Stablecoin primer - Pt 3

https://medium.com/coinmonks/stablecoin-primer-section-3-stablecoin-types-c416ce5f455f

Did someone say central bank on a blockchain?

Osman Sarman, Mar 2022

This article is part of the Stablecoin Primer series. If you are interested in reading the other articles, check out this post.

Types of stablecoins by diedamlas

Central bank on a blockchain is actually one of the most widely used analogies for algorithmic stablecoins, but more on that later.

Two mental models

Before we start talking about different types of stablecoins, I want to pause for a caveat in hopes of making this and the upcoming sections of the Primer more digestible.

So far, in Intro, Section 1, and Section 2, we discussed the consumer grade value propositions and uses of stablecoins, such as using stablecoins for cross-border remittances. These were quite straightforward. However, as simple as the concept of a stablecoin may sound, the protocols and mechanisms behind these stablecoins can be quite intricate, requiring certain level familiarity with economics and blockchains. This is still a Primer so my intention is to keep the content as introductory as possible, but we do need to gear up for some complexity.

To prepare you on what to expect in this section and in Section 4, I’ll propose two mental models:

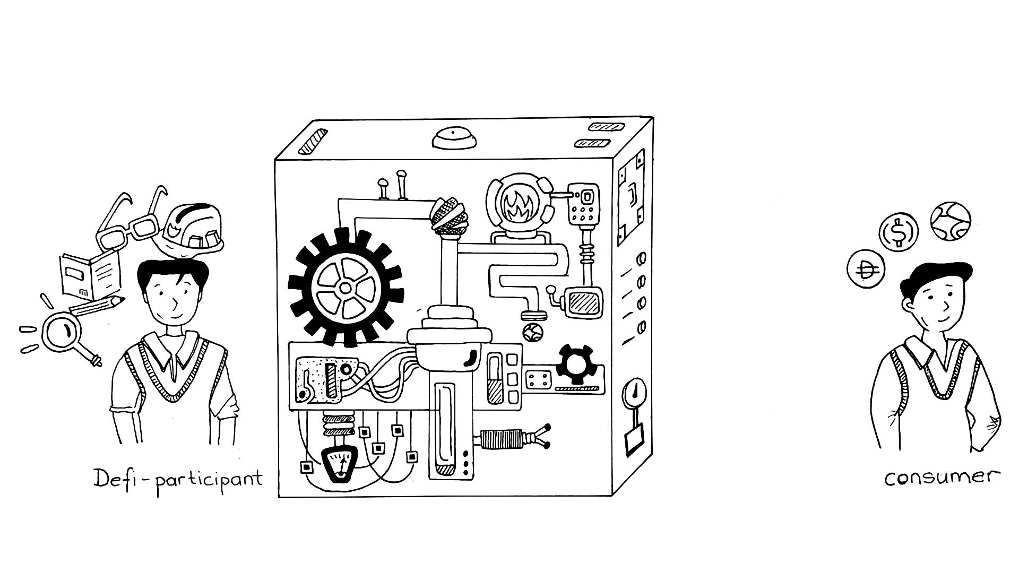

Two different types of stablecoin users: Consumers and DeFi participants (DeFi =decentralized finance). A consumer is someone who simply wants to buy and hold stablecoins. For example, someone who only uses stablecoins to convert their salary into DAI or USDT to save in dollars could be considered a consumer. Consumers usually interact with stablecoins only via secondary markets such as using a fiat-to-crypto exchanges to buy / sell stablecoins. If you identify as a consumer and are not necessarily curious about the systems behind stablecoins, you do not have to worry about the intricacies of stablecoin protocols — feel free to just skim through the sections until Section 5. A DeFi participant, on the other hand, leverages stablecoin protocols to mint (create) stablecoins and participate in various DeFi activities such as yield farming. A range of parties could counted as DeFi participants including but not limited to traders, institutions, crypto exchanges, and DAOs. Understanding how a DeFi participant interacts with a stablecoin protocol is crucial because without them, stablecoins do not exist. If you identify as a DeFi participant or are interested in the nuts and bolts of stablecoins, this section is perhaps relevant and useful for you. Enjoy!

Stablecoin protocols are like financial institutions that run on code: Like I said, stablecoin protocols are complex. I think a helpful and over-simplified way of thinking about them is the following: stablecoin protocols, especially the decentralized ones, are like banks that operate on code (i.e., blockchain) and tokens are critical to how these protocols operate. As simple as that may sound, if you don’t have a finance background or are not interested in the inner workings of financial institutions, it may not be all too intuitive to you how banks work. Add another layer of complexity on top of that thanks to blockchain and tokens. That’s why I think expecting some complexity to start with is helpful.

Two different stablecoin users and a stablecoin protocol by diedamlas

With these mental models in mind, let’s speak about the general principles to design a successful stablecoin.

