Chasing stability - a stablecoin deep dive

https://deathereum.substack.com/p/chasing-stability-a-stablecoin-deepdive

Deathereum, May 2021

This essay is broken down into three parts.

Part I - Intro to Stablecoins + Origins and History of Money

Part II - Desired Traits in a Stablecoin + Deep Dive on Various Designs

Part III - Conclusion: The Best Decentralized Stablecoin Design

Part I

Thirteen years ago, Satoshi Nakamoto kickstarted what is arguably the most notable attempt at creating a censorship resistant, decentralized monetary network (preceded by DigiCash, BitGold, B-money). While Bitcoin, the poster boy of cryptocurrencies, has attracted trillions of dollars of inflow into the system and remains the ideological benchmark for an independent monetary system, it continues to experience significant bouts of price volatility rendering it unlikely to ever offer that which is fundamental to any currency or money - stability. It’s deterministic and capped supply causes it to resemble gold more closely than it does money.

Enter stablecoins - cryptocurrencies with zero/minimal volatility. Though much has been said about stablecoins, their importance in achieving global scale crypto adoption cannot be overstated. Paraphrasing Nevin Freeman, stablecoins will serve as the first point of entry into the world of crypto for millions of future users. Ensuring their journeys are financially safe is essential to repelling negative regulatory attention and preventing a financial collapse from jeopardizing the industry’s prospects.

Beyond merely providing an entry point, stablecoins’ use cases are several: (1) dollarization of currencies in severely inflationary countries (2) savings / yield generation (3) frictionless, borderless payments (4) usage in credit markets and leverage trading (5) safe haven assets for traders and investors and (5) fee tokens for on-chain economies.

Taken for granted by the majority of users, stablecoins are like the internet - enablers of access to goods and services in a blockchain-enabled world. If one believes crypto will reshape global commerce and finance, it would be stupid to ignore the stablecoin opportunity. After all, the Total Addressable Market of global, digital cash is that of all the money in the world.

So what does stability mean for a stablecoin?

Virtually all stablecoins in existence are designed to stabilize their prices at or tightly around the value of 1 unit of a fiat currency, predominantly the US Dollar. This is not arbitrary. It is simply a reflection of the US Dollar’s dominance in the world’s financial markets. Apart from being the global reserve currency, it is the official currency in 10 countries (excluding the USA) and the de facto currency in many more. What makes the US Dollar so attractive to several foreign nations is its ability to preserve its purchasing power better than their own currencies.

To illustrate, Argentina suffered from rising inflation from the 1940s to the 1990s. At its peak in March 1989-1990, inflation was over 20,000%, which translates to the Argentinian Peso losing ~1.5% of its value every day. Consequently, Argentinians would increasingly convert and store their earnings and wealth in the US Dollar to retain purchasing power. Simply put, inflation means ‘X units of currency can procure Y units of goods today and less than Y units of the same goods tomorrow’.

In summary, the stability of stablecoins refers to the preservation of purchasing power within a native economy, no different from stability of fiat money. The simplest and most common way for stablecoins to do so is by piggy-backing on a fiat currency, but as we’ll see later this isn’t the only way.

Before I jump into that, it would be useful to briefly look at the origins and evolution of money.

So What is Money?

Any item or object that facilitates transactions between two or more parties can be considered money. Long before ‘modern’ money was conceived, humans relied on the barter system - a direct exchange of goods between two consenting parties. This works well when each party has something to offer that the other wants. But what if one doesn’t? The transaction would fail. Now imagine some commodity (silver, gold etc.) that everyone considers valuable and knows can be used to trade away in the future. Any seller would be willing to accept such commodity as payment even if he doesn’t intend to use it himself. This indirect exchange mechanism invalidates the need for coincidence of wants, giving money its primary function - a medium of exchange.

The second drawback of barter is that it becomes difficult for any party to value their goods in terms of another good because direct exchange rates may not exist for every single potential trading pair. One might know how many sacks of rice he can fetch by trading away his cow, but not how many chickens he could get unless he knows the exchange rate between chickens and rice. If instead a single common denominator was available to measure the value of all goods in the market, trade would become far more efficient. Thus, money serves as a unit of account.

Now imagine you own a cow that produces 8 gallons of milk a day, more than you can consume yourself. Unless you sold the excess milk today, you would lose some value due to spoilage. You would be better off trading your milk for a more durable good that can be used later. Thus, money as a store of value allows one to preserve surplus productivity for future use or monetization.

All money must fulfill the 3 functions above but merely doing so doesn’t constitute a useful money. Some goods are better at being money than others. To illustrate, crypto traders and investors in the pre-stablecoin days would hold and denominate their portfolios in BTC as it was considered a better store of value than the US Dollar. All other cryptocurrencies would be quoted in terms of BTC (unit of account). Though Bitcoin was designed to serve as a digital, peer-to-peer form of cash (medium of exchange it is not good money as its value tends to appreciate fast. If an asset is expected to increase in value over time, holders are less likely to use it for transacting. Good money, on the other hand, is widely acceptable, durable, transportable, fungible, divisible and stable. On the surface, fiat money checks all boxes.

Note: That money evolved from the failures of the barter system is a tale as old as time, popularized and brought into economic literature by Adam Smith.

Anthropologists have since contested these claims stating that no evidence exists to suggest that a formal barter economy ever existed. While they’re perhaps right, the Smithian version does help illustrate the utility of money, even if it doesn’t necessarily tell us the true origin of it.

From Hard Money to Fiat

In the days of barter, any commodity could be used as money but societies naturally gravitated towards a smaller subset of commodities that had the most marketability, such as gold and silver which were deemed to have intrinsic value. This form of ‘hard money’ allowed parties to transact efficiently and trustlessly. Economists also refer to this form as ‘outside money’ - one person’s asset that doesn’t represent another’s liability, i.e, if represented on an aggregated balance sheet of the world, its value would be net positive. Such money requires no enforcement of value and hence no trust.

Precious metals were often deposited with trusted parties like goldsmiths, who would then issue a paper receipt acknowledging a depositor’s claim to the assets.

Eventually, people realized it was more convenient to trade these receipts, rather than carry metals around. Because these receipts were redeemable for real assets, they were implicitly accepted as money. The practice of representing claims on hard money as ‘paper money’ / currency notes led to the monetary system known as the ‘Gold Standard’.

The Gold Standard restricted a country’s Central Bank from issuing currency in excess of the value of its gold reserves. A commitment to the standard was a means to prevent inflation. The Bretton Woods Conference in 1944 adopted the US Dollar as the international reserve currency and the Gold Standard was used within each of the adopting nations as an exchange rate pegging mechanism between Central Banks. In 1971, the USA defaulted on its promise of redeeming US Dollars for Gold and abandoned the Gold Standard altogether. This is how the present ‘pure fiat’ system was born.

If fiat money is just worthless paper that has neither intrinsic value nor a claim against hard money, why does it continue to be used all over the world? Simply because of a collective belief that it must be worth something because others believe it is worth something. Vitalik describes this as legitimacy and suggests ways in which legitimacy develops, two of which can explain the growth and survival of fiat money:

“Legitimacy by brute force - someone (e.g. Central Government) convinces everyone that they are powerful enough to impose their will and resisting them will be very hard. This drives most people to submit because each person expects that everyone else will be too scared to resist as well.”

“Legitimacy by continuity - if something was legitimate at time T, it is by default legitimate at time T+1.”

The concept of money’s value being derived from a common belief isn’t an entirely new phenomenon. Stone disks in Micronesia, known as Rai or Fei (sounds familiar?) have been used as money, showing that value can be assigned to an object through consensus.

The main drawback of fiat money isn’t that it lacks intrinsic value. It’s that there aren’t any restrictions on a Central Bank’s ability to print money. The implication of switching to a pure fiat regime is that Central Banks can print money as they please and Commercial Banks can further multiply the money in circulation through fractional reserve banking. What happens when the quantity of money increases without an increase in actual output of goods and services? Every unit of money is less valuable. In other words, purchasing power of money reduces. Doesn’t seem very stable, does it?

Stablecoins hold the promise of a transparent alternative to money. One type in particular - algorithmic stablecoins not backed by assets - can theoretically combine the essence and scalability of fiat money while removing the risks of arbitrary money printing. Let’s take a look.

Part II

What Makes for the Ideal Stablecoin?

