The true sources of DeFi yield

https://incentivized.substack.com/p/where-do-defi-yields-come-from

Yuga.eth, Jan 22

From https://ethereumprice.org/guides/article/yield-farming/

One of the most distinctive characteristics of Decentralized Finance (DeFi) is the prevalence of the concept of “yield.” Every day, new protocols advertise absurdly high numbers in an attempt to attract customers: 97% APR on ThisCoin, 69,420% APY on ThatCoin, and so forth. Of course, this property of DeFi is also what makes newcomers suspicious. How could a new protocol on a blockchain you’ve never heard of possibly earn a billion percent when the rate for a typical savings account is 0.5%?

This article will demystify the notion of DeFi yield. We will lay out the most common mechanisms by which DeFi protocols provide yield to their customers, and in particular, we will make the following argument:

DeFi yield comes from the value of the underlying DeFi protocol. Thus, locking up your money with a yield-generating DeFi protocol is a bet that the protocol itself is intrinsically valuable.

Let’s dive in.

Definition of “Yield”

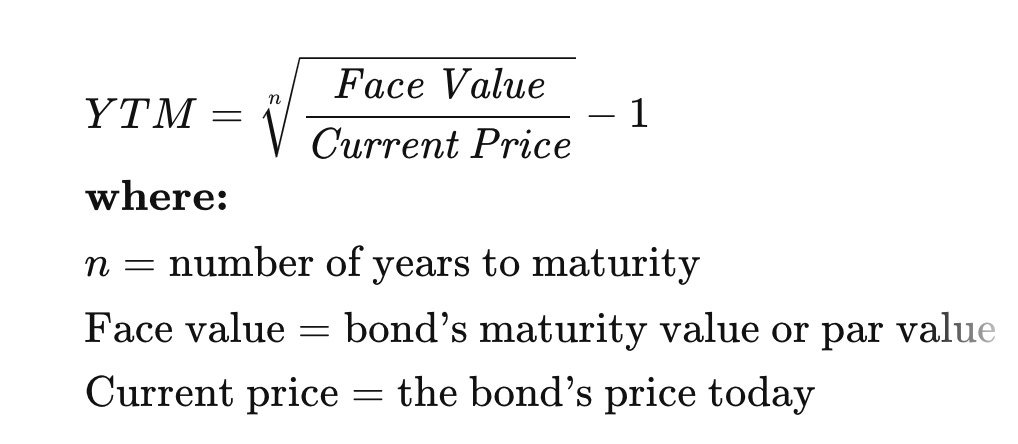

For the purposes of this article, we will define yield to be the rate at which a financial position expects to accrue value. This is roughly consistent with TradFi’s definition of “yield-to-maturity” (YTM) for bonds, which is the interest rate at which the bond reaches par value given current prices. So broadly speaking, if you hold 1.0 unit of value, and you deposit it into a protocol with a 10% yield, you should expect to have 1.1 units of value after a year.

From Investopedia

Denominating Value

Notice how I used the word “value” above. How does one denominate “value”? The fact is, it’s up to you: understanding denomination of value is the key to understanding DeFi yield.

As an example, let’s suppose that a DeFi protocol offers 1,000% yield for staking its native asset, ThisCoin. ThisCoin is currently trading at $2 per coin. You take $100, buy 50 ThisCoins, and stake the entire sum and expect to receive 50 * 1,000% = 500 ThisCoins at the end of a year.

A year passes, and you indeed do receive 500 ThisCoins back: you have achieved 1,000% yield! But now, each ThisCoin costs just 1 cent. That means that your 500 ThisCoins are worth $5, and in dollar terms, you suffered a 95% loss. On the other hand, if each ThisCoin costs $20 per coin, then you now have a $10,000 stack, for a 10,000% yield in dollar terms.

The point is this: whether you value the 1,000% yield in ThisCoin more than the 95% loss in US Dollar value is up to you, depending on whether you believe ThisCoin holds more intrinsic value than the US Dollar. (In this case, it probably doesn’t.)

The example serves to illustrate that to understand a protocol’s yield, you must understand the assets by which the yield is being disbursed. The potential fluctuations in the value of the yield-disbursed assets is a risk that needs to be taken into consideration.

Calculating Yield

Even with the proper denomination of value, there can be a great deal of variability in the way that yield is calculated. Here are some common aspects that you should be aware of when you see a sky-high number for the yield.

