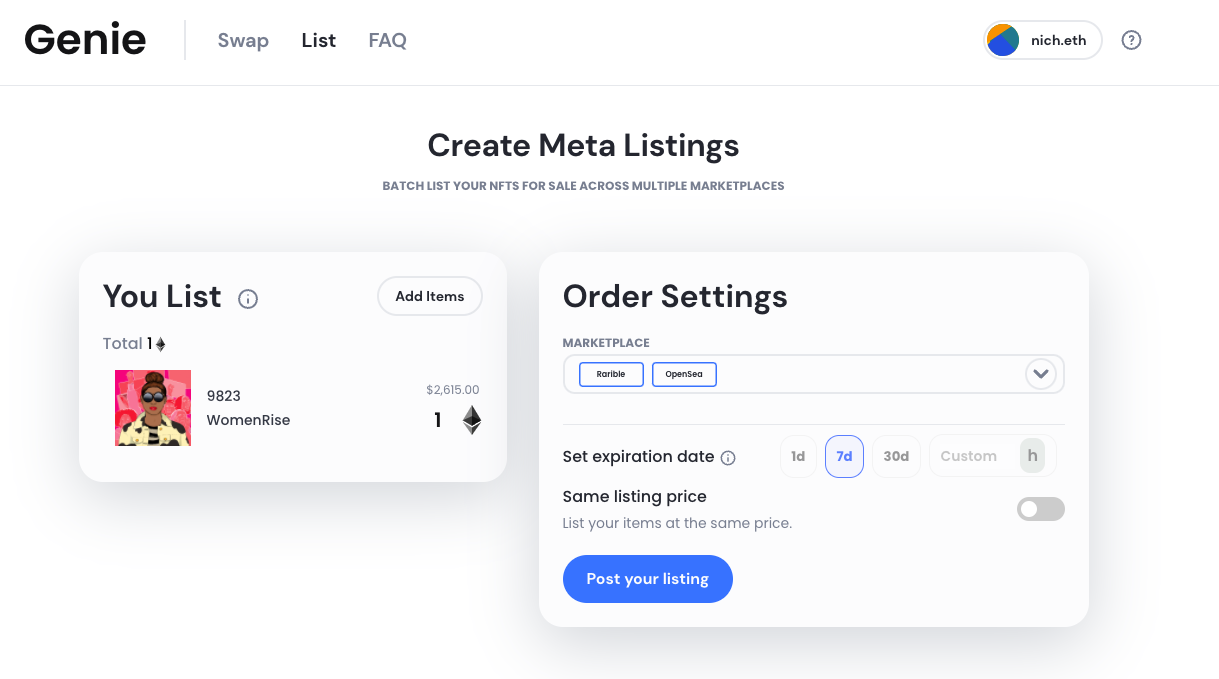

In P2Peer lending protocols like NFTfi and Arcade, the lender and borrower come to an agreement for loan terms (duration, loan-to-value ratio, and APR) in a peer-to-peer fashion. Because the matching process is manual (parties need to agree on terms, borrowers need to approve loan offers), time-to-liquidity may be slow. The advantage here is that loan terms are customisable on a per-user basis without a need to rely on price oracles. This is useful for items without a reliable price feed, and require specialized knowledge to conduct valuation.

Squiggle up for a loan on NFTfi

There is room here for underwriter DAOs with whiteglove valuation capabilities to come in to offer informed, favorable loan terms. Gringotts formed as a community of NFT collectors, traders, and analysts pooling capital to give out loans through NFTfi. In its first season, the DAO used its collective expertise to define valuation models which were deployed through automated and manual lending strategies. MetaStreet is building infrastructure on top of lending protocols to enable more efficient capital aggregation and risk tranching, drawing inspiration from traditional securitization markets.

In P2Protocol lending solutions like JPEG’d and DeFrag, lenders can agnostically provide liquidity to a protocol, which then automatically allocates capital to borrowers who have collateralized their NFTs.

Unlike its P2Peer counterpart, P2Protocol lending can offer instantaneous time-to-liquidity as the protocol takes care of the matching process. However, this means they must rely on price oracles to automate loan terms. Therefore, eligible collateral will be limited to collections that have reliable price feeds (those that are already liquid) or quantifiable properties that enable valuations to be determined algorithmically.