BitShares, the OG stablecoin network proposed and was built on 17 foundational principles of an ideal free-market financial system. Out of these, 6 in particular are desirable traits in a stablecoin (apart from stability, of course)

1) Decentralization[1]

2) Trustlessness

3) Scalability

4) Simplicity

5) Endogenous information[2] (only use price information from within the system)

6) Privacy[3]

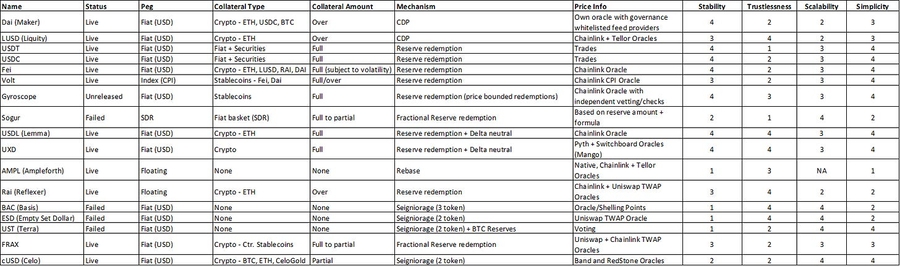

The scope of this evaluation, however is restricted to stability, trustlessness, scalability and simplicity as my primary objective is to conclude on what I believe is the most decentralized and scalable stablecoin design.

[1] The BitShares whitepaper refers to decentralization as all parties in the system having equal status with no special privileges and democratic governance.

Trustlessness refers to removing a party’s ability to default/withhold assets and not needing contractual obligations to transact - this directly aligns with ‘Decentralization’ embedded in the Stablecoin Trilemma.

[2] I will provide brief explanations of each protocol’s information mechanism but refrain from making judgements.

[3] While desirable, privacy-enabling mechanisms at present are limited to proposed integrations of existing stablecoins with Tornado Cash to allow anonymous minting (E.g. FRAX) and stablecoins built on privacy-enabled networks (E.g. SILK on Secret Network).

Classification

At a high level, stablecoins can be classified on the basis of peg, collateral and the core mechanism employed. Below is a taxonomy along with examples.

PEG - Fiat, Commodity, Index, Floating

Fiat - Price is pegged to a real currency (E.g. USDC, agEUR TerraKRW)

Commodity - Price is pegged to the value of a unit of commodity (E.g. PAXG linked to price of 1 troy ounce of gold)

Index - Price tracks some index of assets/commodities/currencies (E.g. Volt pegged to CPI, Saga pegged to IMF’s SDR)

Floating - Price freely fluctuates within a range of values as a function of supply, demand and incentives, similar to how exchange rates between currency pairs fluctuate (E.g. RAI, FLOAT)

COLLATERALIZATION

Type of collateral/reserves

Fiat - Stablecoins are 1:1 tokenized versions of US Dollars, Euros etc. deposited with intermediaries

Crypto - Stablecoins backed by on-chain crypto assets like ETH and BTC.

Commodity - Stablecoins backed by off-chain physical assets like Gold, Oil, Real Estate.

None - Stablecoins backed by a protocol’s native token (UST<>Luna, Silk<>Shade) or nothing at all (ESD, BAC)

Quantum of reserves

Excess - Reserves/Collateral greater than 100% of a stablecoin’s market cap. (Maker’s DAI, Liquity’s LUSD, Abracadabra’s MIM)

Full - Market cap of stablecoin is 100% backed by assets (USDC, UXD, Lemma’s USDL)

Partial - Backing is less than 100%. (FRAX, Sperax’s USDs).

None - Backed either by nothing (NuBits, AMPL, ESD) or endogenous capital (UST)

MECHANISM

Redemption of reserves - Stablecoins can be surrendered/burned in exchange for reserve assets (USDC, Fei, Float)

Seigniorage shares (2 token and 3 token models) - Stablecoins which have an associated equity and/or debt token that absorbs price volatility arising from excess/shortfall of stablecoin demand (BAC, ESD, NuBits, UST)

Collateralized debt positions (CDP) - Issuance of stablecoin loans against excess collateral (BitUSD, Dai, MIM)

Rebase - Coin supply changes algorithmically to achieve price control (AMPL)

Peg Stability Mechanisms

In this section we will look at the various methods/tools available to protocols to influence price and maintain a stablecoin’s peg. Although they may appear different from one another, the underlying mechanics are the same.

The market price of an asset moves up when the intensity of demand exceeds intensity of supply at a given price point. The inverse is true for price to move down. Intensity here means that buyers are willing to pay more than the current price (when demand > supply at current price) or sellers are willing to receive less than the current market price (when supply > demand at current price) to get their respective orders filled. Phrased differently, price moves up when market buy orders eat up sell limit orders and price moves down when market sell orders eat up buy limit orders.

So how do we ensure price doesn’t get pushed above or below the peg? By maintaining buy walls and sell walls.

Buy walls are large quantities of buy orders at $1 (or whatever the desired peg is) which absorb sell pressure. Sell walls are large quantities of sell orders at $1 which absorb buy pressure. By ensuring adequate buy pressure at or slightly below the peg, and sell pressure at or above the peg, price does not change. With this in mind, let’s look at some of the most common ways to achieve liquidity around the peg.

SM 1 - Reserve Redemptions and Arbitrage

a) Some or all of the protocol reserves are directly redeemable by surrendering stablecoins. E.g. If 1 unit of LUSD is trading at <$1, a stablecoin holder/arbitrageur can exchange this for $1 worth of collateral, thus providing a floor price of $1 for 1 LUSD.

In general, the more the reserves available for redemption, the more the reliability of the peg.

b) Any user can mint 1 unit of a stablecoin by placing at least $1 of collateral in the protocol. When the stablecoin trades at >$1, users can mint new coins for $1 each and sell them in the market for >$1, pocketing the difference, until price falls to $1.

The above supply adjustments can be initiated either by users or designated actors.

SM 2 - Interest rates & Fees

a) SM 2.1 Deposit rates - A protocol can offer holders a savings rate to incentivize locking up or staking of the stablecoin to reduce the circulating supply. By increasing rates, more users are expected to buy and lock up stablecoins, pushing the price up. By decreasing rates or removing interest altogether, sell pressure is expected to push the price down. (E.g. Dai’s DSR - Dai Savings Rate)

b) SM 2.2 Borrowing rates - In case of CDP stablecoins (explained in the Mechanism section), increasing or decreasing borrowing rates incentivizes borrowers to either close out existing loans (thereby reducing stablecoin supply) or create new ones (increasing stablecoin supply). (E.g. Dai’s Stability Fee)

c) SM 2.3 Redemption Fee - When stablecoins are redeemed for collateral, a variable fee can be charged to penalize any redemption that could harm the peg.

SM 3 - Open market operations

Much like Central Banks print money and acquire assets from the open market, the system expands by minting new stablecoins to buy other crypto assets. This increase in supply drives the price of stablecoins down. During a contraction phase where price is below the peg, these assets are sold to buyback and burn stablecoins, thus reducing the supply and pushing the price up. (E.g. Celo USD)

SM 4 - Shares, Bonds and Binary Options

a) SM 4.1 - Shares - Share tokens are volatility absorbing tokens in the seigniorage shares model. When stablecoin price is above the peg, new coins are minted and given to holders who burn a portion of their share tokens. When supply needs to decrease to push the price back up to peg, stablecoin holders who surrender/burn their stablecoins are compensated by freshly minted share tokens. (E.g. Terra’s $Luna)

b) SM 4.2 - Bonds & Binary Options - A variation of the original seigniorage shares model includes a bond token. When stablecoin supply needs to decrease, bond tokens with a face value of $1 are sold at a discount in exchange for stablecoins, thereby reducing supply and pushing the stablecoin’s price up towards the peg. Bond tokens represent a promise to compensate bond holders in the future with more stablecoins during an expansion phase. When price of the stablecoin exceeds $1, new units are issued to bond holders. (E.g. Basis Cash’s $BAB)

Some ‘bond’ based models impose an expiry date on bond tokens, implying that bonds expire valueless if an expansion phase fails to arise prior to expiry. These are essentially binary options. (E.g. ESD’s $ESDS)

SM 5 - Target Prices (in Floating Peg models)

The protocol derives a periodically changing Target Price for the stablecoin through an algorithm taking into account various factors. Target prices are used for redemption of reserves. Differences between the Market Price and Target Price are arbitraged, causing a price convergence.

A Deep Dive on Stablecoins

The previous section covered the types of stablecoin designs and the peg stability mechanisms available. We now apply this knowledge to evaluate some of the noteworthy attempts at building stablecoins.

