An explanation of DeFi options vaults (DOVs)

https://qcpcapital.medium.com/an-explanation-of-defi-options-vaults-dovs-22d7f0d0c09f

QCP, Dec 2021

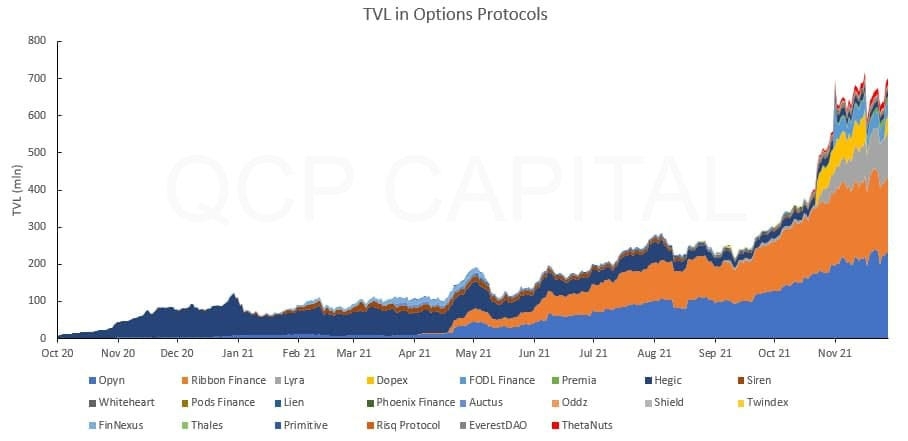

Defi options vaults (DOVs) have been a phenomenon in the second half of 2021, capturing the interest of not just retail Defi investors but the largest institutional players as well. From scratch, DOVs have grown exponentially to become the dominant part of the $700 million Defi option TVL, with notionals trading in billions of dollars every month.

What are Defi options vaults (DOVs)?

The beauty of DOVs lies in its simplicity. Investors simply ‘stake’ their assets into vaults which deploy the assets into options strategies. Before DOVs, option strategies were only available to accredited investors through over-the-counter (OTC) trading or by self-execution on option exchanges like Deribit.

The strategies deployed thus far have been vanilla covered call and cash-covered put strategies which provide the highest base yield available in Defi (averagely 15–50%). On top of that, token rewards are distributed, providing an even higher yield for users.

In some instances, the collateral in the vault earns staking/governance yields as well, creating three sources of yield in a single vault. This triple layer of option premiums, token rewards and staking yield creates significantly high and (more importantly) sustainable yield that is unprecedented in Defi.

On the other side, market makers compete to buy these options from the vaults. They pay the premium for these options upfront and thus provide the high base yield.

Why are DOVs a game-changer?

DOVs bring high organic yield to Defi

The primary source of yield in Defi has been token rewards. While money market protocols, AMMs and more recently Protocol-Owned Liquidity (POL) protocols like OHM do provide some small base yield, there is critical dependence on token distributions to achieve high APYs.

The problem here is that the yield is largely synthetic and circular, heavily dependent on token price inflation. If the flood of new entrants into Defi reverses and token prices collapse, yields will flatten out across the board, putting an end to the virtuous cycle that we’ve seen in Defi.

The base yield from DOVs do not rely on token rewards at all. DOVs effectively monetise the high volatility of the underlying asset and inject this yield into Defi through the payment of option premiums. It also solves the problem of diminishing returns (or crowding out) from increasing sizes of LP pools, as the base yield is sourced from a large external options market.

This real base yield is the missing key for long-term sustainability and scalability in Defi. Moving away from the ponzinomics of token creation and distribution (layer, rinse and repeat) and towards true value accrual from underlying market structures and trading volatility.

DOVs are effectively democratizing the element of the crypto space that financial institutions have been eyeing with envy, which is the implied volatility (IV) that is 10–20 times the IV in Tradfi instruments. Institutional players have been scrambling to offer this to Tradfi investors, structuring products on crypto assets with risk-adjusted returns that far outstrip anything currently available. DOVs are making this alpha accessible to every individual.

2. DOVs allow for scalable trading of non-linear instruments on Defi

Defi market structures have been able to manage delta-1 or linear instruments well. Spot trading, over-collateralized borrow/lend and margined perpetual swap trading have been scalable with effective liquidation mechanisms through smart contracts. However, when it comes to non-linear instruments like options, Defi has hit a brick wall. Options traded on defi orderbooks has not been a scalable endeavour.

To be fair, non-linear liquidations is a difficult problem to solve. Even centralised exchanges like Deribit manage non-linear liquidations with some difficulty. For the liquidation of large option portfolios, the delta (or spot risk) is managed first by executing a perp/futures position against the portfolio. The other greeks in the portfolio (non-linear risk) are then systematically liquidated over time with a active involvement by the intermediary.

DOVs present an elegant solution to this problem. DOVs use a hybrid Defi model where investment, collateral management, price discovery and settlement occur on-chain while non-linear risk management is performed off-chain. In this model, all the elements that actually need to be trustless are executed onchain, yield is realised upfront and the whole process is fully transparent.

DOVs effectively solve for the sell-side of the problem, bringing in collateral from Defi investors and matching them with market makers who provide the high base yield. All option contracts traded through DOVs are fully collateralized which eliminates the need for liquidations altogether. The option contracts can then be tokenized and actively traded on Defi by RFQ or orderbook in a scalable manner, without the need for a liquidation mechanism.

The solution sounds simple, but the implications are enormous. This is pure Defi innovation. Non-linear liquidations without an intermediary is a problem that Tradfi has never had to solve for. To be able to trade options on a large scale in a transparent, sustainable manner purely governed by smart contracts could fundamentally change the way financial products are structured and traded forever.

