Inside Yield Farming

https://defiprime.com/defi-yield-farming

William Peasteron, Jun 2020

Actual farmers measure yield as the total amount of a crop that’s grown. Accordingly, DeFi proponents have now latched onto the farming metaphor and memed into existence “yield farmers,” i.e. folks who measure yield as the amount of interest that’s grown atop underlying crypto assets like Dai, USDC, and USDT when put to use in DeFi platforms like Compound.

The DeFi arena was already catching fire in 2020 before yield farming exploded onto the scene, but things have definitely kicked into overdrive in the sector thanks to the beginning of Compound’s COMP governance token distribution system in June. Simply put, the scheme rewards Compound users with COMP.

Before the distribution system started, Compound was the second-largest DeFi project per total value locked in its smart contracts. Yet just days after the system’s launch, Compound’s now decisively the largest DeFi project and its COMP token has the largest market cap of any DeFi token at press time. Why? Droves of traders have migrated to Compound to use the platform in order to “farm” COMP.

This buzz around the biggest happening in DeFi this year so far has had more than a few crypto users renewing their focus on various yield farming activities already available in the ecosystem, e.g. through projects like Balancer, Curve, and Synthetix. That said, yield farming is not necessarily new, but the surge of attention around such cryptonative opportunities absolutely is. Let’s dive deeper into DeFi’s hottest meme right now to better wrap our heads around what it means for us users.

