Stablecoin primer - Pt 4

https://medium.com/coinmonks/stablecoin-primer-section-4-stablecoin-projects-28b509624165

With so many stablecoins out there, which one works the best?

Osman Sarman, Apr 2022

If you have come this far, you probably do not need this reminder but the same mental models mentioned in Section 3 applies here as well. If you haven’t done so, I invite you to read the Two mental models part in Section 3. If you have already read Section 3, just a TLDR reminder that:

“As simple as the concept of a stablecoin may sound, the protocols and mechanisms behind these stablecoins can be quite intricate.”

Hopefully, the two mental models from Section 3 reduce some complexity by aligning what to expect from the meat of this section where we analyze stablecoin projects one by one.

The format for each stablecoin project is as follows. First, I provide a brief intro of the protocol and follow that with the tokens that are critical to the protocol. Then, I analyze the details of the protocols using the design principles from Section 3, and end the analysis by presenting some key metrics as well as some specific use cases for each stablecoin. I call this format “Shallow-dive” — the information you will find is more detailed than what you would find on the surface (e.g., via Bloomberg.) But since this is a Primer, we are only diving to the shallow depths of each stablecoin so will not need a too much of a diving experience (also it’s not like there aren’t enough deep-dives out there already.) Let’s go!

Fiat-backed stablecoins:

USDC by Circle and Coinbase (coming soon)

Crypto-backed stablecoins:

OUSD by Origin Dollar (coming soon)

Algorithmic stablecoins:

FRAX by Frax Finance (coming soon)

FEI by Fei Protocol (coming soon)

UXD by UXD Protocol (coming soon)

What needs to be true for stablecoins to reach mainstream adoption?

This article is part of the Stablecoin Primer series. If you are interested in reading the other articles, check out this post.

“Stablecoins are one of the three trillion dollar narratives in crypto” Sam Kazemian, founder of the algorithmic stablecoin issuer Frax Finance

The above should not surprise you at this point. In Section 2, we discussed that the total addressable market of the stablecoin industry could be as high as $57 trillion — that’s because stablecoins are not only safe havens from crypto’s volatility but also global reserve currency candidates that are much more accessible and advanced than the US dollar.

So now the question is — what needs to be true for stablecoins to reach their full potential of being adopted by billions of people? Since I am not in the crystal gazing business, I do not have an easy answer to this. I do, however, have a simplifying approach that I call: the chain of adoption.

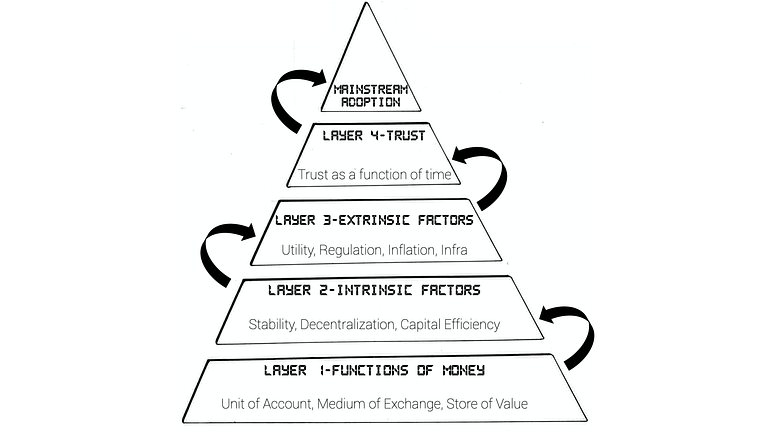

The chain of adoption

The chain of adoption

Think of this as a flow chart, where each layer represents a set of requirements, and only if all requirements in a layer are met, the adoption cycle can continue to the next layer. So that’s the high level - let’s talk specifics.

Layer 1 — Functions of money: In Section 1, we discussed how money is like a technology that has three main functions: unit of account, medium of exchange, and store of value. Building on that, in Section 2, via real life product market fit examples and use cases, we established how stablecoins successfully posses these functions in real life. Check

Layer 2 — Intrinsic factors: In Section 3 and Section 4, we discussed the intrinsic factors of stablecoins, which we called Design Principles. By discussing how the mechanisms behind stablecoins like Tether’s USDT, Maker’s DAI, and Terra’s UST work, we answered the the simple and sought after question — “so how do these stablecoins actually work?” While stablecoin mechanisms are still under question, especially after Terra’s recent collapse, it is safe to say that certain mechanism types like fractional algorithmic stablecoins are proving to function better than the others. As different mechanism design experiments continue, we are getting closer to meeting all the requirements in this layer too.