Taker takes a hybrid approach and bakes peer appraisal into their protocol. Liquidity providers can form or join a “Curator DAO’’ on Taker to collectively appraise assets. This serves as a pricing mechanism which feeds into lending activities, giving instant liquidity to borrowers with the highest appraisal value for their assets.

The nice thing about NFT-backed lending is that debt positions can, too, be represented as NFTs which can then be plugged into other financialization protocols. For example, NFTfi promissory notes can be further leveraged or utilized in other hedging strategies.

It’s important though to consider that loan-to-value ratio is always less than 100% (typically 50%), and APRs may be high depending on the collateral’s risk profile as determined by the lender or protocol (60–80% for high-risk assets compared to 18–25% on blue-chips on NFTfi).

Liquidity Pools

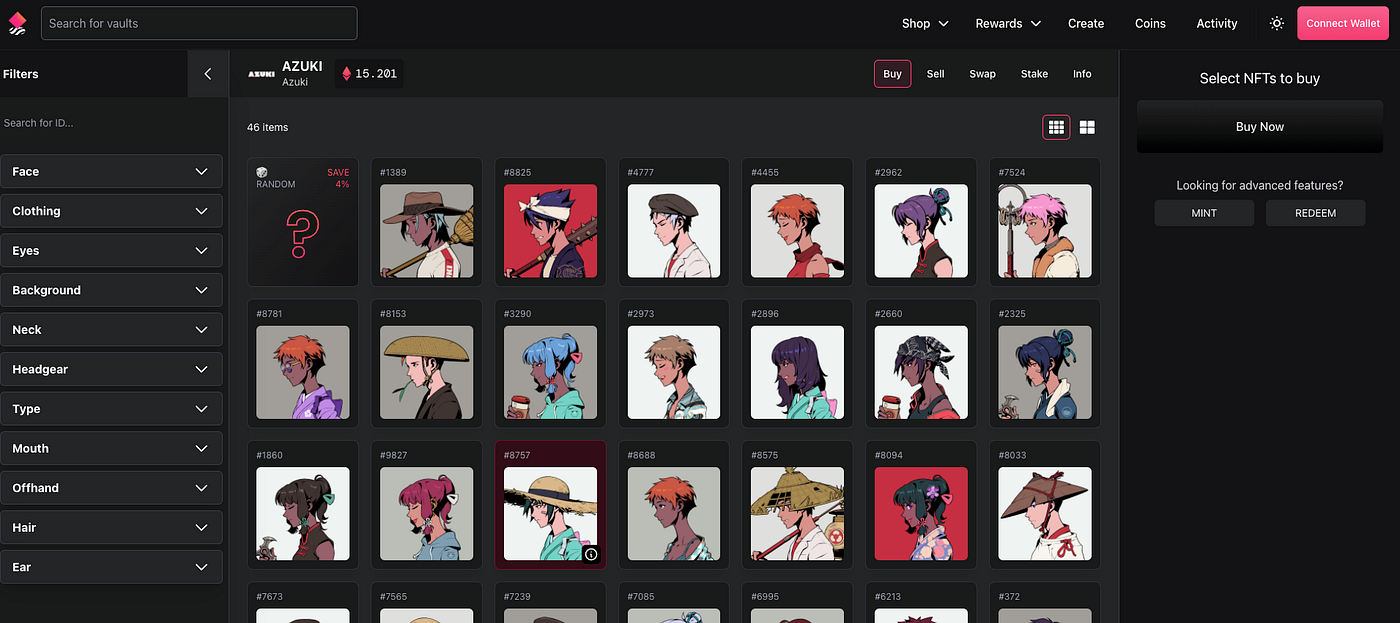

Liquidity Pools allow individuals to deposit similar NFTs into a pool, minting a derivative fungible token that can be used to redeem any asset in the pool at any given time. NFT-LP protocols like NFTX and NFT20 effectively become marketplaces built on top of liquidity pools for “like” groups of assets.

Floor items are an obvious candidate for such protocols, but theoretically one can create liquidity pools based on certain traits for collections where non-floor items can be grouped into trait “classes”. Items within a class can be treated as fungible with one another, provided there is sufficient supply. Buyers can offer to purchase any asset that has that specific trait(s). Any non-floor or overpriced asset for a “class” will be arbitraged out of the pool, achieving price discovery.