3. DOVs will be the cornerstone liquidity for Altcoin option markets

The crypto option market is dominated by BTC and ETH, which are the only coins offered on Deribit. The Deribit orderbooks serve as the core liquidity venue for BTC and ETH and this is reflected in OTC markets as well, where options outside of BTC and ETH are not nearly as liquid.

Many might not recall that even in early 2020, ETH options were wide and illiquid, hardly traded on Deribit. QCP was one of the main players that brought life to the ETH options market by injecting vol supply in huge size and crossing wide spreads that consequently led to more market makers coming in to provide bids and thicken the ETH orderbooks. Fast forward a year and a half to present day and the ETH vol market is arguably more liquid and as large as (if not larger than) the BTC vol market.

We have been trying for a while now to do the same for other coins/tokens with limited success. For a vol market to really come alive, it needs a scalable venue as well as critical liquidity injection to incentivise traders, investors and market makers to participate.

Ironically, we are seeing Defi succeed at bringing life to Altcoins options where Cefi has failed. DOVs have become the largest trading venue for Altcoins with sizable vaults in ALGO, LUNA, AAVE, AVAX and more in the pipeline.

Functioning as both the venue and liquidity source for Altcoins options, DOVs are fast becoming the cornerstone liquidity for Altcoins. This liquidity will inevitably spread into Cefi. Exchanges will confidently list more Altcoin vol books with confidence now that demand already exists and OTC players will be able to tighten spreads and push Altcoin options products having received inventory through the DOVs.

This is significant. For the first time, we are seeing Defi lead Cefi as the originator of liquidity and not just a layer built on top of Cefi powered by layers of token incentives.

More importantly, the advent of Altcoin vaults in DOVs will give holders of all kinds of coins/tokens a viable alternative source of high return, besides just hodling and staking. Investors, speculators, foundations and project treasuries clearly see the value in monetising their large coin inventories and have started to pour into the vaults. The demand for these Altcoin vaults has been incredible and will continue to grow exponentially.

As is the case with all financial instruments, the creation of healthy derivatives markets will also significantly improve spot liquidity. Complaints of poor liquidity in Altcoin spot markets might soon become a thing of the past.

What’s next in the evolution of DOVs?

The appeal of DOVs is the stunning simplicity of the model. But this is just the start.

To begin with, the current strategies offered by the vaults are just vanilla puts and calls but these can and will become increasingly complex. Examples of such are more sophisticated option structures which better utilise the collateral and amplify the base yield. In time, perhaps even the offering of exotic options like digitals and barriers through the vaults. The strategies could even move away from purely option-related instruments to include more complicated non-linear products but of course that will come with additional risk. The sky’s the limit when it comes to DOVs!

Taking it one step further, the option contracts traded by the vaults can be tokenized and traded in secondary markets through orderbooks or RFQ. With large enough TVL and multiple vaults, particularly if the various DOV protocols are interoperable, DOVs could effectively function as a full Deribit exchange on Defi with a wide range of contracts and various types of structured products being actively traded in size. The realisation of this vision would be incredible, full blown derivatives markets trading purely through smart contracts!

Lastly, it is worth nothing that DOVs present a dual Defi disruption. DOVs are not just disrupting how options and structured products are being traded. It is also disrupting how asset management is being conducted. One no longer needs to be an accredited investor with a minimum million dollar investment to access institutional-grade trading strategies. Any investor with a single dollar is able to participate in DOVs and enjoy the supernormal returns from sophisticated strategies, with an optimal risk-return profile of their choice.

Most importantly, DOVs do away with the typical hedge fund 2/20 model. Investors are subject to minimal or even no fees, as all participants are given token incentives to reward both the investment and liquidity provision side of the vaults.

This is how token rewards should be structured, a mechanism to facilitate disintermediation as part of Defi innovation. Not as a primary source of yield. I would go so far as to say DOVs are the true expression of Defi values and will be the point of convergence between the current Defi community and the Tradfi world.

A Quick Overview of Existing DOV protocols

Ribbon.Finance: First mover and successful proof-of-concept for DOVs. Built on Ethereum with close to $200 million TVL mostly in WBTC and ETH. They also offer AAVE, AVAX and STETH. Ribbon uses Opyn and Airswap for settlement and Gnosis for on-chain auctions.

Thetanuts.Finance: Up-and-coming DOV focused on multi-chain operability, it is currently available on Ethereum, Binance Smart Chain, Polygon, Fantom and Avalanche. Will also soon be on most EVM compatible chains like NEAR Aurora, Boba and Solana NEON among others. In addition to WBTC and ETH vaults, they’ve had a big push for Altcoins having launched a $10 million ALGO vault and a $2 million LUNA vault. They also currently offer ADA and BCH with BOBA, ROSE and NEAR in the works. Thetanuts manages settlements in-protocol and does not have third party dependencies.

StakeDAO: Currently operates on Ethereum with plans to provide services on Polygon in the future. Its passive strategies involve the staking of stablecoins and tokens or providing liquidity across multiple protocols to earn rewards.

Other Notable DOVs:

Solana Chain:

Friktion.Finance — Offering SOL, BTC and ETH vaults. Planning vaults with convex structured products and also an impermanent loss hedge mechanism.

Katana Finance

Tap Finance

Polygon Chain:

Opium.Finance — Offering ETH and 1INCH vaults.

Avalanche Chain:

Arrow Markets — Offering bull and bear spread vaults. Also offering a unique price oracle for settlement written and hosted by the protocol.

Last updated