Design Principles

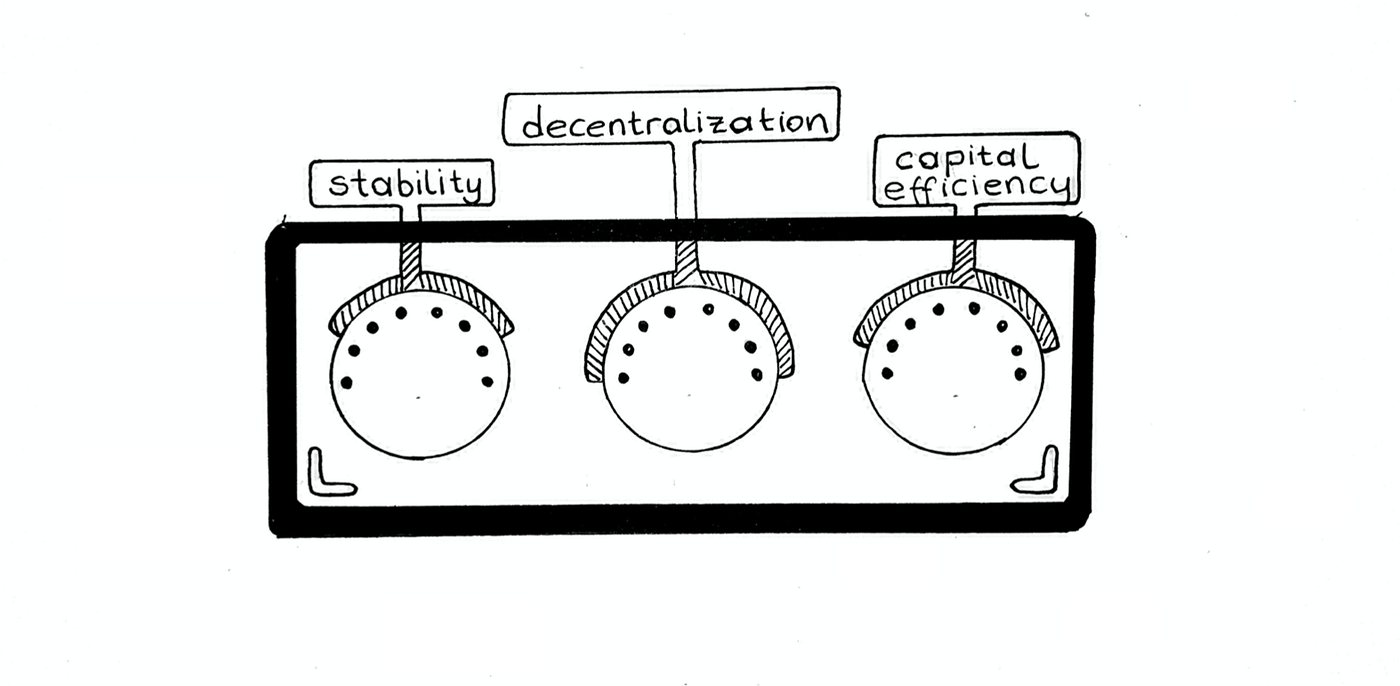

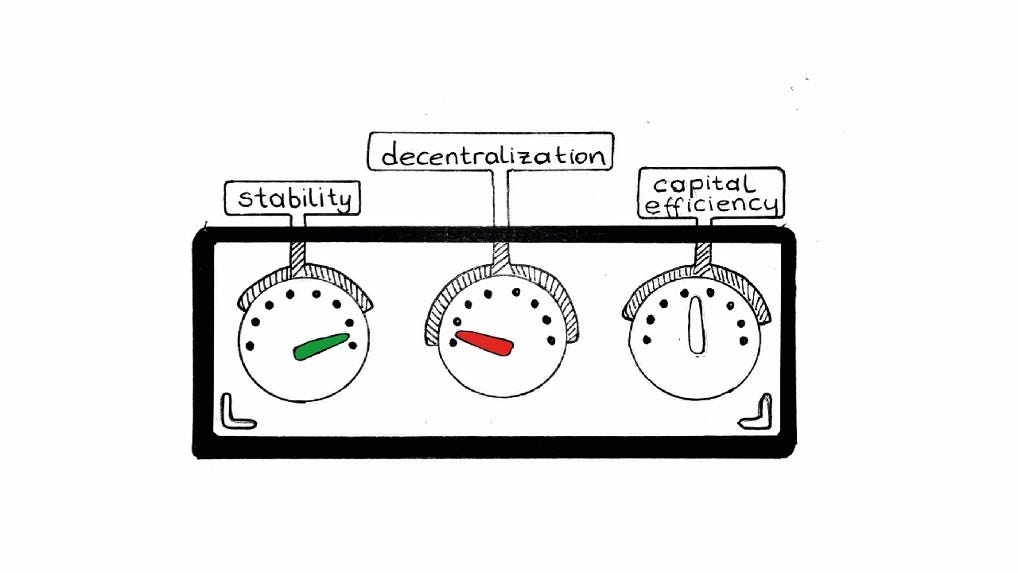

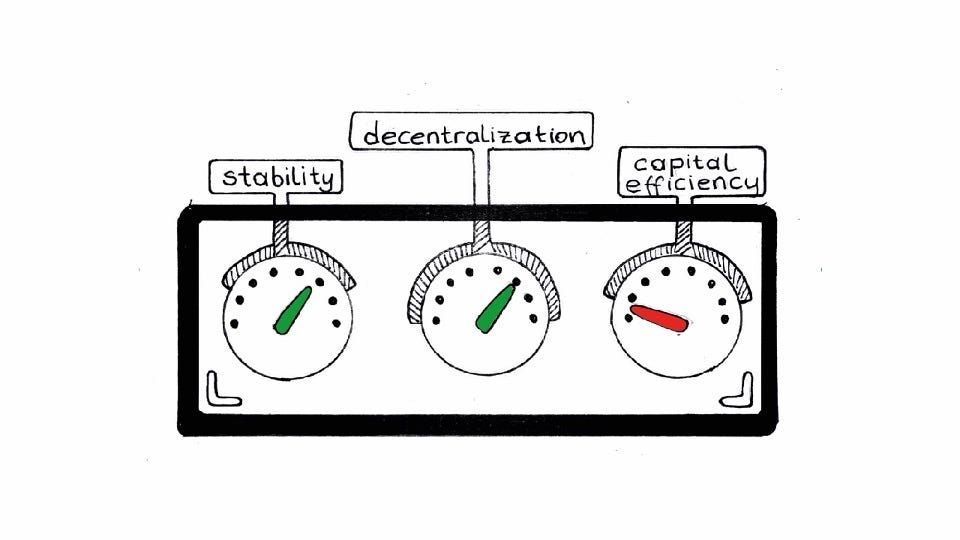

Unfortunately, there isn’t a playbook out there (yet) that clearly lays out how to design a successful stablecoin. The stablecoin landscape is still a wild west where a variety of experiments choose unique mechanisms to achieve stability. Reviewing the overall landscape however, we can observe a pattern where each project optimizes for a common set of parameters and trades off for others, and these make up the design principles of stablecoins.