COMP Farming

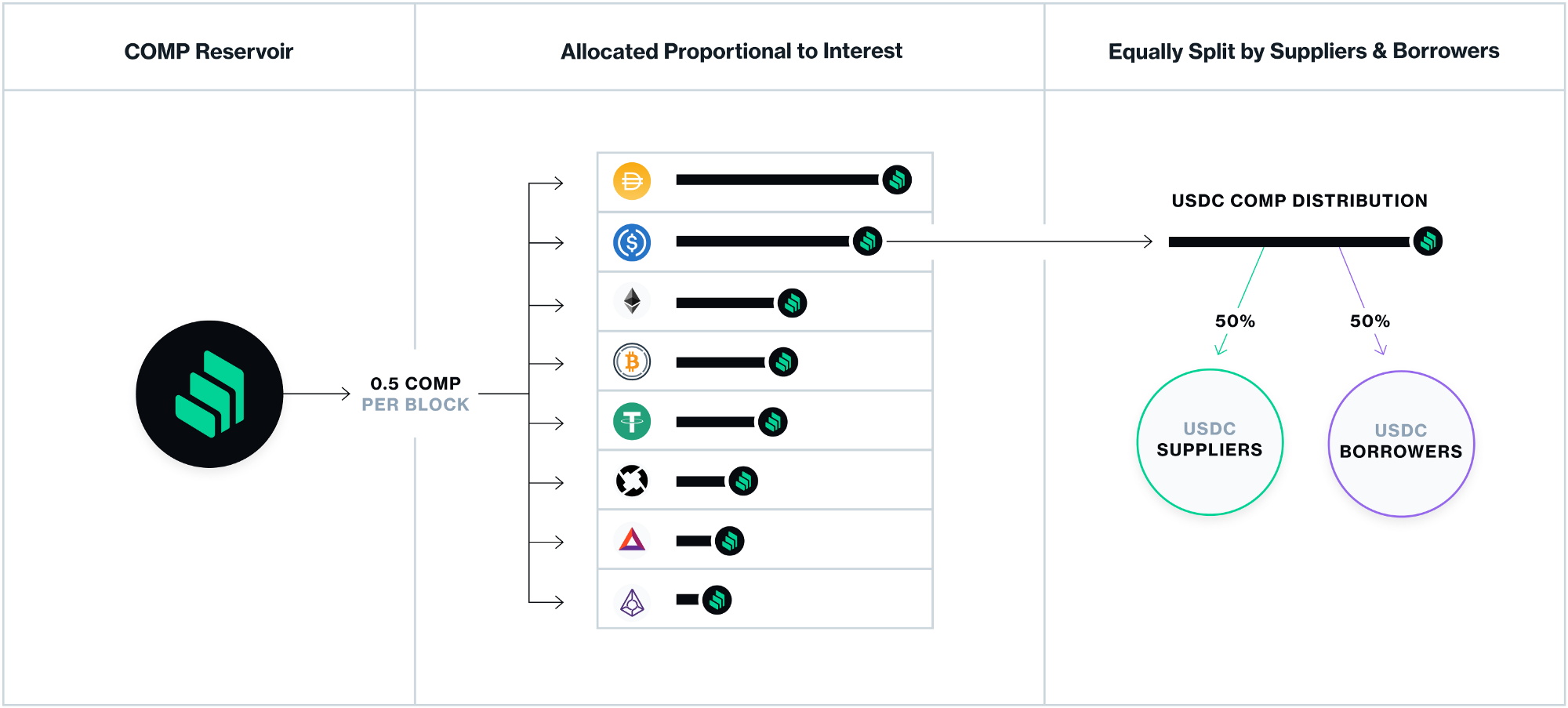

For the next 4 years, Compound is offering “liquidity mining” for liquidity providers. This means that anyone that borrows or supplies assets on Compound in this span will be rewarded with a proportional allocation of COMP, of which 2,880 are distributed daily.

The start of this reward system caught the attention of plenty of traders. In the days since, many folks have moved their assets into Compound in order to start yield farming COMP distributions. Additionally, third-party projects are helping to facilitate COMP farming like the smart wallet project InstaDApp, which rolled out a “Maximize $COMP mining” widget to help users easily hop in on the action in just a few clicks. Essentially, it’s mining using a leveraged position: people borrow and deposit assets simultaneously in order to get more COMP. You can perform the same actions manually without a smart wallet, but something like InstaDApp makes this yield farming much easier, in just a few clicks.

InstaDApp’s made yield farming easy for Compound users.

BAL Farming

Balancer is an automated-market maker (AMM) that allows users to create liquidity pools composed of multiple ERC20 tokens in contrast to the 1:1 pools used by Uniswap. This makes Balancer a flexible protocol, but it’s also newer. Its builders want its governance to be fully decentralized and also do some bootstrapping. For these reasons, the Balancer team recently kicked off its own liquidity mining campaign.

To that end, BAL is the governance token of Balancer. Of the 100 million BAL ever to be minted , up to 65 million have been set aside to reward liquidity providers. 145,000 BAL are now being distributed to these providers on a weekly basis, which has led to traders parking their funds in Balancer pools to yield farm the BAL awards.

sUSD Liquidity Trial

Back in March, Synthetix launched an incentives program for liquidity providers of sUSD, the native stablecoin of Synthetix, through the Curve and iearn exchange protocols. The 4-week test campaign was designed so that 32,000 SNX tokens would be “distributed pro-rata to liquidity providers who stake their Curve LP tokens.”

The system worked as follows: users deposited sUSD and another supported stablecoin (think USDC, USDT, or Dai) into iearn, at which point they’d receive an allocation of Curve.fi sUSD/y.curve.fi tokens. Depositors could then take these tokens to Mintr, the Synthetix ecosystem’s decentralized minting hub, and stake them in order to qualify for the trial’s SNX rewards. The idea, then, was that liquidity providers would get regular pool APY and incentives in the form of SNX, for providing liquidity for the Synthetix ecosystem. Obviously, that’s a very attractive campaign for yield farmers, where you’re earning interest on your parked digital assets as well as additional liquid digital assets you can instantly sell for profits on any DEX.