Azuki Vault on NFTX. All items share the same Buy Now price

Instead of having to find a buyer for a specific NFT, liquidity protocols opens the pool of buyers to those that want to acquire any NFT of the same class, offering faster time-to-liquidity than ordinary marketplace sales. Moreover, while representative ERC-20 tokens (e.g. NFTX’s vTokens) can be traded in any amount, the individual NFTs are not actually fractionalized, and one can redeem one from the pool as long as they have a whole vToken, avoiding the governance overhead of multiple owners of fractions.

Like with lending protocols, there is room to build services atop NFT-AMMs. FloorDAO is a decentralized market maker on top of NFTX. Through Olympus-style bonding, it “sweeps the floor” of community-voted blue chip projects, creating deep liquidity for the collection. This liquidity allows traders to instantly buy, sell, and swap assets, while the trading fees on DEXs and NFTX vault fees flow back to the DAO treasury.

Fractionalization

Fractionalization involves “splitting” an NFT into multiple fractions/pieces, which can then trade as fungible tokens (e.g. 1 NFT becomes 10,000 fungible tokens). By lowering the price to acquire a part of an NFT, more buyers can get exposure to the asset and its upside without having to purchase the entire piece. Fractions allow for composability with other DeFi protocols, and can command a premium to fair market value with a buyout clause.

The limitation with this method is the need to create new markets and supply liquidity per individual NFT, or more recently, per basket of NFTs. This introduces complexity around ownership and governance overhead, rendering this method more suitable for high value pieces, and less useful for low-value/floor assets.

Composability again allows applications to be built on top here. PartyBid — built using Fractional.Art smart contracts — is a crowdfunding platform that enables strangers to pool capital and collectively bid on NFTs. If the auction is won, capital contributors receive the fractionalized tokens pro rata to their contribution amount.

Zombie Punk auction won by a crowd for 1202 ETH on PartyBid. Each contributor issued a pro-rata share of Fractional NFT fraction tokens.

Szns takes another approach and enables communities to create lightweight curation DAOs that collectively govern fractionalized baskets of NFTs — called “Albums”. Album DAOs launch with similar parameters for each community, and can define their own processes for buyouts, NFT management, token distribution, and arbitrary actions.

Renting/Lending

Renting/Lending protocols allow users to rent out their NFTs in exchange for a steady fee (Twitter PFP rental) or future revenue (YGG lending Axies to new players in exchange for future SLP earned in Axie Infinity). While reNFT and Rentable are more generalized, there is also room for specialized rental platforms aimed at specific NFT categories (e.g. Double for game assets, Landworks for virtual land) that enable sector-specific use cases. Landworks for example enable renters to pool capital together to rent adjacent land parcels for larger events.

While typically only gets NFT owners a fraction of their asset’s value, it’s a good option for collectors who don’t want to part ways with their assets to earn yield on idle NFTs. For low velocity, high-value assets, renting is a valuable additional source of demand and liquidity.

Decentraland parcels available for rent on Landworks

Other Price Discovery Solutions

Before we map NFTs to their liquidity methods, it’s worth discussing 2 emergent solutions to price discovery and map them against NFT price properties.