The first, and perhaps the most important, parameter is stability. This refers to the price of a stablecoin to have minimum variance around its price target (e.g., $1). Stablecoins that optimize for stability usually choose to have a collateral or reserve mechanism backing the stablecoin. This means that the stablecoin simply represents an IOU for the collateral in the issuer’s reserves. With reserve mechanisms, the supply of the stablecoins are dependent on the amount of collateral backing them, given stablecoins can only be minted once the system receives a collateral deposit. This prevents a stablecoin issuer from increasing the supply of stablecoins at will, causing instability in the price of the stableocin.

The second design principle that stablecoins optimize for is decentralization, which refers to a stablecoin protocol being governed by many parties and not having a single point of failure. The more decentralized a stablecoin, the more censorship resistant it becomes because decentralization prevents any single party from controlling permissions to the stablecoin. This is especially important for citizens of countries with strong currency controls and censorship where obtaining foreign currencies is not as straightforward — remember the Argentina example in Section 2. Another benefit of decentralization is that it makes the monetary policy of a protocol more transparent to its participants. For example, with algorithmic stablecoins, the amount of seigniorage profit made by the protocol is visible to its participants at all time. This plays a key role in building trust and growing the network of the stablecoin.

The last design parameter that emerges from different stablecoin experiments is capital efficiency, which refers to how effectively the protocol allows a user to utilize their capital. Stablecoins that rely on the backing of other cryptocurrencies are often overcollateralized. This means that, to create (mint) new stablecoins, a user must deposit an amount of collateral (e.g., ether) that is higher in value than the stablecoins they receive in return. For example, a user deposits $200 worth of ether to mint $100 worth of stablecoins. By requiring overcollateralization, these protocols protect their stablecoin from the downward volatility of the backing cryptocurrency. This, however, leads to more expensive lending, borrowing, and loans in DeFi, so protocols need to strike a balance between their collateral requirements and capital efficiency.

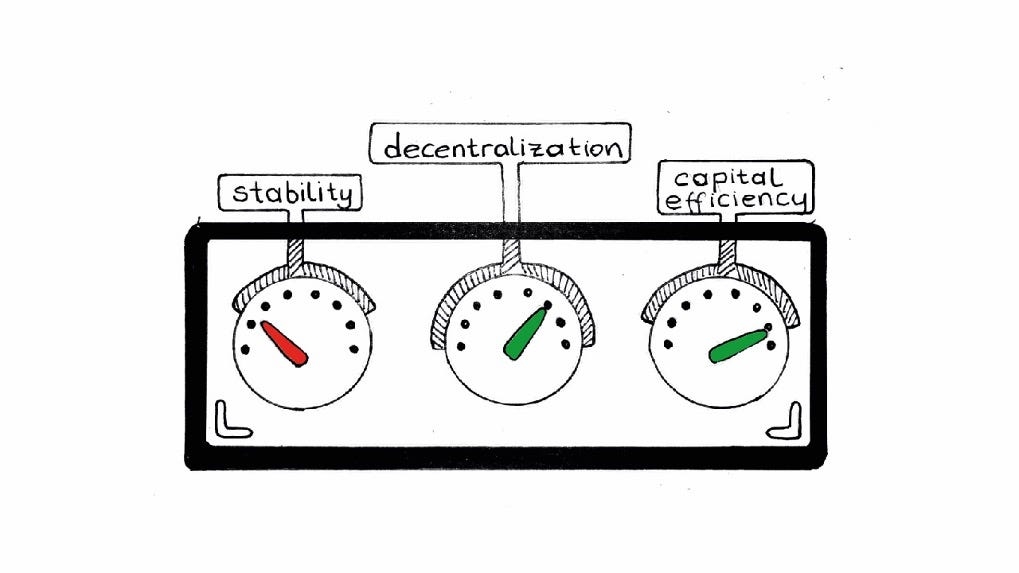

Overly-simplified stablecoin mission control deck by diedamlas

So why do we need these design principles to further complicate our lives? The goal of these design principles is not to benchmark different stablecoin projects against each other but to review the overall landscape and decipher how stablecoins and the mechanisms behind them evolved over time. Ultimately, new projects build on the older ones by identifying the gaps in the latters’ mechanisms.

Through the lens of these design principles, we can see that three types of stablecoins have emerged so far: (1) fiat-backed stablecoins, (2) crypto-backed stablecoins, and (3) algorithmic stablecoins.