APR vs. APY: The annual percentage rate is the amount of additional value you accrue per year. The annual percentage yield is the amount of additional value you accrue per year assuming compounding (i.e. reinvestment of dividends). Depending on the specific protocol, assuming compounding may or may not make sense; use the figure that is a better fit for the protocol. See here for more details.

Lookback Period: The APY figures you see on DeFi protocols can be based on data from a time period in the past: it could be the past day, the past week, the past year, or anything else. Given the variability of market fluctuations, protocol performance, etc. the projected APY can change wildly. Thus, projected APY may or may not resemble actual APY depending on past and future market conditions. Mitigate this risk by understanding the time horizon on which protocol APY figures are computed.

Yield Mechanisms

DEXs / AMMs

Decentralized Exchanges (DEXs) and Automated Market Makers (AMMs) are the canonical example of yield-generating protocols. They are a seminal achievement in financial engineering, to the point of being known as “DeFi’s Zero-to-One Innovation.”

They work as follows: Liquidity Providers (LPs) deposit pairs of tokens into liquidity pools. The purpose of these pools is to allow traders to exchange one token for another without an intermediary; the exchange rate is determined algorithmically according to a formula like a constant-product. In return for depositing these tokens, LPs receive some portion of the fees charged to traders, proportional to the amount of the pool’s liquidity they provided. Fees are generally charged to traders in denominations of the pool tokens.

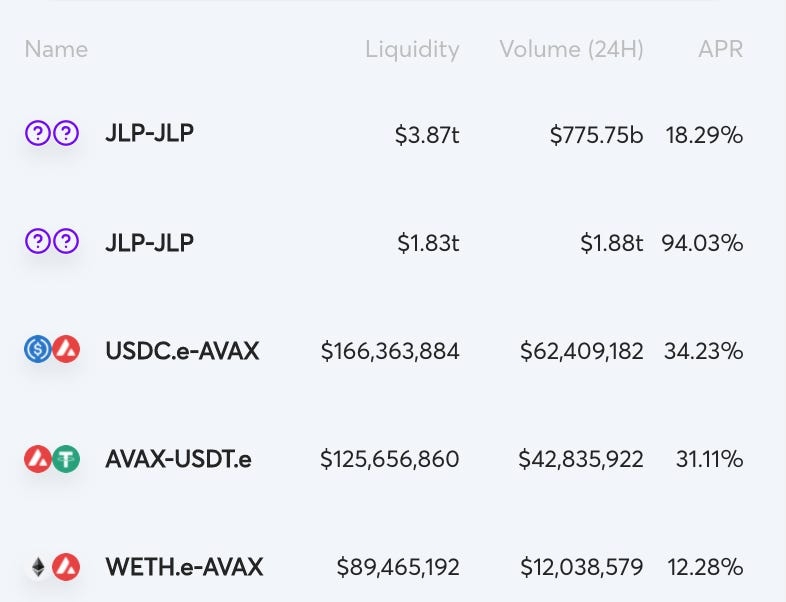

For example, in the last 24 hours, the TraderJoe USDC-AVAX pool received $156K in trading fees, disbursed to the LPs. Given the pool’s overall $166M value, this corresponds to an APR of $156K * 365 / $166M = 34.2% for liquidity providers.

From TraderJoe

The analogous setting in traditional finance (“TradFi”) would be a centralized order book, which keeps track of the highest bids and lowest asks of the assets in the market. The big difference is that in the TradFi setting, it is the exchanges and brokers that capture the trading fees, whereas in DeFi, it is the LPs that capture those same fees. There is a beauty to the fact that in DeFi, anybody can participate in any aspect of the market-making.

LPing is not without risk: if the relative values of the tokens change significantly, LPs can be subject to impermanent loss. With any DeFi protocol, there is also SmartContract risk of hacks and exploits.

But fundamentally, the source of yields for DEX and AMM LPs is clear: they come from trading fees. The traders are willing to pay these fees because the DEXs and AMMs are providing a valuable service: a liquidity pool and an automatic algorithm to swap assets. The more popular the trading pair, the greater the trading volume, the greater the fees, and thus, the greater the yields for LPs. In other words, the yield derives from the value of the underlying protocol

Lending Pools

Borrowing / lending pools are similar to DEXs / AMMs in that they are all about providing liquidity. The difference is that the liquidity is provided in the form of debt rather than sales.