The Curve-Ren-Synthetix Farming Meld

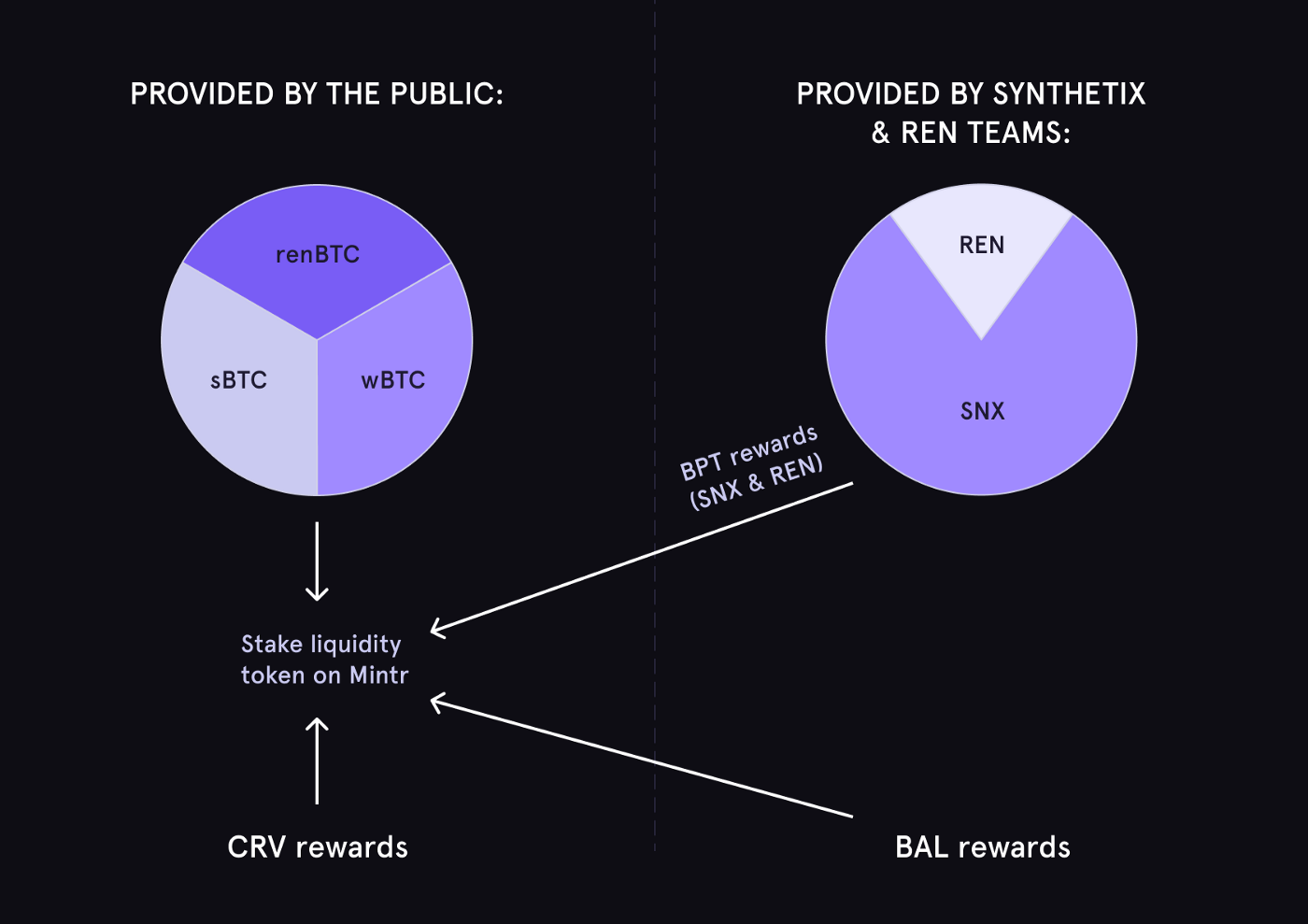

Another intriguing opportunity for yield farmers comes courtesy of a new partnership between Curve, Synthetix, and the interoperability project Ren and involves a 10-week incentivized BTC ERC20 liquidity pool.

Because of the unique way the system has been set up, participants who provide WBTC, renBTC, and sBTC liquidity to the new BTC Curve liquidity pool will simultaneously earn BAL, SNX, REN, and CRV (Curve’s coming reward token). That’s a yield farmer’s dream come true, but how’s it possible? First off, the Synthetix and Ren teams have created a Balancer pool composed of SNX and REN tokens. This pool will generate BAL from Balancer’s liquidity mining campaign, as well as liquidity provider (LP) rewards in the form of BPT, which is simply a wrapped combination of SNX and REN.

For 10 weeks, then, this generated BAL and BPT will go to depositors who provide liquidity to the BTC Curve liquidity pool. Additionally, the LPs will also be allocated CRV tokens for servicing Curve.