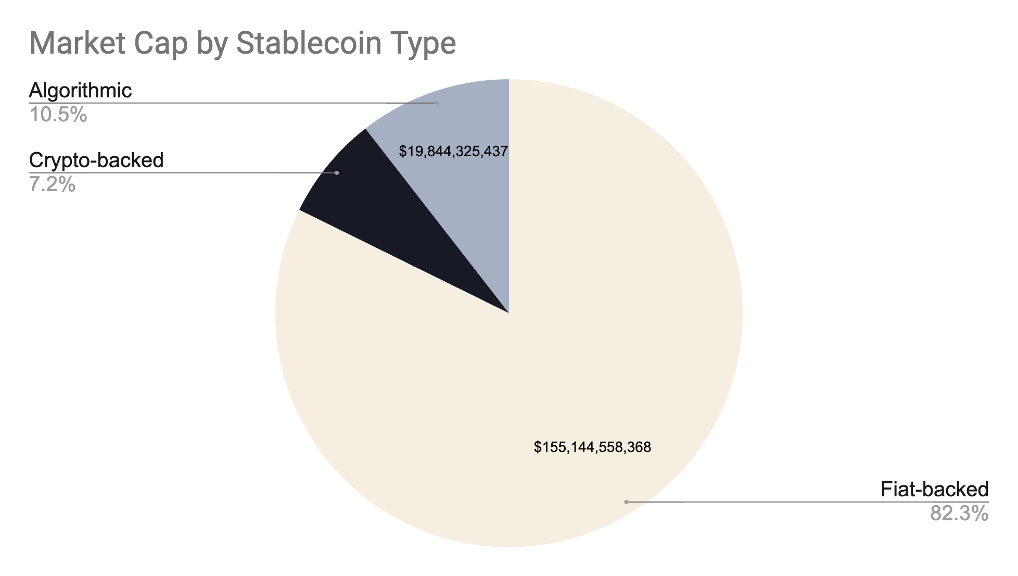

Total market cap of stablecoins currently stands at+$186 billion. Source: CoinMarketCap

Let’s double click into each stablecoin type using our design principles.

1- Fiat-backed stablecoins

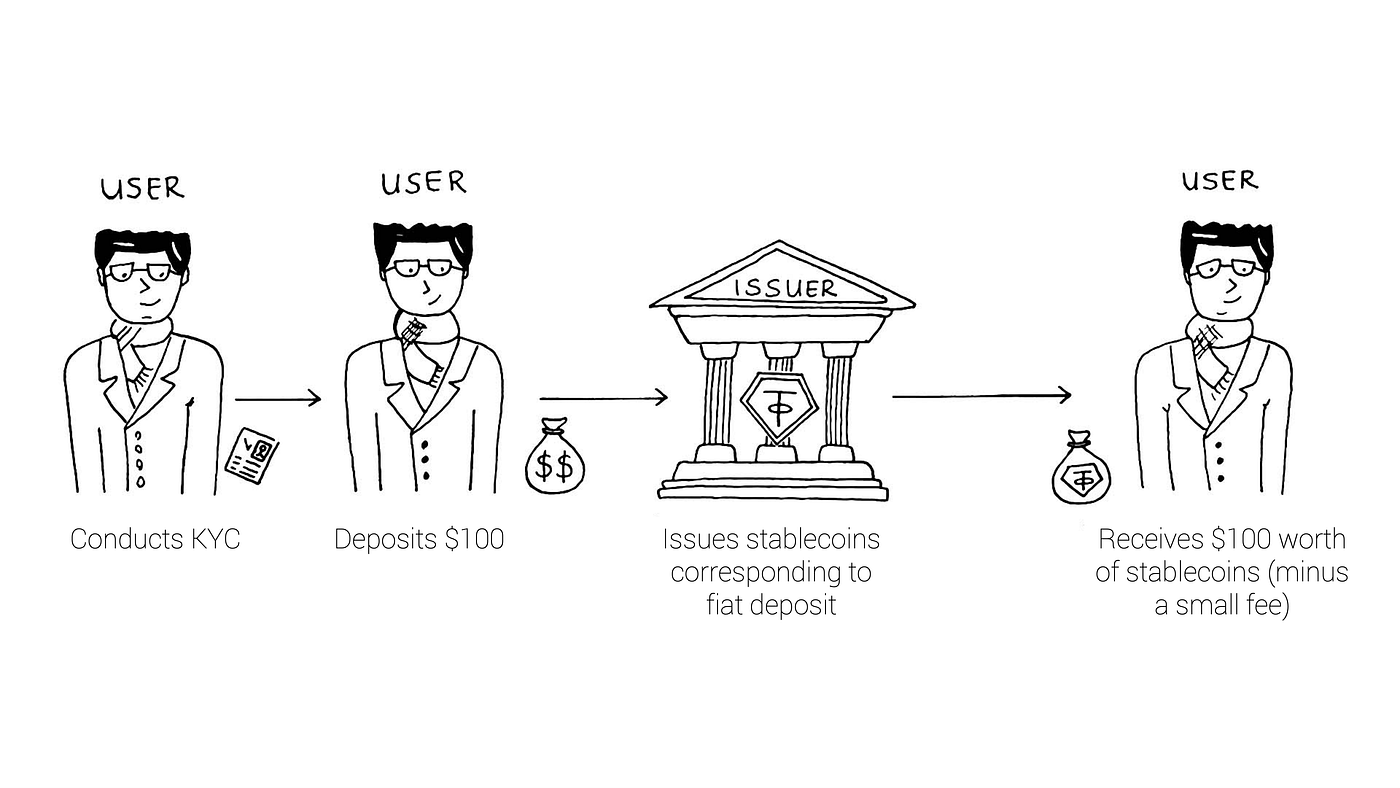

Fiat-backed stablecoin issuance by diedamlas

Definition: For every unit of a fiat-backed stablecoin, there is a corresponding fiat unit in the reserves of the issuing company or protocol. In the example of Tether, for every USDT in circulation, there is $1 in Tether’s centralized reserves at Deltec bank in the Bahamas. This is rather a traditional mechanism that leverages the underlying currency’s stability.