Layer 3 — Extrinsic factors: Now this is where we are approaching in the chain of adoption. Yes, the ultimate goal of any stablecoin is to be stable, and yes, the majority of the stablecoins have intricate mechanisms behind them to achieve this complicated task. But, mechanism design is only a part of the story and stablecoins depend on certain extrinsic factors to reach mainstream adoption as well. While not an exhaustive list, extrinsic factors boil down to the below areas:

Utility: As the founder of the Terra stablecoin (rip) Do Kwon tweeted, great stablecoin mechanisms need to be supported by even greater economies around them. In the fiat economy, we use money for so many purposes (e.g., transact, save, donate, invest, burn). Stablecoins need this type of utility too. Users need simple on/off ramp solutions to move their fiat into stablecoins and be able to use their stablecoins both in the fiat economy and in the blockchain economy. At the end of the day, stablecoin is a money business and what good does money have if it can’t be used?

Regulation: Haseeb Qureshi of Dragonfly Capital states that “all the other avenues have to be exhausted before decentralized stablecoins have a chance of winning.” Along his lines, right now, most stablecoin usage is in terms of fiat-backed stablescoins (e.g., USDC). While this is thanks to their simple mechanism design, strong stability, and early market entry, fiat-backed stablecoins are fully permissioned and non-scalable. This means that if a regulator wants to censor the usage of a stablecoin (e.g., thinking that it poses a threat to other fiat monies), they can easily do so. Additionally, their scaling is dependent on how much fiat collateral is available to them. Decentralized stablecoins however, provide so much more flexibility to their users given they are fully blockchain based, permissionless, and non-custody taking. What this means is that, increased regulation on fiat-backed stablecoins may actually lead to the increased adoption of decentralized stablecoins as people will shy away from regulation.

Inflation of the US dollar: Even throughout the writing of the Primer, inflation in the US continued to increase. At 8.5%, inflation eats into people’s savings in fiat money, making the US dollar a questionable store of value. But as the World’s reserve currency, wasn’t the US dollar supposed to be super stable? Maybe not. Stablecoin projects like Volt and Frax’s FPI aim to solve this problem by pegging their stable tokens’ value not to the US dollar but to the consumer price index (i.e., the real price of goods & services in the economy.) The point is, stablecoins have flexible designs and they will always follow the more stable alternative. Increased and continued inflation of the US dollar may lead to the adoption of such stablecoins, expediting stablecoins’ mainstream adoption.

Infrastructure: While blockchains like Avalanche and Terra boast about their TPS limits (i.e., 50,000 and 10,000 respectively), these limits have not been battle tested at scale. If stablecoins will be used by billions of people, we need a robust infrastructure in place.

Layer 4 — Trust as a function of time: Trust takes years to build and seconds to break. This applies to trust in money as well. When the US dollar was first established via the Coinage Act of 1792, not everyone immediately accepted the rule that 1 dollar should equal 416 grains of standard silver. It required years of consensus building for the US dollar to become engrained in the economy and hit the world stage. Now, the US dollar is not really backed by any hard asset but people still have faith in it because it has been working well for them for a long enough time.

Because of the difficulty of building trust, many forms of private money have come and gone. Similarly, many algorithmic stablecoins have lost their peg to 1 US dollar (e.g., UST, ESD, USDN). Some advocate that a trustless way of building money is via overcollateralization (think crypto-backed stablecoins from Section 3). The logic is that, with this method, users do not need to trust any central issuer because they know that their stablecoins are backed by real collateral behind them. But then again, overcollateralization falls short as it is not scalable to meet the needs of billions of users. This makes algorithmic stablecoins potentially better suited as the stablecoin type that can reach mainstream adoption. And while an extremely difficult feat to accomplish, survival across long durations of time seems to be the last layer in stablecoins’ chain of adoption.

Closing thoughts

As you can tell, I have not explicitly touched upon the specific risks pertaining to stablecoins. Each type has its own risks and a good way to assess the antifragility and long term stability of a stablecoin is via how well that stablecoin is progressing on the chain of adoption.

This is an exciting journey and I hope this Primer sparked the littlest interest in you about stablecoins. We are living at a time when money as we know it is changing. Each stablecoin experiment, whether it fails or persists, can be seen as a step forward in the search for better money. The stablecoin innovation is foundational, making it one of the few technological advancements that may touch every single person’s life in the World.

If you share the same excitement, let’s connect via twitter.

Osman

Last updated