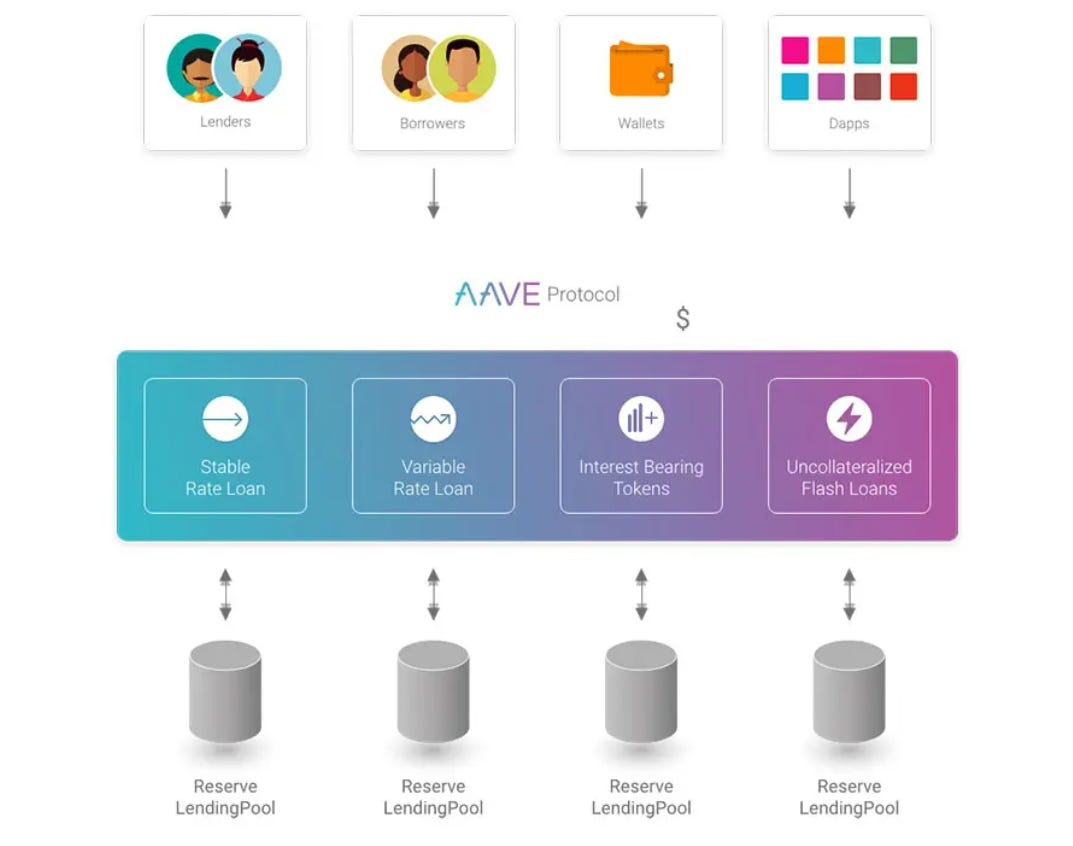

Let’s take AAVE as an example. Users can deposit their funds into a lending pool and expect to earn either a variable or fixed interest rate on it. On the other side, borrowers can deposit assets as collateral, and take out a loan of any other asset up to the value of a certain percentage of their collateral (the collateralization ratio). As long as the value of the collateral does not go below a certain threshold relative to the loan, the loan remains “healthy” and the borrower has unlimited time to repay the loan, with interest. When the value of the collateral goes lower than the threshold, however, it is liquidated (i.e. sold off) and the debt is canceled.

From AAVE

For example, borrowers may want to take out a loan in USDC in order to pay for their groceries. To do this, they deposit ETH. Two scenarios would result in a liquidation of their ETH and a closure of their loan: 1) If the price of ETH dropped enough, or 2) If the loan accrued enough interest. So long as neither of these events happen, the loan remains open. Once the loan is paid back, the borrower gets back their ETH.

Again, likening this to the TradFi setting: in the centralized world, it is the banks and other institutions (e.g. Fannie Mae and Freddie Mac) that capture the interest rate fees, passing on what are generally very low rates to depositors. In DeFi, the lenders themselves get to capture this value, and the interest rates are set algorithmically by open-source code.

Clearly, this type of service has intrinsic value: the ability to automatically cover, originate, liquidate, and close loans without a financial intermediary is valuable in and of itself: it eliminates the possibility of human error, allows greater capital efficiency, and so on. And if you lend your assets towards this end, you are being compensated for contributing value to the protocol. After all, if lending assets didn’t generate yield, you wouldn’t lend them, would you?

Staking

Many protocols use the term “staking” to refer to any locking-up-of-assets, but this is not correct. Staking, in its true sense, is to risk loss of value for potential gain of value.