Futureswap

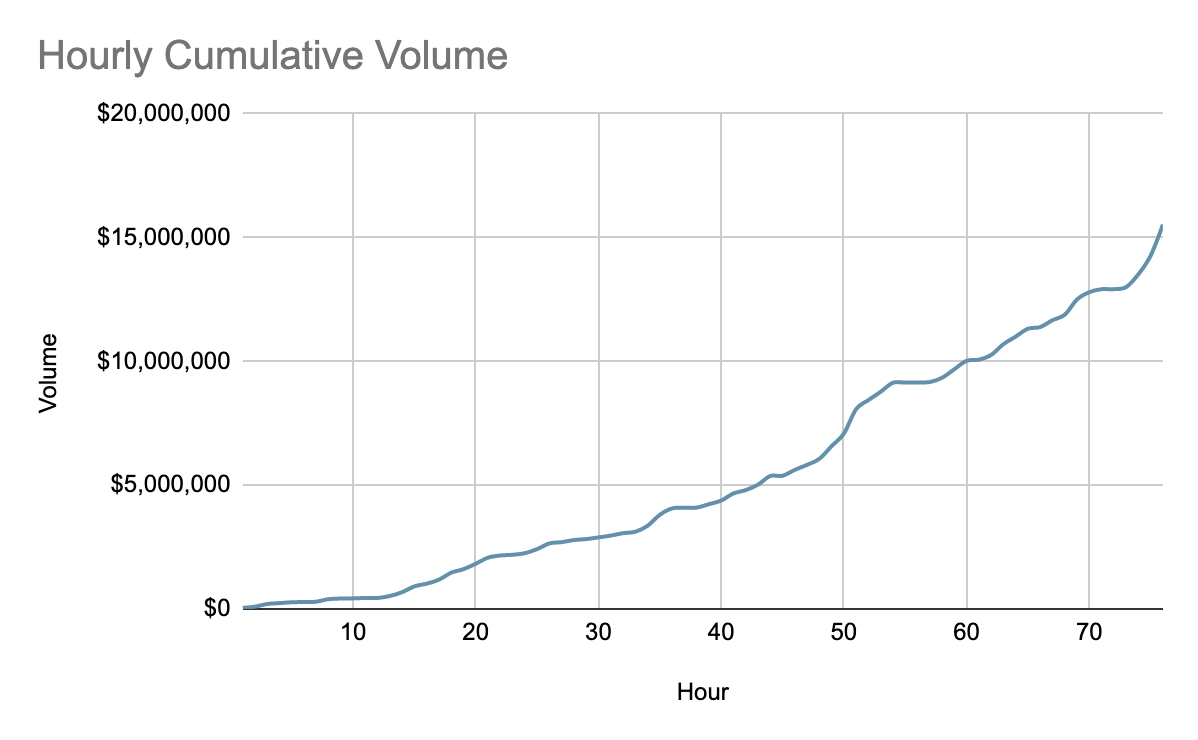

Futureswap is a decentralized futures exchange that’s billed as being both for “traders and yield seekers.” That said, users get paid for providing liquidity on the platform. The project hasn’t fully entered the limelight yet, but users got a taste of what may be to come after the exchange ran a 3-day Alpha release earlier this year.

Why only 3 days? Because the demand to use Futureswap was so explosive in that span that the project’s builders saw enough and decided to shutter the Alpha platform early just to be cautious. But those who used the exchange while it was live saw potential. In a follow-up analysis, the Futureswap team said high volume during the Alpha “translated into the outperforming of holding equal value amounts of ETH/DAI for liquidity providers of over 550% annually.” That margin will certainly get most yield farmers’ attention.

Conclusion

Yield farming has exploded onto the DeFi scene and captured peoples’ imaginations, and the fervor at hand makes it easy to envision this exciting meme going on to attract people to Ethereum for years to come. But remember: it’s not all fun and games, either. As Ethereum stalwart Eric Conner recently put it, yield farming does have liquidation risks and smart contract risks, and as such you should never farm with money you’re not willing to lose while things are still early.

Be curious, but don’t be reckless. Yield farming is new and isn’t going anywhere, so there’s no need to rush in. And in zooming out a bit, the fact that yield farming isn’t going anywhere makes it yet another ace for Ethereum when it comes to fostering interesting things that users want.

Last updated