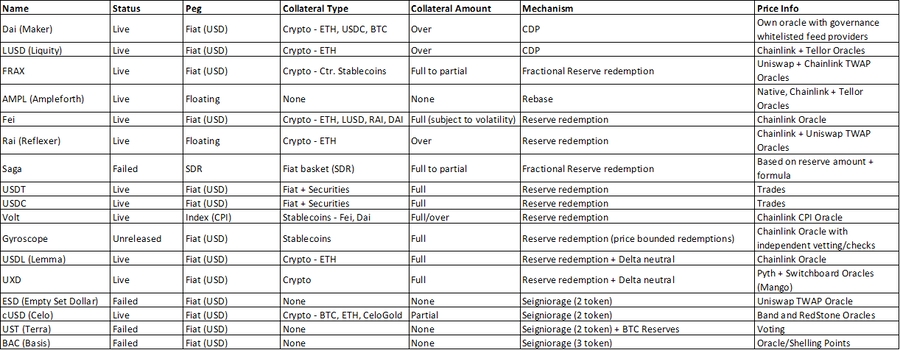

Classification of Stablecoins Covered

h/t: Amani Moin, Emin Gün Sirer, and Kevin Sekniqi of Ava Labs for the framework/ nomenclature

Maker’s DAI

USD Pegged / Crypto Collateral / Over Collateralized / Reserve Redemption

As one of the longest surviving stablecoins with a market cap in excess of $8B, DAI is widely considered DeFi’s native stablecoin. It is primarily a borrowing protocol that allows users to a) get leveraged exposure to crypto assets and b) get liquidity for their crypto assets while maintaining exposure and without triggering a taxable event.

DAI is a CDP-based stablecoin. A user deposits any pre-approved collateral into the protocol and can borrow newly minted DAI at a Collateralization Ratio of

101%-175% (higher CR for higher volatility collateral and lower for USD- stablecoins). DAI can then be used buy more crypto or sold on the open market. The borrower may close their loan and retrieve their collateral by repaying the borrowed DAI along with interest (stability fee).

If the collateral drops in price resulting in the borrowed amount breaching a specified CR % (Liquidation Ratio), the loans are liquidated and the borrower loses a part of his or her collateral to liquidators, plus a liquidation penalty.

Liquidation

The liquidation system relies on the following to work

Keepers - Actors who facilitate liquidations by taking over the DAI-denominated debt and some collateral from defaulting borrowers.). Additionally, they arbitrage DAI when it trades away from the peg.

Oracles - The system receives collateral prices from Oracle Feeds (whitelisted actors), which are then medianized to weed out extreme values. Medianized values pass through the Oracle Security Module which effects a 1-hour delay before prices are published. This allows sufficient time to introduce Emergency Oracles to prevent malicious attacks on main Oracles.

Stability Mechanisms

Dai Savings Rate (covered in SM 2.1) - This reduces supply of DAI only in the short term, so it is works better in conjunction with other mechanisms.

Historically, demand for DAI has outweighed supply, causing DAI to go above peg. In such scenarios, reducing DSR (to increase supply) would only be partially useful since it cannot go below 0.

Stability Fees (SM 2.2) - Like the DSR, Stability Fees have short term/limited impact on DAI’s price. Additionally, the effectiveness also depends on other factors such as overall market sentiment and other stablecoin yield opportunities. For example, if higher yields are available elsewhere, users may still borrow at higher stability fees, negating the expected decrease in supply.

Borrower Actions - When DAI is below its peg, users who borrowed DAI (vault creators) at the peg may be incentivized to buy cheaper DAI to close the loan. However, this is unlikely to be a strong enough incentive if leverage is the primary objective of borrowing since the upside potential from leverage is uncapped while gains from repaying DAI are capped (DAI trading below peg is likely when market sentiment is positive and speculators wish to move from stables to crypto). On the flipside, when DAI is above the peg, it may seem that users can borrow DAI to sell it above peg expecting price to revert to $1, locking in a profit. However, there are two issues here (a) this is not an instantaneous arbitrage loop and requires arbitragers to expose themselves to the collateral’s directional risk while they wait for DAI to return to peg and (b) the arbitrageurs will need to rebuy the same number of DAI from the market to close their CDP, likely causing an increase in DAI’s prices. Thus, reliance on vault creators provides temporary stabilization at best.

Emergency Shutdown - This is Maker’s last-resort mechanism which suspends core borrowing functions and gives both vault creators and DAI holders an exit to underlying collateral. The logic behind this mechanism is that expectation of an impending shutdown prevents DAI from trading too far away from the peg.

However, the effectiveness of this depends on how much confidence arbitragers have that a shutdown will be triggered. In the absence of clear, objective triggers for initiating a shutdown, it becomes difficult for arbitragers to assess the probability and consequently, the risk-reward potential and time value of money.

DAI Peg Security Module (SM 1) - Until the Peg Security Module (PSM) was introduced in the December 2020, DAI was reliant on the mechanisms explained above to maintain stability. DAI’s stability suffered from 4 major issues:

No redemption of reserves - When DAI was below peg, unless an emergency shutdown was initiated, it was impossible for DAI holders to redeem 1 DAI for $1 of collateral from the system, even though fully backed, preventing arbitragers from pushing the price back up

Liquidations broke DAI’s peg to the upside - Since keepers bidding for collateral liquidation require DAI, it adds upward pressure on DAI’s price.

Reduced supply from vault closures - During a market crash, collateral values collapse, prompting vault creators to close vaults to prevent liquidation. Thus, DAI’s supply is reduced when it is most needed for stability.

Arbitrage loop kicks in only when DAI >$1.5 - Without strong stability mechanisms, DAI could theoretically go up to $1.5. When DAI >$1.5, an arbitrager would be willing to place $1.5 of collateral in the vault (at 150% CR), mint and sell DAI for >$1.5 and pocket the difference, repeating the process till DAI is back to $1.5.

Dai’s PSM solved all the problems above. By allowing any user to swap USDC<>freshly minted DAI on a 1:1 basis without opening a vault, it enabled an instantaneous closed arbitrage loop. Since the launch, DAI has maintained its peg well (refer chart below). However, this has come at the cost of centralization risks. By allowing USDC, a stablecoin issued by a centralized financial institution, into the system Maker has sacrificed decentralization.

Source of Price Information

Oracle - Covered under ‘Liquidation’

Noteworthy Elements

Maker has differentiated itself from other stablecoin protocols by building their oracles in-house.

Risks/Limitations

A sharp drop in prices of collateral assets and inability to conduct auctions.

Coordinated oracle attacks - i) Whitelisting of malicious feed providers by colluding MKR holders ii) Manipulated price feeds by colluding feed providers

Malicious governance proposals

Scalability - Theoretical limit of DAI supply is ~67% of aggregate market cap of all collateral assets due to Collateralization Ratio of ~150%.

Primary demand for Dai comes from leverage - Not competitive compared to DEXs which offer 2x-125x leverage, making it less likely that crypto lending demand will drive significant supply expansion

Rating

Stability - 3 - Thanks to DAI’s PSM, its ability to maintain peg has vastly improved. Making full-redeemability available (like Liquity) at all times would further improve resilience.

Trustlessness - 2 - DAI has significant (>50%) exposure to USDC, a centralized stablecoin. This adds systemic risk to Maker

Scalability - 2 - While minimum CR is ~150%, actual CR may be 200-250% to ensure all loans are safe from market crashes. This is inefficient use of capital.

Simplicity - 3 - Dai is simple to use for the average DeFi user but management of vaults requires constant monitoring.

Disclaimer: Ratings are an expression of the potential of each design choice, rather than a comment on the quality of execution of those design choices or the current viability. The guiding principle here is ‘Cannot fail > Should not fail’.

To illustrate, UXD’s/Lemma’s models require deep futures markets on DEXs which may not exist today to support a widely adopted stablecoin. A Scalability rating of 3 (on 4) implies that high scalability can be achieved in the future without compromising on the design choice. In contrast, DAI is comparatively more scalable today, however, in the long run it cannot scale as efficiently as 100% collateralized stablecoins without changing its design.