In my opinion, the best example of how staking produces yield is the Proof-of-Stake mechanism, adopted by such blockchains as Cardano, Solana, and eventually Ethereum. These algorithms can be abstruse, with names like Ouroboros and Last Message Driven Greediest Heaviest Observed SubTree, but the intuition behind them is simple.

Proof-of-Stake is about ensuring that the transactions on a blockchain have integrity - there is no double-spending, fake accounting, and so on. To ensure that a series of transactions have integrity, validator nodes do the work of checking that every transaction is valid according to the rules of the blockchain.

How can we trust that the validators will do honest work? This is where Proof-of-Stake comes in. At a high level, it works as follows:

Users stake some amount of their asset with a validator.

Once staked, there is usually a minimum lock-up period, ranging from weeks to months. Eventually, users can unstake their asset.

For every honest piece of work that the validator does (e.g. computing transaction integrity, voting on correct blocks etc.), they are rewarded.

The rewards are disbursed to the stakers, and this is the yield.

For every dishonest piece of work that the validator does (e.g. violates rules, cheats, goes offline, etc.), they are slashed (i.e. some portion of funds are taken away).

The penalties are taken proportionately from the stakers.

Validators verify and vote on each other’s work to decide on honesty / dishonesty.

The security of Proof-of-Stake networks comes from the fact that the amount of capital it would take to control enough validators to make the entire network dishonest is intractable.

As a de facto successor to Proof-of-Work, Proof-of-Stake is a monumental achievement in the field of distributed consensus. By locking up your assets with a validator, you are earning yield by contributing to the security of the underlying network, which is intrinsically valuable, and you are risking the possibility of losses if the validator is dishonest or broken.

From ethmerge.com

Yield Optimizers

If you don’t want to think too hard about how to generate yield, an optimizer might be for you. These are giga-brained mechanisms that take your asset, perform a bunch of DeFi operations behind the scene, and return a larger amount of the asset to you in the end. The best analogy for this type of operation might be a mutual fund or hedge fund: you aren’t really doing the investing, you are outsourcing that to an algorithm.

Yearn Finance’s vaults may be the most famous example of this. They accept a bunch of different assets and employ a wide range of strategies to earn yield on your assets. For example, the LINK vault had the following description:

Supplies LINK to C.R.E.A.M. to generate interest.

Supplies LINK to Vesper Finance to earn VSP. Earned tokens are harvested, sold for more LINK which is deposited back into the strategy.

Supplies LINK to AAVE to generate interest and earn staked AAVE tokens. Once unlocked, earned tokens are harvested, sold for more LINK which is deposited back into the strategy. This strategy also borrows tokens against LINK. Borrowed tokens are then deposited into corresponding yVault to generate yield.

Stakes LINK in MakerDAO vault and mints DAI. This newly minted DAI is then deposited into the DAI yVault to generate yield.

Supplies LINK to League Dao to earn LEAG. Earned tokens are harvested, sold for more LINK which is deposited back into the strategy.