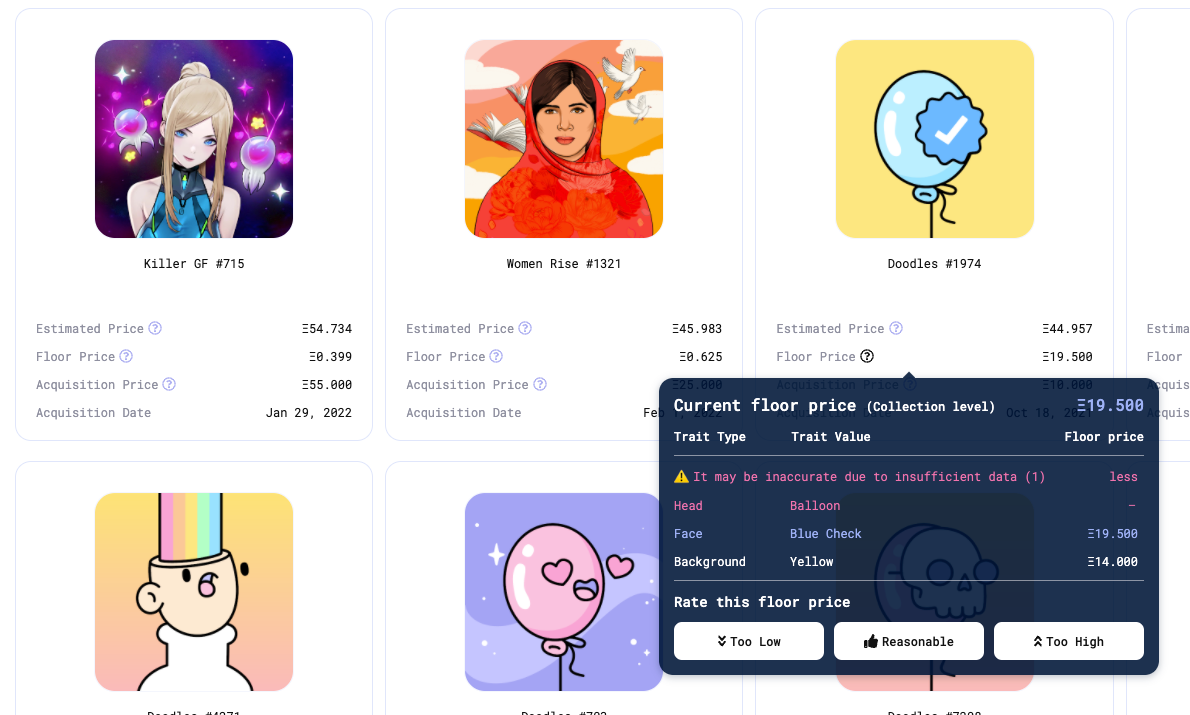

Algorithmic

Despite the often-cited uniqueness of NFTs, collectibles markets are often priced on quantifiable properties such as trait rarity (Alien Punks). In these cases, pricing can simply be computed based on historical sale data. NFTBank uses machine learning to predict prices of assets based on past pricing of similar assets.

Algorithmic Portfolio Valuation on NFTBank

This is a more capital efficient means to price discovery because the fixed cost of developing pricing models is amortized across many assets over time. However, given the relatively low amount of available data on top-tier items (“grails”), this method is likely most useful for liquid items within a collection for the foreseeable future (floors, mid-tier). Data-driven approaches are also less useful for items that are subjectively priced, like 1/1 art, for which crypto-economically incentivized appraisal protocols may be more suitable.

Peer-prediction or Appraisal-based

Peer prediction incentivizes participants to honestly answer questions about the valuation of an asset. In its first version, Upshot enabled NFT owners to put their assets up for valuation, and in turn incentivised individuals to appraise them using a crowdsourced approach*. Abacus offers another way for sellers to discover a spot price on their NFTs without having to give up ownership of their asset by creating a liquid market for traders to speculate on the value of an NFT’s pool.

Like the algorithmic methods, the valuation costs through peer prediction are amortized across a large number of assets.

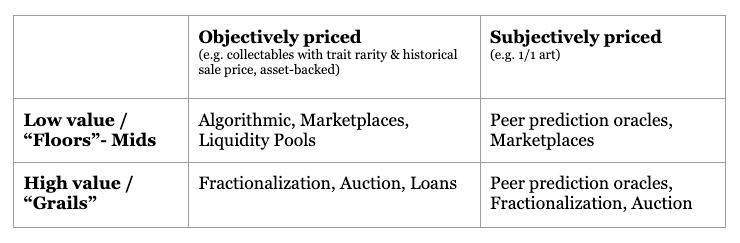

Considering these trade-offs, we can deduce a simple mental model for appropriate price discovery methods for NFTs with certain price properties.

Defining Price Tiers

A rough framework to think about NFTs within a collection is the price “tier” that they fall under. By setting price bounds relative to the floor, we can map out the price distribution across collections:

Floors. Floor items typically make up the majority of a collection and behave homogeneously, rendering them especially suited for liquidity pools which effectively act as “Floor AMMs” through which users can earn yield on the trading activity of floor assets and enjoy deepest liquidity compared to other tiers. We define floors items here as being floor price to floor price * 1.4

Mids. Mid-tier NFTs within a collection may have properties that render them more valuable than floors, but are not the most valuable items in a collection. For the below graph we define this tier as items whose price lies between floor price * 1.4 and floor price * 2.5.