Liquity’s LUSD

USD Pegged / Crypto Collateral / Over Collateralized / Reserve Redemption

Liquity is a CDP-based borrowing protocol that shares many similarities with Maker (DAI). Liquity differentiates itself from Maker through the following:

one-time borrowing fee of 0.5-5% and 0% interest rate

lower collateralization ratio (CR) requirement of 110% on individual vaults (troves) and protocol level CR of 150%

direct redeemability of 1 LUSD for $1 of collateral at any time a more efficient liquidation mechanism

immutability of contracts and governance-free

Liquidation

The liquidation system relies on the following:

Stability Pool (SP) - In the Maker system, liquidators bid for a defaulting borrower’s collateral in exchange for DAI. Liquity achieves the same thing through a SP, a readily available pool of LUSD funded by Stability Providers (LUSD holders) who stand to gain a share of the liquidated collateral. When the CR of a trove falls below 110% (liquidation ratio), the outstanding debt of the trove is repaid using LUSD from the SP. Stability Providers make a profit equal to the difference between the loan amount and the value of collateral received (0-9.9%).

Oracles - The system uses Chainlink’s ETH-USD oracle to trigger liquidations. Under specific circumstances, it uses Tellor’s ETH-USD oracle instead.

Redistribution - When the SP is empty, the outstanding debt and collateral of the liquidated trove are transferred and allocated to other trove owners in proportion to their respective collateral balances. Although this results in the CR of the recipient troves decreasing, the collateral gained is in most cases higher than the debt inherited, making it profitable.

Stability Mechanisms

Reserve Redemptions and Arbitrage (SM1) - When LUSD trades at <$1, any arbitrager can buy 1 LUSD from the market and redeem it for $1 of ETH. This loop repeats until the peg is regained. This mechanism provides a hard floor of $1 to LUSD.

When LUSD trades at between $1 and $1.1, arbitrageurs must deposit $1.1 of ETH and expose themselves to the collateral’s directional risk while they wait for DAI to return to peg.

However, when LUSD is >$1.1, the arbitrageur can deposit $1.1 of ETH and instantly mint and sell LUSD for >$1.1, repeating the process till LUSD drops to $1.1. Thus, LUSD has a hard ceiling price of $1.1 and not $1.

Borrower Actions - The same logic explained in Dai’s third stability mechanism (Borrower Actions) applies to LUSD too.

Issuance Fees* (SM2.2) - A one-time borrowing fee that is similar to and replaces Dai’s Stability Fee. Like Stability Fees, Issuance Fees have short term/limited impact on LUSD’s price. Additionally, the effectiveness also depends on other factors such as overall market sentiment and other stablecoin yield opportunities. For example, if higher yields are available elsewhere, users may still borrow despite higher Issuance fees, negating the expected decrease in supply.

Redemption Fees* (SM 2.3) - Liquity has a variable fee that increases when the rate of redemption increases. Fees may prove useful when LUSD trades above

$1 as it disincentivizes unnecessary redemption. However, when LUSD is below $1, redemption fees need to be carefully managed to avoid a situation where high redemption fees make arbitrage unprofitable.

*Issuance Fee % and Redemption Fee % are based on the same function (base rate

+ 0.5%). The base rate is dynamic and based on the rate at which minting/redemption occurs.

Source of Price Information

Oracles - Covered under ‘Liquidation’

Noteworthy Elements

In Maker, the liquidation engine acts as a single barrier when price of collateral starts to crash, taking on the obligations of ensuring healthy liquidations without expected losses. Liquity uses game theory to shift partial responsibility to trove owners.

LUSD redemptions are settled against troves with the lowest CR. This poses a risk of liquidation to any trove that is close to 110% CR.

These 2 mechanics force trove users to ensure that they are not the least collateralized participants and that the protocol CR is at least 150%

Risks/Limitations

During a rapid crash in collateral value, trove owners will look to buy LUSD to repay their loans and avoid liquidation. This can drive price of LUSD above $1 (as with Maker’s Black Friday 2020 crisis). Since LUSD is endogenously generated within the system, additional stablecoins cannot be procured easily to repay loans.

If the CR drops below 100% in a flash crash and liquidation is facilitated through the Stability Pool, collateral gained by Stability Providers is less than LUSD spent, resulting in a net loss.

In a flash crash, demand for LUSD could push the price up beyond $1. As the price of LUSD approaches $1.1, it becomes less profitable for Stability Providers since the maximum potential gain is 10%, causing LUSD to be withdrawn.

Although the protocol uses 2 of the most trustworthy oracle providers - Chainlink/Tellor - they have been known to fail.

Liquity’s governance-free design makes it impossible to rectify contract errors. This means thinking about edge case fragility scenarios are critical since there is no ‘failsafe’.

Due complexity of trove management, growth of LUSD supply will come from leverage demand rather than stablecoin demand.

Rating

Stability - 3 - Unlike Maker, Liquity doesn’t have a PSM to ensure 2 way 1:1 swaps. Instead it has a hard peg on the downside (through arbitrage incentives) but a soft peg on the upside - a range of $1 to $1.1 (explained above)

Trustlessness - 4 - ETH is the only accepted collateral and there are no custodians involved.

Scalability - 2 - Due to a better liquidation system, it is more capital efficient than Maker but less than fully-collateralized stablecoins.

Simplicity - 3 - Simple to use for the average user but management of vaults requires constant monitoring.

Tether’s USDT and Circle’s USDC

USD Pegged / Fiat Collateral / Fully Collateralized / Reserve Redemption

USDT and USDC are the 2 largest stablecoins with market caps of $83B+ and

$48B+ respectively. They are substantially similar with a few noteworthy differences.

While USDT is promoted by Tether, an unregulated entity with opaque shareholding and operating structures, USDC is backed by Coinbase and Circle, two regulated, public US financial institutions.

Peg Stability Mechanism

Redemptions and Arbitrage (SM1) - Both USDT and USDC rely on institutions to arbitrage peg breaks.

Risks common to both

Not censorship-resistant (risk of regulatory clampdowns) - Since fiat collateral is stored in commercial bank accounts, risk of attachment of assets is non-trivial

Redemption of stablecoins for underlying assets is available only to institutions (exchanges, hedge funds etc.). When peg is broken to the downside, only mode of exit for retail users is selling to other retail/market makers at a loss.

Not permissionless redemption - Institutions rely on contractual agreements for enforcing redeemability of stablecoins. Even so, Tether and Circle have discretionary power to delay redemptions.

Risks unique to USDT

Tether holds only 30-40% of its reserves in cash and cash equivalent assets. The rest are held in the form of debt assets (loans, commercial papers, money market funds, bonds etc.). This presents liquidity and credit risks. In comparison, USDC is fully backed by cash and short-term US Treasuries.

Tether’s reserves are held in undisclosed banks, possibly exposing it to concentration risks. Circle on the other hand maintains its reserves across multiple custodians ensuring there is no single point of failure that can affect the entire system.

Source of Price Information

Trades - Observable from DEXs and CEXs.

Rating

Stability - 4 - Both have managed to maintain their pegs over time better than other crypto collateralized/ non-collateralized stablecoins.

Trustlessness - USDT 1, USDC 2 - While both require trust assumptions, USDC fairs marginally better due to limitations on single party exposure.

Scalability - 3 - Only $1 of collateral required per stablecoin.

Simplicity - 4 - Straightforward design, easy to acquire due to level of retail and institutional adoption.

Tribe’s Fei

USD Pegged / Crypto Collateral / Fully Collateralized (subject to volatility) / Reserve Redemption

Fei Protocol is the pioneer of Protocol Controlled Value (PCV). Users sell crypto assets to the protocol in exchange for Fei. The protocol’s treasury consists of

decentralized crypto assets such as ETH and LUSD. While currently over- collateralized, Fei can become under collateralized due to market volatility. In such cases, any PCV shortfall in fulfilling redemptions is compensated with newly minted Tribe tokens (similar to how FRAX redemptions are partly paid in USDC and FXS)

Peg Stability Mechanism

Peg Stability Module (SM1) - Similar to DAI, FEI’s PSM allows any user to swap DAI<>FEI around a tight price band. Minting Fei with DAI is incentivized through zero fees, while redemptions attract a 10bps fee. The PSM combined with other Fei liquidity pools enable the classic arbitrage loop.

In v1 of the protocol, Fei relied on 2 mechanisms for peg stability:

Direct incentives - FEI swaps/redemptions took place in a Uniswap LP that penalized/rewarded users for selling/buying Fei below the peg. As the price drifted further away from the peg, the penalty increased. While sound in theory, these incentives failed - panic-stricken users sough to salvage what value they could rather than wait for the peg to be regained. This caused the peg to drop as low as $0.5.

PCV Reweights - When the FEI/ETH liquidity pool is unbalanced, the protocol withdraws all its liquity from the pool, uses some of the ETH to buy FEI to rebalance the pool, and then resupplies PCV to the pool in the balanced ratio, and burns the excess FEI that is left.

Both the mechanisms above were phased out and replaced by the PSM.