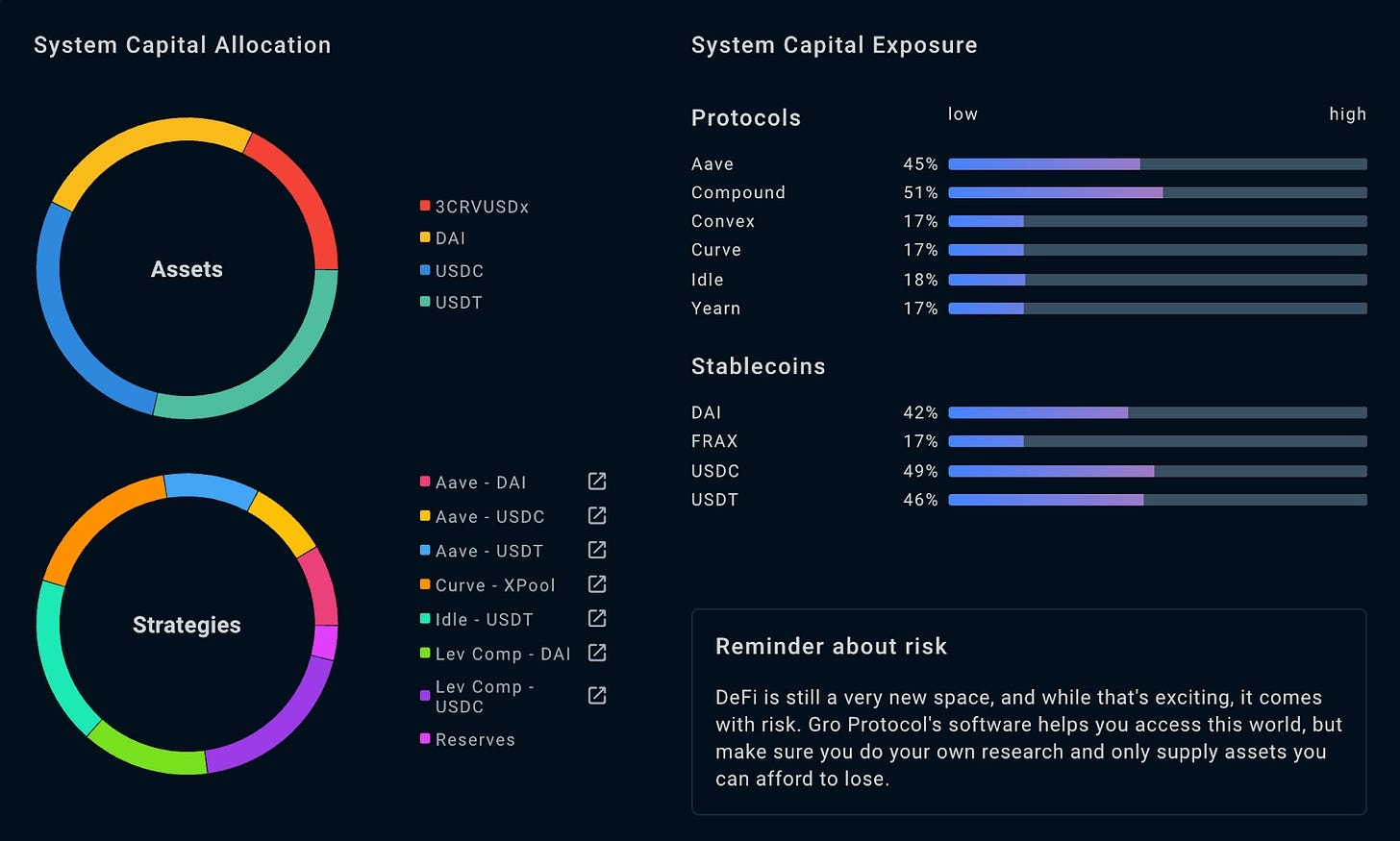

Another great example of a yield optimizer is Gro Protocol. [Full disclosure: I am a member of the G-Force, Gro’s decentralized marketing arm, and have unvested GRO.] Gro is a risk-tranched stablecoin yield optimizer, so it accepts assets like USDC, USDT, and DAI. It deposits these into a number of different protocols downstream to generate trading fees (i.e. from DEXes), lending income (i.e. from lending pools), and protocol incentives (i.e. governance tokens), and liquidates them back into the original stablecoin.

Gro Protocol’s Capital Allocation.

Yield optimizers are attractive because they amalgamate a diverse range of strategies so that if any single one fails, you might still end up making money with the other ones. They also save you the time of having to research how exactly any single protocol works. That said, you assume the risk of trusting the authors of the optimizer strategy - the yield you’ll receive is a function of how good the optimizing strategy is.

Derivatives

Financial derivatives are an increasingly popular area in DeFi, with ever more sophisticated products becoming available. In our last post, we covered Dopex - the decentralized options exchange that allows users to earn yield through Single Staking Option Vaults. Another great example of this is Ribbon Finance, which provides mechanisms for users to write covered call options and sell put options on their DeFi assets. In these instances, the yield being generated comes from assuming the risk of certain price action on the underlying asset.

Derivatives are a double-edged sword. On one hand, the ingenuity of these protocols are filling a niche that will undoubtedly become more valuable as DeFi matures as an industry. On the other hand, these are fairly complicated pieces of financial technology that the average DeFi participant cannot be expected to be knowledgeable about. If you are going to get your yield from derivative-based protocols, it’s important that you understand how the structure of the derivative directly relates to your yield!

Governance

Governance tokens are one of the largest sources of advertised yield, and yet they are also arguably the hardest to understand.

As the name suggests, these tokens give holders the right to participate in governance of the underlying DeFi protocols, through proposals and on-chain voting. These changes can encompass something as minimal as a parameter change (e.g. “increase the interest rate for this vault by 0.1%”) to an overhaul of the entire ecosystem (e.g. the MIM and Wonderland Merger).