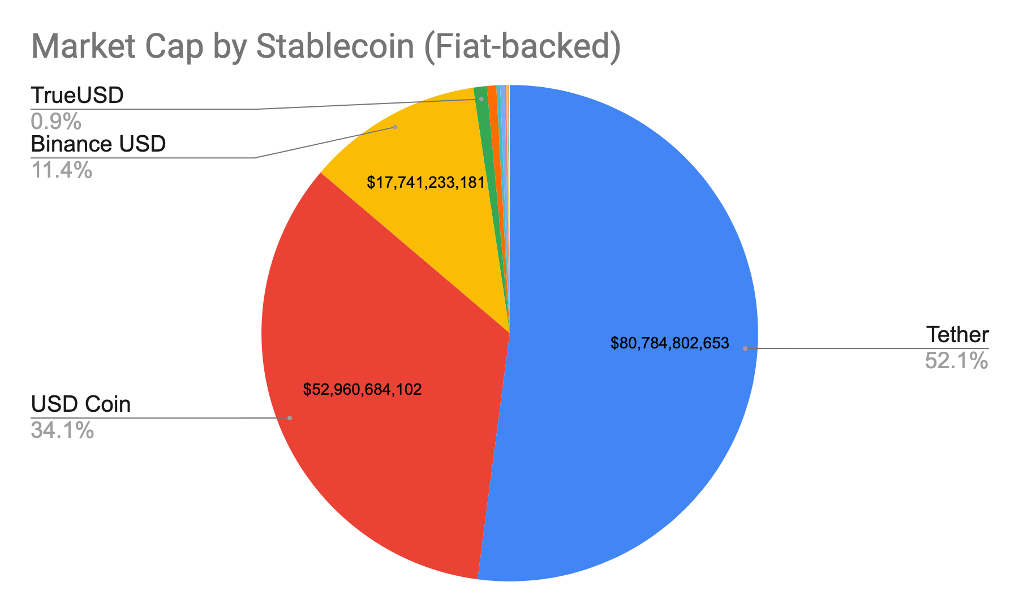

Market Cap:

Total market cap of fiat-backed stablecoins currently stands at +$155 billion, account for ~85% of the total stableocin market. Source: CoinMarketCap

Projects: USDT (Tether), USDC (Circle and Coinbase), BUSD (Binance), TUSD (Trust Token), TRYB (BiLira), USDP (Paxos Dollar), to name a few…

Stability: Fiat-backed stablecoins achieve stability using reserve mechanisms. A user can only mint (create) a fiat-backed stablecoin if they deposit some fiat currency to the issuer’s reserves. In other words, an issuer is not able to mint new stablecoins without receiving the fiat currency deposit in the first place. By keeping users deposits in reserves, the issuers warrants that every user will be able to redeem their original fiat deposit once they return the stablecoin. Since the price of the stablecoin tracks the price of the underlying fiat, stability is dependant on that of the underlying currency. If a relatively stable fiat is used as collateral (e.g., EUR), the stablecoin will remain more stable.

Decentralization: This is a fully centralized structure as the issuing company acts as the custodian of users’ collateral or fiat currency. Unless the issuing company is regularly audited, this may not be the most transparent structure to the user. Because who knows if an issuer holds all the collateral in their reserves. Critics of fiat-backed stablecoins say that the fact that most of the stablecoins in this category rely on US dollar reserves ends up dollarizing the blockchains. Ultimately, US dollar backing introduces systemic (e.g., inflation) and regulatory risk (e.g, KYC requirements, censorship, etc.) to the crypto-economy.

Capital Efficiency: These stablecoins can be expensive to create (mint) and slow to liquidate. Issuers usually charge a fee for fiat deposits and may take more than a day for redemptions since they traditional fiat settlement channels. Additionally, we may see a scenario where the crypto economy’s capital needs may exceed what fiat money can provide, which would make fiat collateral less efficient. For example, at the height of the Ukraine-Russia war, Ukrainian crypto exchange Kuna was only able to offer USDT at a 4% premium due to USDT’s limited supply at the exchange.

Mission control deck for fiat-backed stablecoins by diedamlas. High stability, low decentralization, medium capital efficiency.