Source of Price Information

The protocol uses the following oracles

Chainlink DAI/FEI - This is used in the PSM. The PSM only relies on this oracle to ensure that DAI-FEI is trading within an acceptable range (0.975- 1.025). If it is, the mint/swap occurs on 1:1 basis. This way, Fei piggybacks on DAI’s peg.

Chinlink PCV asset/USD - This is only used to calculate the USD values of PCV assets to determine the system’s collateralization ratio.

Risks/Limitations

By design, PCV is entirely under the control of TribeDAO, which can choose not to provide liquidity to FEI (Yes, there are safeguards in the form of a ‘Guardian’ Multisig which can veto malicious proposals, but it isn’t impossible for the DAO to reconstitute the Guardian itself. Further, the Guardian Multisig is controlled by the Fei team which also holds a substantial share of TribeDAO. Here is an actual event where a proposal to offer 1:1 redemptions to all FEI holders was shot down by TribeDAO governance. A stablecoin must offer easy and permissionless exits to holders to inspire long term confidence in the protocol. (Gyro Finance, another stablecoin protocol, has a unique design that combines the PCV model while empowering Gyro Dollar holders through governance rights)

Although the protocol has a collateralization ratio of 230%+, ~75% of PCV is comprised of volatile assets (mostly ETH). Sharp market downturns can lead to redemption of FEI for ETH and DAI. In the last week of Jan ‘22, ETH’s price dropped by ~28%, this led to a FEI supply reduction of ~$293M (~40%).

Fei cannot achieve both reserves stability and scalability without the FEI/DAI PSM. Without the PSM, Fei would need to be over-collateralized at all times

Rating

Stability - 4 - Since the launch of its PSM, Fei has maintained its peg with a variance of 30-60 bps. It may not have the tightest peg, but it is stable enough for general use.

Trustlessness - 2 - Even though the reserves are fully comprised of crypto assets, the governance mechanism concentrates power in the hands of TribeDAO and the Fei team. (Explained under Risks and Limitations)

Scalability - 3 - Fei is scalable because of the Fei/Dai PSM. In the absence of a PSM, Fei supply cannot be scaled without compromising reserve stability. Increasing supply during a market uptrend puts Fei’s reserves at risk in subsequent downtrends.

Simplicity - 4 - Minting and redeeming Fei is easy.

Gyro Finance’s Gyro Dollar (GYD)

USD Pegged / Stablecoin Collateral / Fully Collateralized / Meta Stablecoin (Reserve Redemption)

GYD (yet to be launched) is a meta stablecoin i.e, a stablecoin that’s 100% backed by other stablecoins. GYD can be minted by depositing any of the accepted stablecoins into the protocol. The idea is to build a stablecoin reserve that shields itself from all DeFi risks - price, censorship, regulatory, counterparty, oracle and governance. This is achieved through segregation of reserve assets into isolated vaults such that failure of one doesn’t impact the others.

Peg Stability Mechanism

Reserve Redemptions and Arbitrage (SM1) - It relies on closed loop arbitrage when GYD >$1 or when GYD <$1 and reserve ratio ≥100%.

However, when reserves are <100%, the system uses a bonding curve for redemptions that provides decreasing redemption quotes for GYD. The redemption quotes ensure that all circulating GYD can be redeemed sustainably. This serves to disincentivize selling under the peg. While the exact mechanics are unknown at this point, they seem similar to the Direct Incentives employed by Fei initially.

Integration of CDPs - As a secondary mechanism, the protocol will give users the option to borrow against collateral, like Maker. It hopes that during a depegging event (<$1), borrowers will help defend the peg by repaying their debts cheaply.

Source of Information

The protocol intends to use Chainlink oracles but adds its own consistency checks

Triangulated Price Feeds - Unlike most protocols that directly use Chainlink/Tellor oracles, Gyro aims to construct the reference price of reserve assets by collecting on-chain information from highly liquid AMMs and DEXs, applying a set of consistency checks and cross-referencing them with information obtained through Chainlink oracles. This proposed design requires fewer trust assumptions compared to other protocols.

Balancer LP Tokens - The protocol uses its own method to calculate the individual values of assets in the LPs and aggregates them, instead of summing the units of each asset and multiplying by the target price ($1).

Noteworthy Elements

Governance

Although the protocol follows a PCV model, similar to FEI, it does not suffer from the same governance risks as Fei (Covered under Risks of Fei). The protocol also pioneered the concept of Optimistic Approval which Fei forked. Here, Gyro Dollar holders have the right to veto any decisions taken under the Optimistic Approval framework - thus giving them protection from malicious actions. But in the Fei protocol, Fei holders have no such right, instead they are at the mercy of TribeDAO members.

Conditional Cashflows - Gyro seeks to align the interest of governers and the protocol. Cashflows generated from operations flow as rewards to governance token tolders at a future date provided the protocol remains healthy. This is similar to underperformance/misconduct clawbacks.

The protocol uses its reserves to provide liquidity between GYD and other stablecoins. Liquidity pools are created in a way that assets with the same underlying risk factors are grouped together to prevent contagion and other uncorrelated assets being drained from reserves in the event one fails. For example, a liquidity pool may contain USDC and USDT along with GYD. If USDT fails for some reason, users may deposit USDT and drain USDC and GYD from the pool. In such an event, the protocol’s loss is restricted by insulting other reserve assets (like Dai, Liquity etc).

Algorithmic Pricing - The protocol has 2 AMM modules

Primary AMM - This AMM uses a bonding curve to set the mint/redemption rates taking into account the velocity of supply changes.

Secondary AMM - These are similar to regular AMMs but allow configurability of customized trading curves (i.e., the curve via which price impact manifests). The shape of the curve is determined by configuring the amount of liquidity available at each price point. At launch, the parameters of the AMMs (price range and liquidity distribution) will be chosen upon creation of the pool and will remain static. For a future version, the team is considering a dynamic version where the curve shape adjusts to market conditions (mainly the PAMM’s), but it requires significant work to do this safely.

Gyro’s oracle design is theoretically more robust than any other protocol’s. This significantly reduces trust assumptions and failures due to errors.

Unlike other stablecoins which stand clearly on either side of the decentralization spectrum, Gyro doesn’t discriminate between centralized and decentralized assets. Rather, its model is based on the belief that any risk cannot be eliminated, only minimized through diversification.

Risks/Limitations

Due to its composite design, GYD exposes itself to risks with relatively higher probability but lower magnitude of impact compared to other fully-backed stablecoins, which might protect themselves from specific risks but remain exposed to others. Gyro’s design choice follows the portfolio theory model by exposing itself to the risks of each constituent stablecoin, yet minimizing the potential impact of individual failures.

Rating*

Stability - 4 - The protocol is designed to be 100% collateralized by other stablecoins and uses arbitrage incentives.

Trustlessness - 3 - The protocol is intended to operate trustlessly with innovative governance mechanisms, however it exposes itself to some centralized stablecoins.

Scalability - 3 - $1 of collateral per stablecoin.

Simplicity - 4 - Gyro allows users to mint GYD by depositing any of the accepted stablecoins.

*Based on information publicly available.

UXD Protocol’s UXD and Lemma Finance’s USDL

USD Pegged / Delta-neutral Crypto Collateral / Fully Collateralized / Reserve Redemption

UXD is a yield-generating stablecoin on Solana testnet that claims to solve the Stablecoin Trilemma by being stable, decentralized and capital efficient. The mechanism is simple and elegant. The protocol issues 1 UXD for every $1 of crypto collateral deposited into the reserves. Unlike other crypto collateralized stablecoins like Dai and Fei which require over-collateralization to shield themselves from volatility in reserves, UXD instantly hedges every Dollar’s worth of crypto deposited with a delta-neutral position (E.g, 1 SOL (long) deposited by a user is paired with -1 SOL Perpetual (short) on a decentralized exchange. Any adverse price movement in the collateral is offset by an equivalent gain in the hedged position, and vice versa.

Lemma Finance employs a similar design, but on Arbitrum mainnet.

Peg Stability Mechanism

Reserve Redemptions and Arbitrage (SM1) - Both rely on closed loop arbitrage.

Noteworthy Elements

Yield Generation - Since both protocols are exposed to short positions on their reserve assets, they are exposed to funding fees. As funding fees in crypto markets have been predominantly positive (on a long-term basis), the protocols generate a ‘yield’ on their reserves which are passed on to users. However, their yield distribution mechanisms differ

In UXD, all UXD holders’ balances are increased automatically, giving everyone an equal share of yield. However, in Lemma only users who stake USDL benefit from the yield. This gives USDL stakers access to leveraged yield (If half the users stake and the others don’t, stakers will be entitled to the yield generated on the total reserves (attributable to both stakers and non-stakers). Losses if any, are entirely borne by the USDL stakers. But if there are no USDL stakers, the funding payments will uniformly eat into all users’ balances.