When DeFi protocols are starting out, they often reward Liquidity Providers and other early participants with the protocol’s own governance tokens, a process known as “liquidity mining.” They will also bootstrap liquidity pools on DEXes for their governance tokens, so that the tokens become exchangeable for common assets like USDC and ETH. This induces a market price for the token.

The question then becomes: why does a governance token have value? One standard answer is that governance tokens are analogous to equity in a company. You are theoretically entitled to some portion of the future cashflow of the protocol, and you have fractional decision-making power over it as well. In practice, however, this may or may not be the case: depending on how the protocol is structured, the revenue could flow mostly to the treasury rather than to governance token holders. And the amount of decision-making power you have will only be proportional to the amount of tokens you hold due to the constraints of coin-voting.

Governance tokens become particularly difficult to reason about when they exhibit a recursive structure - i.e. holding the tokens results in rights to control or partake in the allocation of future such tokens. This dynamic was covered extensively in our articles covering the Curve Wars.

The moral of the story here is that if a significant portion of the yield for a DeFi protocol comes in the form of its native governance token, you should apply extra scrutiny to it, because in this case, your yield literally derives from the value of the underlying protocol.

Rebasing Tokens

Rebasing Tokens, or “reserve currencies” as they sometimes call themselves, refer to OHM and its forks, as we detailed in our post on [redacted].

Rebasing tokens are fundamentally defined by the eponymous mechanism of rebasing, which just means that if you lock up the currency in a staking contract, the amount of the currency that you hold increases by a certain percentage at a regular time period, like 8 hours. The frequency of this compounding is what leads to astronomically high APYs. For example, currently, OlympusDAO offers rewards of 0.3265% per epoch (8 hours) on staked OHM, which results in a 3,450% APY.

Of course, if you’ve been reading this post closely, you’ll easily see that an increase in the underlying currency amount does not necessarily imply an increase in value. That is, if the number that represents the amount of currency does not meaningfully correspond to something intrinsically valuable - like software that facilitates financial exchange, or a real-world asset like the US dollar, or a share of future revenues of a protocol - then the currency amount going up does not necessarily imply that you own more value.