2- Crypto-backed stablecoins

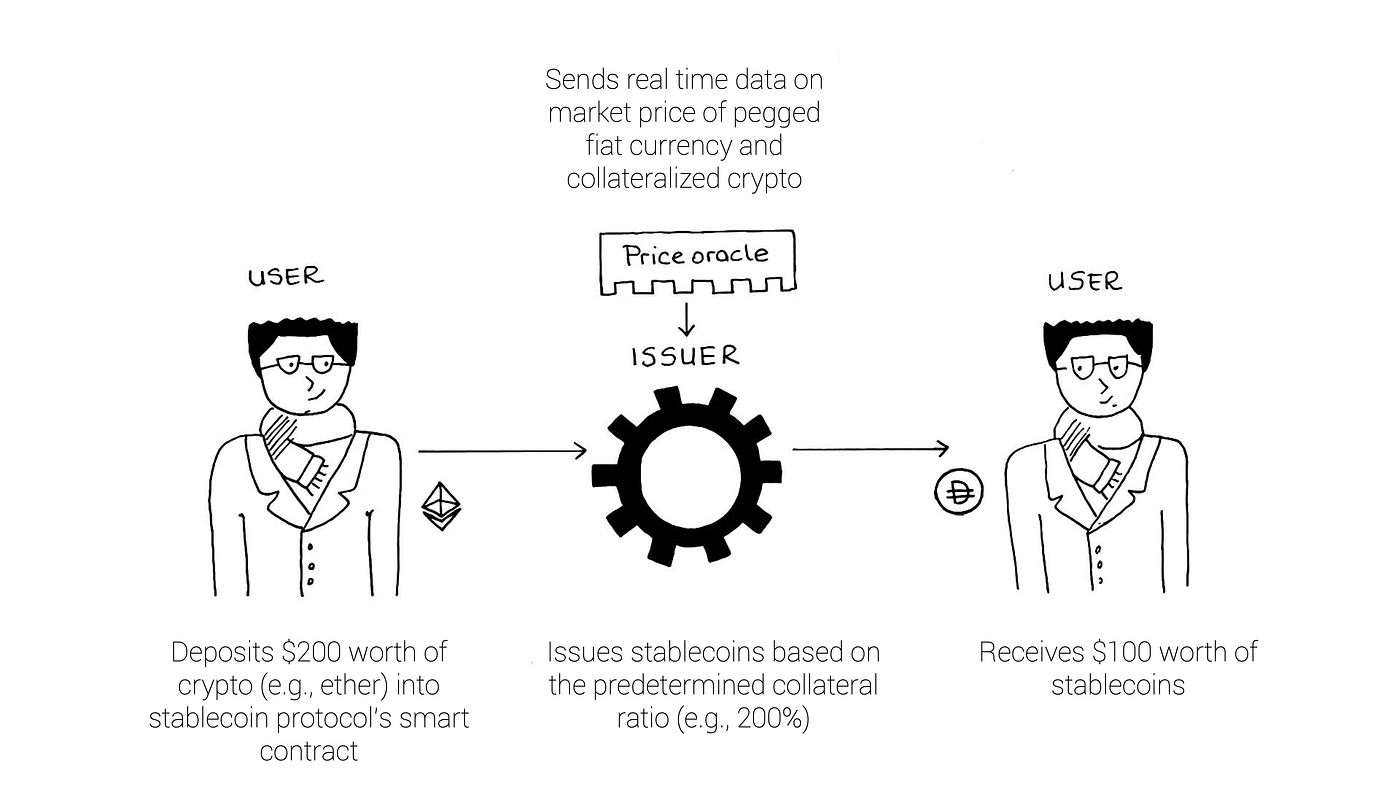

Crypto-backed stablecoin issuance by diedamlas

Definition: For decentralization seekers who want to avoid the systemic risk of fiat currencies (e.g., inflation, censorship), crypto-backed stablecoins achieve stability by overcollateralizing their reserves with other cryptocurrencies. “Over” is essential because the issuing protocols want to ensure the volatility of the backing cryptocurrency does not make the system undercollateralized, or not sufficiently backed. These stablecoins do not only function as permissionless, inflation-protection monies though. As crypto-native currencies created on the blockchain, these stablecoins also have a variety of uses in DeFi applications such as leverage trading, which we discuss in Section 4.

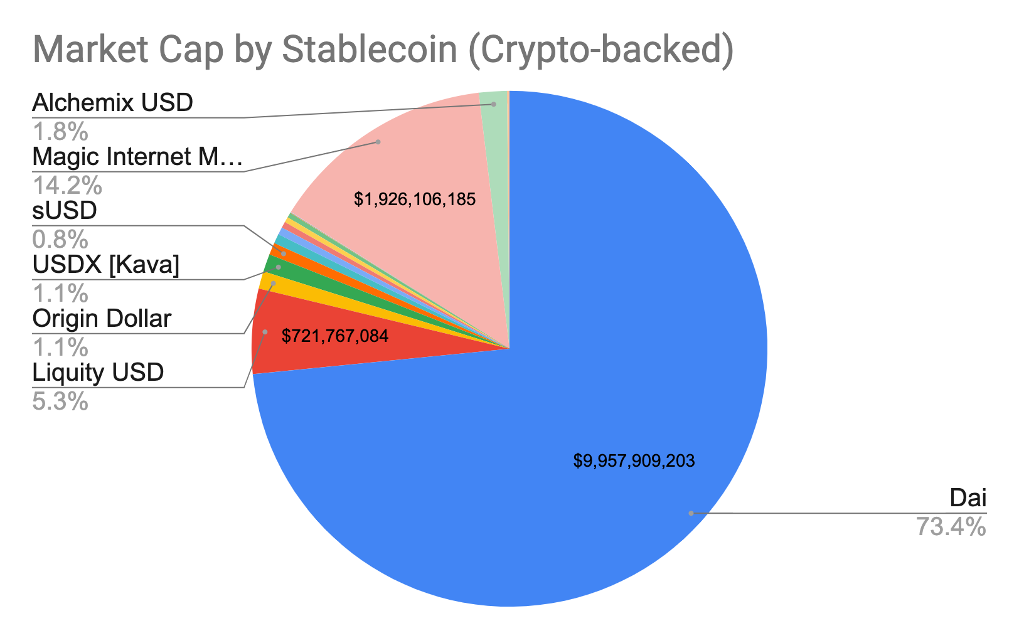

Market Cap:

Total market cap of crypto-backed stablecoins currently stands at +$13 billion. Source: CoinMarketCap

Projects: DAI (MakerDAO), MIM (Magic Internet Money), LUSD (Liquidity USD), OUSD (Original Dollar), to name a few…

Stability: A user can only mint a crypto-backed stablecoin if they deposit the required amount of collateral to the issuing protocol. This ensures that the protocol does not generate stablecoins out of thin air, causing inflation. Price of a crypto-backed stablecoin is usually pegged to the price of a fiat currency. To maintain a stable peg to their fiat counterparts, these stablecoin protocols deploy a variety of specialized mechanisms to influence their users’ demand to and the supply of stablecoins. For example, if a stablecoin’s price is above a target peg, a protocol will implement strategies to increase the supply of these stablecoins.