Insurance Fund - UXD has an insurance fund (~$50M) that was initially seeded by capital raised by the team. This fund is used to smoothen out variations in funding yield over time and backstop any losses occurring due to exploits/under- collateralization. If the insurance fund is depleted, the protocol auctions off UXP tokens to refill the fund.

In contrast, Lemma has an insurance fund which takes a 30% share of the yields and is backstopped by the LEMMA token. The fund is not used to absorb negative funding rates. Instead, it is used to cover losses from black swan events such as collateral losses from forced settlement of positions etc.

Source of Price Information

UXD’s sources price information from Mango DEX which in turn uses Pyth and Switchboard oracles.

Lemma uses a Chainlink oracle

Risks/Limitations

Exposure to negative funding for a prolonged period - Although historical data may show otherwise, it is possible that a prolonged period of bearish market sentiment causes funding rates to turn and stay negative. In these times, the protocols would lose money. To avoid this situation, UXD protocol diverts a portion of the yield generated during periods of positive funding to the insurance fund so as to provide a sustainable yield to UXD holders when funding rates are negative.

Erosion of insurance fund - If the insurance fund is drained out and negative funding eats into the reserves, the protocol will become under-collateralized.

In contrast, USDL stakers receive the full yield when funding is positive and bear the losses when funding is negative. Further, if some portion of the stakers unstake their USDL, the leveraged exposure of the remaining stakers increases.

UXD’s automatic yield distribution mechanism can affect composability with other DeFi apps and liquidity pools.

The biggest risk to UXD’s/USDL’s ability to scale is shallow derivative DEX markets. Illiquidity may affect the protocols’ ability to enter/exit positions or may result in forced settlement leaving collateral unhedged. Further, if demand for UXD/USDL grows, the protocols may become one of the largest holders of ‘short positions’ on DEXs, causing funding fees to turn negative. A bet on UXD or USDL is thus a bet on Solana/Arbitrum’s DeFi ecosystem expanding multi-fold.

UXD’s reserve fund is at times deployed on centralized exchanges by transferring funds to the founder’s personal CEX account. This is done when funding rates are negative on DEXs while positive on CEXs to arbitrage the spread.

Apart from the protocols’ own smart contract risk, reliance on integrations with external DEXs expose them to potential bugs in their codes. Any exploits/code failures can lead to loss of protocol assets. (Such losses are borne by their insurance funds)

Although both reserves comprise uncensorable assets, exposure to any DEX that settles all P&L positions with USDC presents a short-term, transitory risk. However, there are rebalancing mechanisms to minimize exposure.

Rating

Stability - 4 - The protocols can not only achieve price stability, but offer inflation- beating yields to preserve purchasing power.

Trustlessness - 4 - The reserves offer the trustlessness of crypto assets without the volatility.

Scalability - 3 - They can theoretically scale better than other crypto collateralized stables due to a wider choice of collateral which would ordinarily be too risky as reserve assets.

Simplicity - 4 - Straightforward minting and guaranteed redemption.

Volt

CPI Pegged / Delta-neutral Crypto Collateral / Fully Collateralized / Reserve Redemption

Volt is designed to be an inflation-resistant stablecoin whose price starts at $1 and tracks the CPI-U index movement every month. The CPI adjusted value of VOLT represents the target rate, or the rate at which VOLT can be minted or redeemed by the user.

VOLT has two issuance mechanisms - (1) by deposit of FEI in the VOLT/FEI PSM and (2) through opening a CDP on Fuse Pool 8. VOLT is issued based on the price displayed in the VOLT Price Oracle, instead of using VOLT’s market price to prevent risk of CDP-liquidation.

Volt’s reserves are always over-collateralized and is expected to increase over time due to accrual of fees and yields in excess of inflation. Reserves can be segregated into core assets (stablecoins) used to yield farm and fully back VOLT and non-core assets comprising stablecoins, ETH, and other high-risk tokens which have the potential to increase protocol buffer/equity.

Peg Stability Mechanism

Peg Stability Module (SM1) - Similar to FEI and DAI PSMs.

Noteworthy Elements

Liquid Governance - VOLT introduces the concept of Liquid Governance, a mechanism through which Protocol Controlled Value (PCV) is redirected/allocated to yield generation avenues in a market-driven manner. Holders of the VCON (governance) token can pledge their tokens in a Fuse Pool and borrow a the PCV assets (in proportion to their VCON holding) for deploying in whitelisted avenues. These token holders borrow at the rate of inflation + a 2% reserve fee. Any excess return generated flows to the borrower. Any loss of capital is reimbursed to the PCV.

Source of Price Information

Oracle - The VOLT Price Oracle is fed monthly CPI data by the Chainlink CPI oracle. This price is used to facilitate minting and redemption.

Risks / Limitations

Since the price of VOLT automatically moves in line with CPI, it creates pressure on the system to achieve sustainable yield even when market conditions don’t support it, thus increasing the risk at which yield is generated.

Supply of VOLT is constrained by the availability of good yield farming opportunities, so it is less responsive to VOLT demand.

VOLT has partnered with Maple Finance to lend its assets to whitelisted borrowers on their platform. These are USDC loans secured through contractual agreements with the borrowers. Relying on off-chain contractual protections introduces trust assumptions in a ‘decentralized stablecoin’ ecosystem.

Due to its ever-increasing price, VOLT is not a borrowable asset. It serves as a store of value, but it cannot function as a standard of deferred payment, thus limiting its demand potential and scalability.

Volt’s PCV model puts Volt holders at the mercy of its governance token holder (similar to Fei)

Rating

Stability - 3 - The peg’s resilience will significantly depend on the protocol’s ability to generate yield and track the CPI movements. In the absence of protocol equity to cover the shortfall, VOLT will trade at a discount to the oracle price since reserves will be inadequate to fully back each VOLT.

Trustlessness - 2 - The only available yield generating avenue is Maple Finance. Assets are lent as under-collateralized loans, basis contractual rights. Further, Volt holders do not have guaranteed access to underlying assets of the protocol

Scalability - 3 - Lack of composability + Limited use case as a stablecoin ‘wrapper’

Simplicity - 4 - VOLT is easy to understand with a clear value proposition.

Sogur (Sagar) - Shut down

Pegged to IMF’s SDR initially, then floating / Basket of Fiat Collateral / Full to Partial Collateralization / Fractional Reserve

Although FRAX, the popular algorithmic stablecoin, claims to be the inventor of the fractional stablecoin, there was another before it. Sogur, formerly Saga, pioneered the concept of the fractional reserve model in 2017. Here’s an excerpt from their whitepaper -

“Reduction of the reserve ratio reflects increased confidence in the SGR token. Indeed, our model only decreases the reserve ratio when more SGR tokens have been bought, indicating increased demand and trust. When the reserve ratio is

reduced, SGR value no longer stems entirely from the backing reserve. SGR gains its own value as an independent means of exchange and store of value, and therefore our model allows SGR market cap to exceed the amount of money in Sögur’s reserves.”

For comparison, look at this -

“Although there's no predetermined timeframes for how quickly the amount of collateralization changes, we believe that as FRAX adoption increases, users will be more comfortable with a higher percentage of FRAX supply being stabilized algorithmically rather than with collateral.

The protocol only adjusts the collateral ratio as a result of demand for more FRAX and changes in FRAX price”

Sogur started off as a stablecoin pegged to and backed by a basket of assets, mirroring the IMF’s SDR (a basket of 5 currencies). The plan was to start with a peg to instill trust in the system and reduce the collateralization over time as a function of increasing demand, indicating trust and growing intrinsic value independent of reserves. When demand grew, the pricing algorithm would reduce the reserve ratio (by increasing the SGR price for the same amount of reserves) and vice versa. The system generates bid and ask prices at which it facilitates minting and redemption of SGR for reserves.

To clarify, under-collateralization did not mean that a portion of the reserves were siphoned off by the team or other parties. Rather, since the pricing module consistently increases the minting price of SGR when demand is high, previously minted SGR is valued at the new price (or marked to market), thus resulting in under-collateralization. A more relatable example is Ohm, whose bonding price increases with demand.

(Side note: Ohm = Sogur - floor price redeemability + rebasing rewards (funded by difference between bonding price and 1 DAI floor).