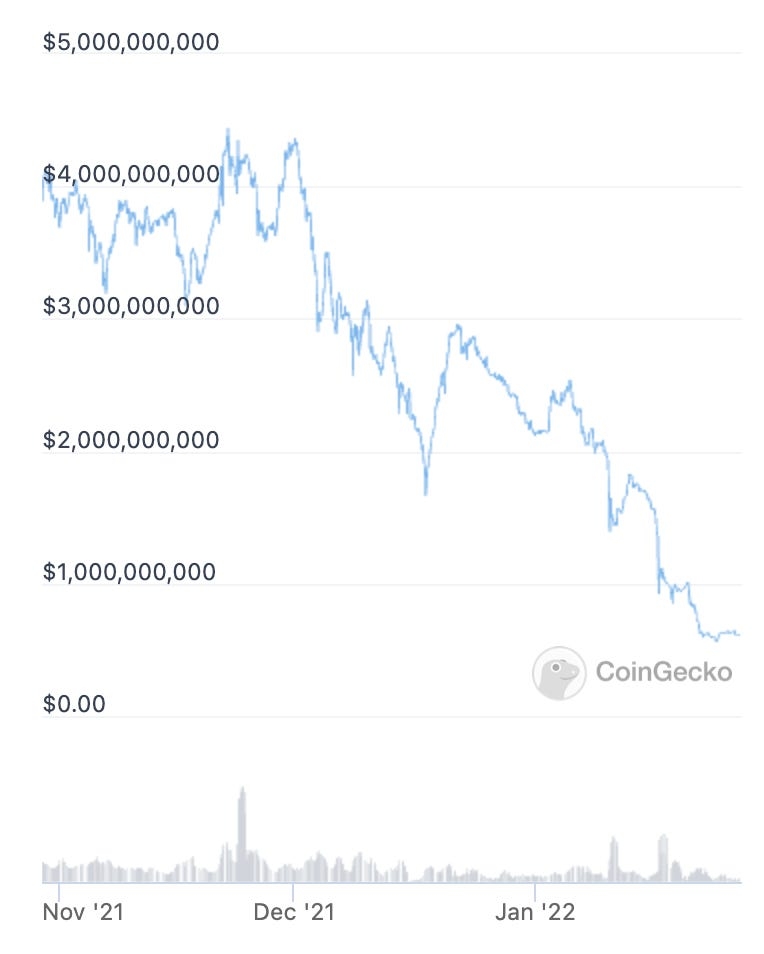

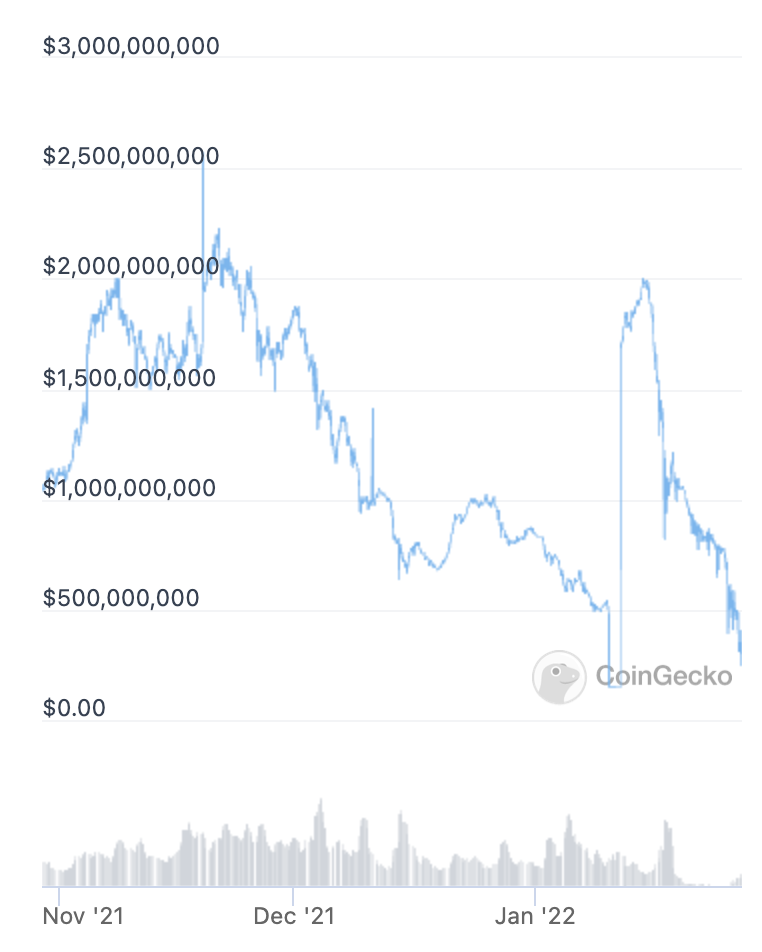

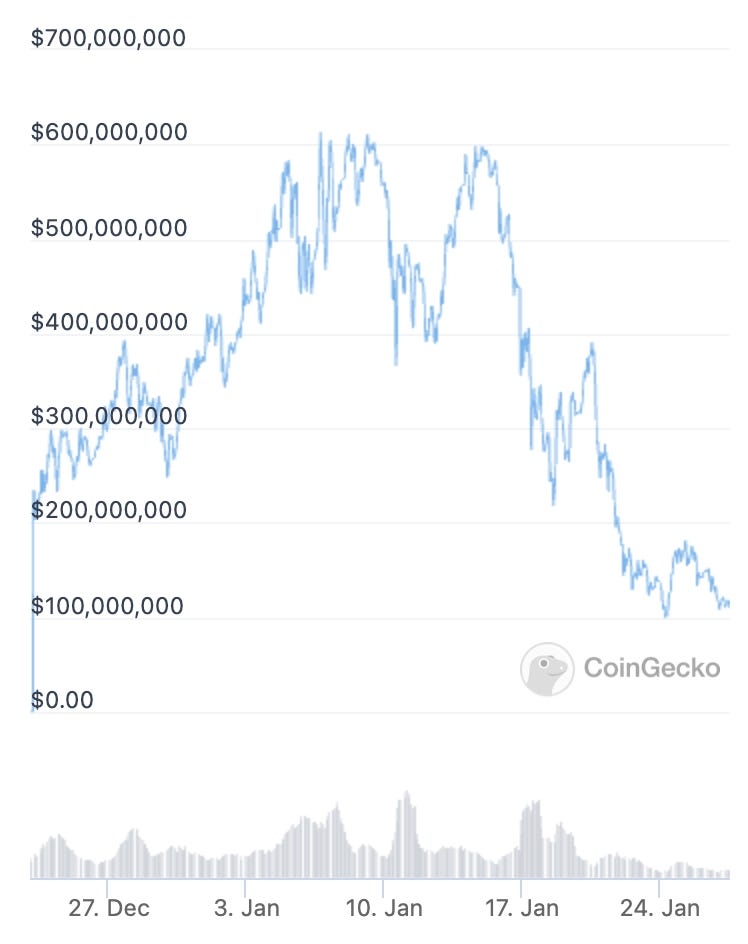

Recently, rebasing tokens had a reckoning as more participants realized that their high APYs didn’t actually mean they owned more value. Here are the charts of OHM, TIME (Wonderland) and BTRFLY ([redacted]) market cap:

OHM market cap has declined 85% over 3 months.