Decentralization: Crypto-backed stablecoin protocols are governed by decentralized autonomous organizations (DAOs). This means that anyone with the required knowledge can participate in the governance of a crypto-backed stablecoin. For example, participants can vote on the interest rate offered by a protocol or contribute to the development of an algorithm that the protocol leverages (more in Section 4). Additionally, users of a stablecoin can usually inspect the collateralization ratio and the algorithms that define these ratios, making the protocols’ monetary policy as transparent as possible. Unlike fiat-backed stablecoin issuers, crypto-backed stablecoin protocols do not take custodianship of a user’s assets. When a user wants to mint stablecoins, they simply lock their crypto assets to a smart contract as collateral and maintain full control over the smart contract. One criticism regarding crypto-backed stablecoins is that to achieve stability, they tend to rely heavily on centralized fiat-backed stablecoins, making them vulnerable to the same risks that apply to fiat-backed stablecoins. For example, currently 68% of the collateral backing DAI is comprised of centralized stablecoins.

Capital Efficiency: These stablecoins are more capital intensive than fiat-backed stablecoins due to overcollateralization. To mint new stablecoins, the amount of collateral a user deposits is usually higher in value than the stablecoins they receive in return. While with fiat-backed stablecoins, the collateral user deposits and the stablecoins they recieve in return are equal.

Mission control deck for crypto-backed stablecoins by diedamlas. High stability, high decentralization, low capital efficiency.

3- Algorithmic stablecoins

Algorithmic stablecoin issuance by diedamlas

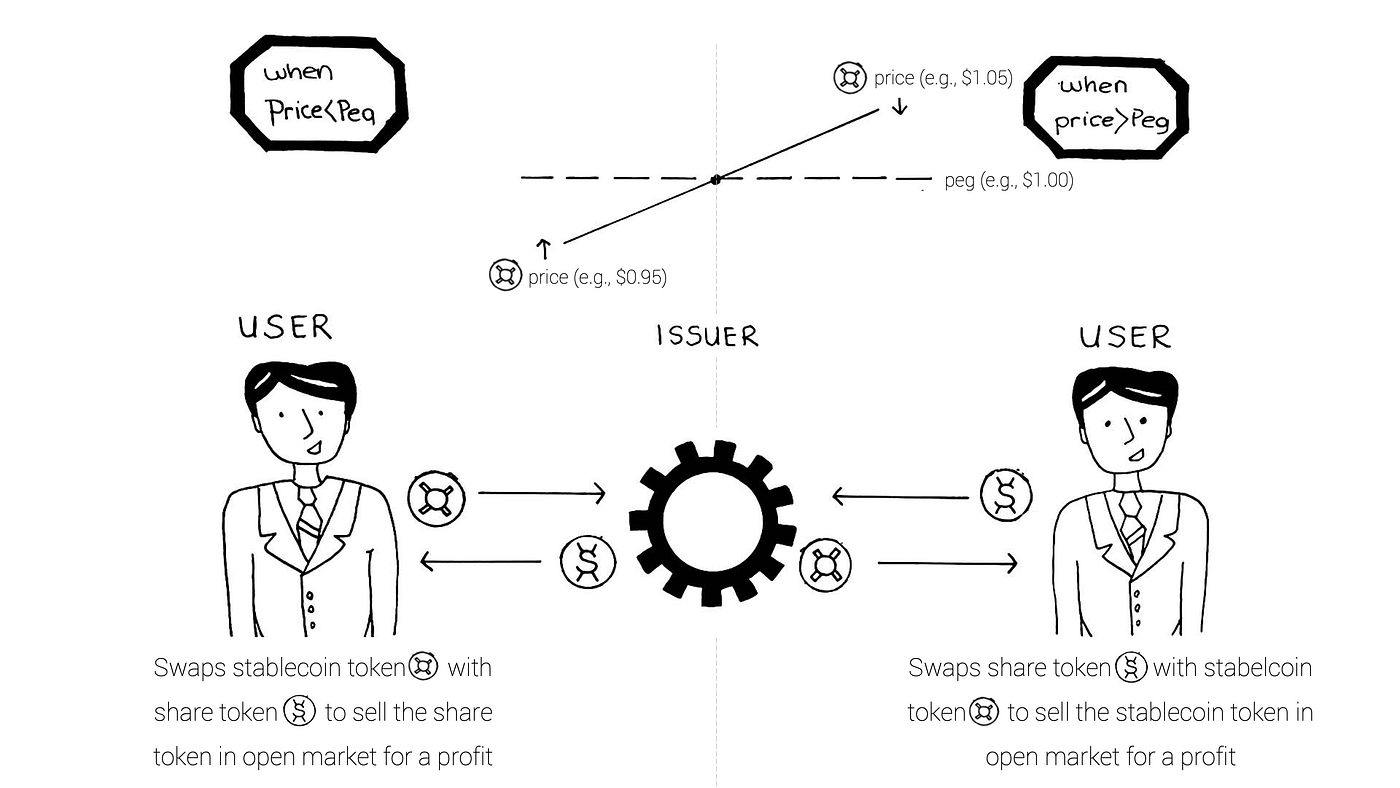

Definition: Growing in popularity, an algorithmic stablecoin is a cryptocurrency that adjusts its supply deterministically in order to move the price of the token in the direction of a target peg. In other words, these stablecoins achieve stability not via a collateral mechanism but via algorithms that mimic the monetary policy of a central bank (remember from the title?) Basic dynamics of supply and demand apply to algorithmic stablecoins, so at a high-level, these stablecoin protocols rely of open-market arbitrage incentives to increase or decrease the supply of stablecoins to match the target pet. In addition to their stablecoin token, algorithmic stablecoin protocols usually have another indigenous token: the share token (e.g., FXS for Frax Finance). Share tokens are used in stabilizing the price of their stablecoin counterparts as well as governing the protocols.