Peg Stability

After launch, SGR had no pegs but traded on the secondary markets in a range determined by the bid and ask prices from the pricing module.

Rating

Stability - 2 - As collateralization reduces when demand increases, the protocol is more prone to bank runs before it can achieve widespread adoption.

Trustlessness - 1 - Treasury assets are real world currencies held in bank accounts.

Scalability - 4 - Supply is not constrained by collateral

Simplicity - 2 - Floating pegs are more nuanced and less intuitive compared to fiat-pegged stablecoins.

Reflexer’s RAI

Floating Peg / Crypto Collateral / Over Collateralized / Reserve Redemption

RAI is a stablecoin backed by ETH. As in Maker, users deposit ETH (in SAFES, like Maker vaults) and borrow RAI. Its primary use case is to act as a volatility-dampened version of ETH to be used as collateral in lending protocols or as reserve assets in DAO treasuries. RAI revalues/devalues itself based on the its market price movements caused by interactions between the SAFE owners and RAI holders. It has a dynamic target price known as the Redemption Price.

Peg Stability Mechanism

Redemption Price & Redemption Rates (SM 5)

At inception, the protocol starts with an arbitrary redemption price. Once the Market Price deviates, the protocol sets a per second Redemption Rate (or the rate of change of redemption price) that increases/reduces the Redemption Price. The price movements are expected to occur as follows:

If MP is more than RP >> Redemption Rate turns negative to reduce RP >> RAI supply goes up because (a) borrowing power increases (debt is taken in RAI but valued in USD terms) and (b) RAI holders sell in anticipation of MP going down >> MP goes down.

If MP is less than RP >> Redemption Rate turns positive >> RAI demand goes up because (a) debt becomes more expensive as MP increases so SAFE owners repay loans and (b) speculators expect RAI’s MP to increase >> MP goes up.

The redemption rate works similar to DAI’s stability fee. But this design is more effective because when price needs to go down, stability fees cannot become negative, whereas redemption rates can keep decreasing till the market price reacts.

Liquidation

The protocol uses a liquidation mechanism that is practically the same as Maker’s but with a few additions

Liquidation Protection - SAFE users have the option of creating a safety pool (or ‘Saviour’) containing Uniswap LP tokens or ETH. When the SAFE falls below the liquidation ratio, the liquidator is forced to first add collateral from the user’s

Saviour to the SAFE. This is an innovative feature, unique to Rai, that allows SAFE users to avoid liquidation without sacrificing capital efficiency.

Dampened Oracle Prices - Explained below

Source of Price Information

The system receives collateral prices from Oracle Feeds (Governance whitelisted actors), which are then medianized to weed out extreme values.

Medianized values pass through the Oracle Security Module (which effects a 1 hour delay before prices are published) and into a Dampened Security Module that limits the value change between 2 consecutive price feeds updates.

The system also has alternatives to the Governance whitelisted Oracle Feeds - Chainlink and Uniswap TWAP.

Noteworthy Elements

Governance minimized - The team intends to hand over control of all key components in a phased manner. The end goal is to automate most system parameters such that changes can’t be made without deploying new contracts.

Liquidation Protection - Covered under Liquidation.

Risks / Limitations

The protocol is complex for the average Joe. A stablecoin needs to be intuitive and not over-engineered to have mass appeal and adoption. Complexity limits use case to traders / speculators and as a reserve asset for DAOs (allows ETH exposure without excess volatility)

Borrowing RAI is like borrowing in a foreign currency - principal is exposed to exchange rate volatility

Treasury is susceptible to crashes in ETH’s price.

Fundamentally, RAI is intended to be DeFi’s reserve asset/stablecoin. For this to hold true, everyday users must not evaluate RAI in USD terms. However, this is in contrast to the core stabilization mechanism which involves comparison with USD. RAI (or any other unpegged stablecoin) is likely to achieve mass adoption only when the comparison with USD ends (1 RAI = 1 RAI). That Rai is soft pegged to $3 begs the question ‘what does it really achieve by pegging itself to $3 instead of $1?

Unpredictability of rate setter feedback mechanism - only inputs are known, output is unpredictable. Even careful parameterization with extensive simulation cannot reliably predict results. The success of the protocol is contingent on the mechanism being able to influence market prices in a timely manner.

Rating

Stability - 3 - RAI has maintained a stable value around $3 since inception. However, considering its low daily trading volumes ($1M~5M) and the experimental nature of the target rate feedback mechanism it is difficult to assess whether the mechanism breaks under heavy stress.

Trustlessness - 4 - ETH is the only accepted collateral

Scalability - 2 - (a) The protocol only accepts ETH as collateral (b) Collateralization requirement is considerably more onerous than in Maker since SAFE owners need to manage situations where the price of ETH goes up while RAI’s goes down (this will have a dual impact on the LTV ratio)

Simplicity - 2 - RAI is a more complex version of DAI and is likely to restrict usability to speculators and DAOs.

Ampleforth’s AMPL

Floating Peg / Non-Collateralized / Rebase

AMPL is a rebasing stablecoin backed by nothing. It adjusts its supply in response to changes in demand. What this means is that if the price of AMPL goes up by 20%, the system algorithmically reduces the number of coins for all holders by 20%. This means that as long as one doesn’t sell any of their AMPL, their ‘shareholding’ (% terms) does not get diluted.

Peg Stability Mechanism

Let’s say you and I start with 1 AMPL each worth $1 each. Total combined value of AMPL = $2

Next, I manage to sell 1 AMPL for $2 to Elon. You now have 1 AMPL worth $2 and the Elon has 1 AMPL worth $2. Total combined value of AMPL = $4

Seeing that the price per AMPL has increased to $2, the system targets a price of $1 per AMPL by increasing its supply. In this case, your 1 AMPL previously worth $2, is replaced by 2 AMPLs worth $1 each, while the value of holdings remains the same.

Basically, if the price of AMPL goes up by X%, the supply of AMPL reduces by X%. Notice that the rebase mechanism has no impact on the value of your holdings. It simply replaces a static coin balance with a static coin price.

But if you started with $1 and now have AMPL worth $2, where did the increase come from? Because I sold 1 unit if AMPL for $2, all other units are valued at $2, increasing the market capitalization of AMPL. The increase is unrealized profit that exists only on paper, unless you sell it in the market for $2. What if I’d sold the AMPL for $0.5? You would now have $0.5 (0.5 AMPL x $1 after rebase). Volatile much?

Since the price of AMPL is always rebased to around $1, we measure stability based on the total market cap.

As one can see from above, AMPL’s market cap has been anything but stable. Funnily, AMPL maxis claim that it fulfils all the functions of a stablecoins but that it isn’t one.

Of all the attempts at creating a crypto-native form of money, Ampleforth is one of the most obfuscated designs, coming second only to Ohm.

Rating

Stability - 1 - AMPL is nowhere close to being considered stable. It’s a volatile asset masquerading as a stablecoin.

Trustlessness - 3 - In its initial version, Ampleforth was a centralized network with the team having the ability freeze tokens, blacklist addresses and upgrade contracts unilaterally. These rights were subsequently relinquished to the community.

Scalability - NA - In theory, AMPL is infinitely scalable. But that’s meaningless as supply is irrelevant in a rebasing token.

Simplicity - 1 - AMPL serves no purpose other than being a Bitcoin-wannabe / speculator’s hobby.

Basis Cash (BAC) and Empty Set Dollar (ESD) - Both failed

USD-pegged / Non-Collateralized / Seigniorage Shares

Basis Cash is an unbacked algo stablecoin that relies on a 3 token seigniorage model to maintains its peg. BAC is pegged to 1 USD, BAS is the dividend yielding share token of the system used to support expansion and BAB is the debt or bond token used to support contraction.

ESD is an unbacked algo stablecoin which uses the 2-token seigniorage model. The key difference from Basis Cash is that ESD has a bond token (ESDS) but not a share token. Instead, by staking ESD (stablecoin), a holder of ESD is entitled to a share for future expansions in supply.

Peg Stability Mechanism

Basis Cash

Contraction

When BAC is <$1, the protocol issues bonds (BAB) at a discount. Bonds entitle buyers to future increases in supply when BAC trades above $1 in exchange for surrendering BAC held by them today. BAB issuance leads to a decrease in BAC supply and increase in its price. BAB buyers bid on how much BAC they are willing to give up per BAB.