TIME market cap has been extremely volatile and declined 52% over the past 3 months.

BTRFLY market cap has declined 48% in 3 months.

“Reserve Currencies” showcase how DeFi can quickly become untethered from reality. As new participants see extremely high numbers, they become excited and buy in. This drives the price up, leading to more participants buying and staking, creating a flywheel effect. If at any point people had stopped to consider why the numbers were going up they might have realized that their high APYs were not based on value, but on an inflationary monetary instrument.

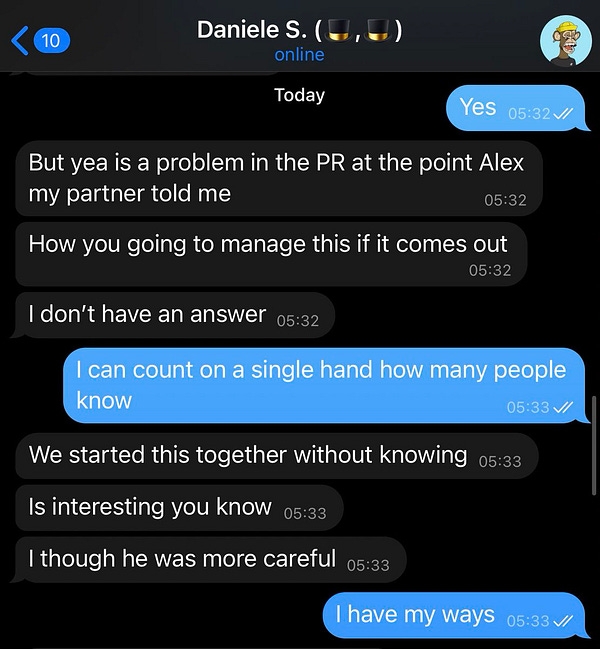

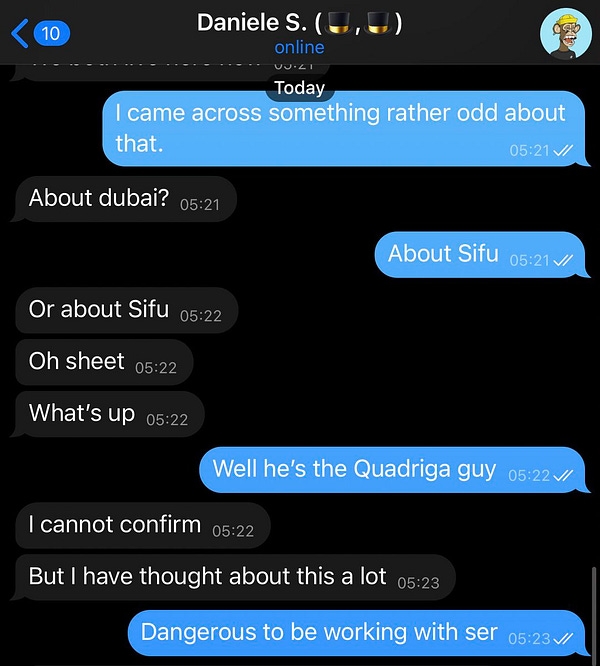

TIME in particular has seen quite a bit of drama recently, with accusations that the manager of the treasury is a convicted financial felon:

To be fair, there has been discussion by some Rebasing Token communities about changing the dynamics, likely triggered by the recent price crash. Furthermore, these tokens are backed by treasuries and streams of revenue, like OlympusDAO’s protocol-owned-liquidity-as-a-service.

But if the currency doesn’t even attempt to make its “amount” meaningfully reflect an underlying source of value, then they shouldn’t be seen as a reliable deliverer of DeFi Yield.

Conclusion

There are many ways of earning yield through DeFi. Some are low-risk and some are high-risk, but in all cases, it behooves you to understand where the yield is coming from. The straighter the line between the underlying value of the protocol and the yield being disbursed to you, the surer you can be that there won’t be a rugpull down the line. Since DeFi Yield comes from the value of the underlying protocol, your key job is to determine the value of DeFi protocols. And I’ll be here to help you do that :)

Last updated