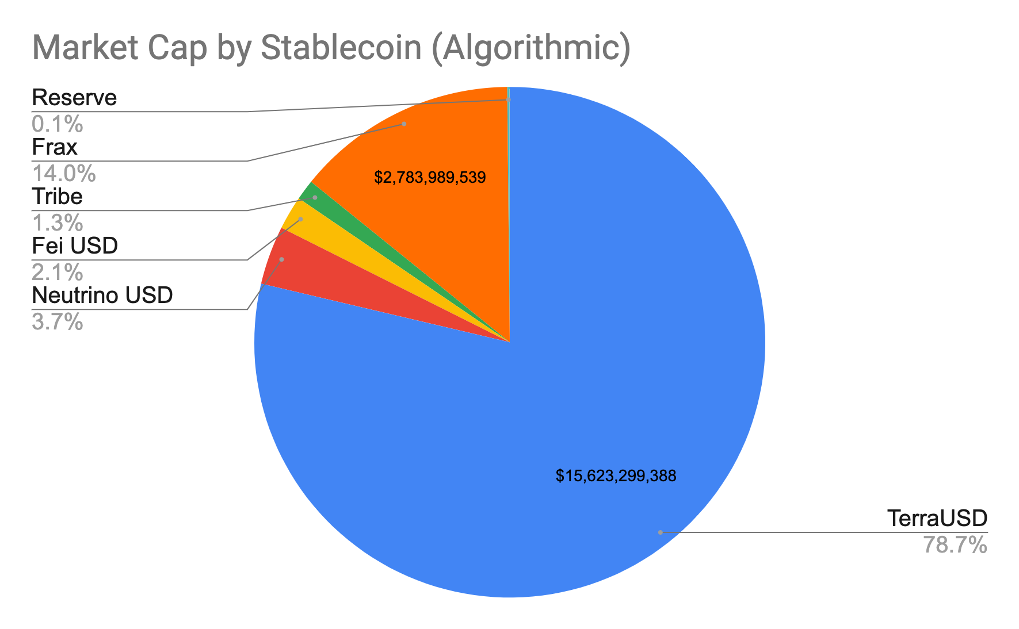

Market Cap:

Total market cap of algorithmic stablecoins currently stands at +$19 billion. Source: CoinMarketCap

Projects: UST (Terra Protocol), FRAX (Frax Finance), USDN (Neutrino), FEI (FEI Protocol), and many other exiting projects like UXD and VOLT

Stability: Algorithmic stablecoin protocols rely on protocol participants to achieve stability. For example, when demand to an algorithmic stablecoin falls, the price of that stablecoin falls below its peg. This requires existing participants of the protocol to collectively absorb short-term volatility. They do this by holding onto their share tokens (and not selling off like the rest of the market) and betting on the future of growth of the demand to stablecoin. This is difficult to achieve with so many trustless parties, and historically, many algorithmic stablecoins lost their pegs during market downturn. This will become more clear as we talk about specific projects in Section 4.

Decentralization: Similar to crypto-backed stablecoins, algorithmic stablecoins achieve decentralization via DAO governance. Monetary policies implemented by these protocols are voted on by share token holders and are transparent to anyone that uses their stablecoins. Lack of collateral backing these stablecoins make them the most permissionless form of money.

Capital Efficiency: Algorithmic stablecoins do not require any collateral and hence they are collateral efficient.

Mission control deck for algorithmic stablecoins by diedamlas. Low stability, high decentralization, high capital efficiency.

As we can see, there isn’t a clear cut answer on which type of stablecoin is better. “It’s a spectrum, bro!” applies here too and tradeoffs are all over the place. One thing for sure based on data is that fiat-backed stablecoins are the most widely used, accounting for ~85% of the total circulating stablecoin supply. If you ask why that may be, I think it boils down to three simple facts:

Dollar access: People around the World want to transact and save in US dollars. Dollar denominated fiat-backed stablecoins are simply a faster and easier way to get dollar exposure compared to traditional banking channels.

Familiar mechanism: At the end of the day, people will ask “so, how does this work?”. It’s quite easy to explain the reserve mechanism of fiat-backed stablecoins, and that simply builds trust.

Early entry: Tether has been operational since 2015, and has grown its popularity following the 2018 ICO boom. People are just familiar with USDT and hence other fiat-backed stablecoins.

So do decentralized stablecoins (including crypto-backed and algorithmic) even matter? I am no judge here but inspired by Haseeb’s post, I can totally see that only with increased inflation of the US Dollar and increased regulation on dollar-backed stablecoins (as discussed in Section 2), people will transition to decentralized stablecoins. While UST’s and FRAX’s recent market cap growth are bright spots for decentralized stablecoins, for now, numbers tell us that people seem to be just fine using permissioned crypto-dollars.

So you can answer that question for yourself though, in Section 4, let’s take a closer look at specific stablecoin projects to understand how they achieve stability, decentralization, and capital efficiency.

Last updated