Top. Top-tier items (“grails”) can include blue-chip collections in general (e.g. Fidenzas, Autoglyphs, CryptoPunks), or coveted works by prominent crypto artists (e.g. XCOPY, Beeple, Hackatao). But for our purposes here they are the rarest, typically most sought after items within any collection. For example, Alien Punks, Black Suit Board Apes, and Matrix CrypToadz. We define grails here as being floor price * 2.5 and above.

Below is based on NFTBank data-pulls from 12/15/2021 and 01/15/2022: Former contained 279 collections with a total ~2.4mn NFTs evaluated at 3.7mn ETH market capitalization. The latter had 540 collections on ~14.2mn NFTs estimated with 8.9mn ETH.

*Prices are estimates by NFTBank algorithm. The data was pulled on 01/15/2022 and contains ~14.2 million NFTs across 540 collections, totalling 8.9 million ETH in market cap.

Across collections, we can see that floors (blue) make up the majority of items.

# Item share of NFT collections that fall into floor tier (blue), mid (orange), top (green)

Things get a bit noisier when we look at market share for each price tier. This is because it is common for collections to have grails that are 10–1000x above the floor, eating into the collection’s market cap.

Market shares of NFT collections that fall into floor tier (blue), mid (orange), top (green)

While at first glance it seems like financialization protocols targeted at floor items have the largest slice of the addressable market, there is plenty of untapped value in finding liquidity solutions for mid- and top- tier items.

Mapping NFT Price Tiers to Liquidity Methods

Putting this all together, we arrive at a matrix that provides a rough mental model of where to look for liquidity for NFTs, depending on their price tier, supply, and utility.

Summary of the above discussion. Mapping NFT price tiers to their most effective liquidity methods.

Future Work

Beyond the development and adoption of the aforementioned financialization projects, some things I’ll be keeping an eye out for are:

Specialization. Just like how there are generalized and specialized marketplaces today, it wouldn’t be surprising to see other financialization products emerge to target specific NFT categories — we’re starting to see land rental platforms, for example. The rapid proliferation of NFT projects across categories will soon render it futile to consider “NFTs” as a singular ecosystem. Instead, the NFTs and financialization products for virtual land, art, game assets etc. will be standalone ecosystems, with specialized protocols serving as the infrastructure layer for each vertical.

Composability. Protocols can leverage each other for further utilization of idle assets. For example, an NFT liquidity pool could reuse assets inside the AMM, renting them out or use as loan collateral. Or an NFT that is used as loan collateral could also be rented for the same duration. Locked NFT’s can either be used to leverage liquidity or to offset loan repayment.

Service DAOs. Communities of analysts, appraisers, underwriters, and liquidity providers will continue to emerge to either drive or service demand for financialization protocols. These can form from within communities of these protocols themselves, or a more agnostic party of NFT collectors. Service DAOs will play a key role in helping protocols bootstrap adoption, improving valuation capabilities and reducing time-to-liquidity for NFT holders.

New NFT Derivatives. For example, Putty is a put options marketplace that allows users to trade put contracts on any basket of NFTs or ERC-20s. NFT owners can hedge downside risk by buying a put contract, sold by speculators who believe the NFT will not decrease past that certain price point.

In this article we defined price tiers and shed some data about their market share for the purposes of mapping NFTs to their most suitable liquidity methods. However, we only scratched the surface when it comes to the price data itself, how it’s distributed across collections, what the common price distribution patterns are, and how distributions change over time. A more in-depth article that expands on these topics is in the works.

The potential for NFTs remains untapped despite trading volumes having recently surpassed $45 billion on Ethereum alone. Many are still dismissing NFTs as an illiquid asset class. But as we have seen with previous waves of innovation, a proliferation of apps is soon followed by a wave of infrastructure that enhances those apps and unlocks more complex use cases in alternating, responsive cycles. If 2020–2021 was the NFT boom, we are now about to ride an upcoming infrastructure wave — one that will dramatically enhance what we are able to do with them — by solving the liquidity problem.

Last updated