Expansion

When BAC trades at >$1, the protocol mints new BAC. The increase in supply causes downward pressure on price until it reaches equilibrium at $1. New issuances of BAC are first distributed to BAB holders on a FIFO basis. Once all BAB holders have been paid, excess BAC is distributed to BAS holders proportionally.

ESD

ESD uses a similar expansion and contraction model as Basis Cash with the following differences:

ESDS bonds expire 30 days from purchase, while BABs don’t. This ensures that the bond queue doesn’t become too long. On the flipside, this will warrant a higher discount for buyers due to the risk of losing the entire purchase amount.

Supply increases are first paid out to ESDS holders and thereafter split between ESD stakers and ESD LP stakers.

Risks / Limitations

The hardest part about maintaining a peg is stimulating demand when the peg breaks below $1. It requires users to believe that the peg will be regained and take action to reinforce this belief in others. But as is the rule with financial markets, incentives create action. Stronger the incentive, more predictable the outcome. The biggest drawback of bond-based stablecoins is that hope is a pre- requisite for bond buyers - they must believe in the peg - and that is never a good strategy. If some users buy bonds and realize that the peg isn’t being regained, it deters other potential buyers. In order to create a stronger incentivize, more bonds need to be issued per stablecoin. Further, as more bonds are issued, the probability of late bond buyers being able to benefit from a future expansion reduces, requiring even greater incentives in the form of lower bond prices. This cycle perpetuates till bond prices crash to zero. When this happens, it is mathematically impossible to further reduce the supply of stablecoins. On the other hand, stablecoins with an inbuilt redemption arbitrage loop have a significantly easier time mainting peg since the existence of an exploitable profit opportunity is incentive enough to garner required demand.

The bond system is susceptible to manipulation by whales in the following ways:

(i) suppressing the stablecoin price to cause expiration of bonds

(ii) drive stablecoin price above $1 to cash out on bond yields and drive it back under $1 to repeat.

(iii) not selling new BAC supply during expansion faces to keep the price of BAC >$1 in order to collect further yields.

Whale moves are a deterrent to participation of smaller users in stability management. In contrast, in reserve redemption models, any user can exploit arbitrage opportunities without taking on speculative risks.

Rating

Stability - 1 - Both protocols rely on profit-driven actors to maintain stability in the absence of reserves. However, these incentives are weak and require some amount of speculation. Further, ESD has a weaker design than BAC for 2 reasons

o the stablecoin is merged with the share token - as a result, the ESD’s fair value will always be >$1 since holders expect to benefit from future supply increases.

o In Basis, BAC/DAI LPs continue to earn LP incentives even during contraction phases. In contrast, ESD/USDC LPs only earn LP rewards when ESD > $1. As a result, ESD is prone to liquidity withdrawals during contraction, further weakening the peg.

Trustlessness - 4 - The tokens themselves are trustless, even if they are unbacked by reserves.

Scalability - 4 - As long as there’s enough demand for the stablecoin to push the price above $1, new supply can be created.

Simplicity - 2 - A stablecoin protocol should be easy enough for the average user to understand, including how stability is maintained.

Terra’s UST - Failed

USD-pegged / Non-Collateralized / Seigniorage Shares

UST is the native stablecoin of the Terra ecosystem. It is collateralized by LUNA, a volatile asset endogenous to the Terra ecosystem. It uses arbitrage incentives to enable a 1:1 mint/redeem function between UST and Luna.

Users can mint UST by burning $1 of LUNA and redeem by burning it for $1 of LUNA. As LUNA gets burnt in the process of minting, two things happen:

The number of LUNA in circulation reduces, so every other LUNA increases in value (call this a base increase since ‘Market Cap / Circulating Supply’ changes.

Demand for UST is perceived as growth of the Terra ecosystem, and hence estimates of future cash flows increase. This increases the market cap of LUNA which is the ‘equity share’ of Terra (this is a speculative increase)

Peg Stability Mechanism

Arbitrage Incentives [SM1] - Enabled by minting/redemption of $1 LUNA for every 1 UST, instead of using exogenous collateral as reserves. This mechanism works only as long as the market perceives LUNA to have value. When there is loss of confidence, UST is subject to the same downward spiral risk that stablecoins with bond tokens are subject to (i.e the amount of LUNA minted to redeem 1 UST increases with every redemption when LUNA’s price falls. In anticipation of this, concerned LUNA holders will front run this dilution and dump their holdings, causing additional sell pressure).

External Backstops - In a recent move, Terra Form Labs introduced an emergency backstop mechanism in the form of BTC reserves to absorb UST remption pressure. Instead of redeeming 1 UST for $1 of LUNA, users would redeem it for $0.98 of BTC. As we’ve seen over the past week, reserves can help support the peg, but only until they last.

On-chain Redemption Spreads - The protocol’s market swap function limits the amount of UST that can be redeemed for LUNA on 1:1 basis. Redemptions in excess of this limit will increase the slippage exponentially. This mechanism can only slow down the rate of redemption temporarily. When the shutters are lifted, users flee once more. Additionally, the mechanism requires frequent parameter changes to ensure inadequate on-chain liquidity for market swaps doesn’t lead to larger spreads and, as a consequence, depegging.

Source of Price Information

Terra relies on its validators to periodically vote on the exchange rates of LUNA and other Terra assets. Votes are tallied and the final exchange rates are determined by votes clustered around the weighted median value. All validators who have voted within a narrow band from the weighted median are rewarded and those who vote away from the median incur a penalty.

Risks/Limitations

Like every uncollateralized algo stablecoin, UST requires demand for it (and consequently LUNA) to be ever-expanding. The system fails when demand falls and UST redemptions lead to sell pressure on LUNA.

UST is not as trustless as one would think. Under the guise of preventing bank runs, the protocol choaks the redemption function by introducing swap spreads (as redemptions exceed a specified threshold, users get less than $1 of LUNA for every 1 UST). However, this mechanism only slows down the pace of bank runs, it doesn’t prevent them.

Seigniorage models backed by endogenous collateral, like Terra, by design benefit early investors of the governance token. Late participants are left holding the bag.

Rating

Stability - 1 - Death spiral risks eventually materialize. History has taught us that on several occasions. The next uncollateralized algo stablecoin is no different.

Trustlessness - 2 - The protocol makes it extremely simple for a user to enter the system but hard to exit for anyone other than the earliest users. Further, Terra’s reliance on investors/market makers to support the peg made it impossible for anyone to evaluate when the music would stop.

Scalability - 4 - Supply is not constrained by collateral

Simplicity - 4 - Terra was able to achieve widespread retail and merchant adoption due to its advertised 20% yield. But the apparent simplicity combined with shilling by investors and influencers without highlighting hidden complexities and risks of the protocol has left the average user worse off.

Frax’s FRAX

USD-pegged / Collateralized (Centralized Stablecoins) / Full to Partial Collateralization / Fractional Reserve + Seigniorage

FRAX is a stablecoin that fuses the fractional reserve concept pioneered by Sogur (Saga) with the classic seigniorage shares model.

Unlike Sogur which reduces the collateralization ratio (CR) by increasing the mint/redemption price of SGR , Frax reduces it by gradually taking away a larger share of the collateral deposited by FRAX holders and transferring that value to holders of its governance token, FXS.

Frax’s goal is to provide a highly scalable, decentralized, algorithmic money but the team has chosen to prioritize adoption growth over decentralization. The is understandable since decentralization without adoption is pointless. However, in its present form it is a wrapped version of USDC/USDT since >70% of its reserves are in centralized stablecoins (USDC, USDT) and Dai (which itself is heavily reliant on USDC).

Minting & Redemption

To mint, a user gives the smart contract $1 worth of USDC and FXS (if Collateralization Ratio is 70%, $0.7 USDC and $0.3 FXS). FXS is then burned to accrue value to FXS holders.

To redeem, the user deposits 1 FRAX and gets back $1 worth of USDC and FXS (similar to minting). FXS is minted by the protocol. Redeemer can sell FXS instantly for $.

Peg Stability Mechanism

Reserve Redemption & Arbitrage [SM1] - When FRAX > $1, arbitrageurs mint new FRAX for 1 USDC and sell them. When FRAX <$1, arbitrageurs can buy cheap and redeem for $1 (collateral + FXS)

Dynamic Collateralization - Frax implements a dynamic system which increases the Collateralization Ratio when FRAX is trading below $1. However, this is a weak solution that cannot respond fast enough to handle a panic-driven peg break and works when only a fraction of FRAX holders want to exit to the underlying collateral. It is impossible for FRAX to maintain its peg in a bank run scenario where all FRAX holders look to exit. In any case, FRAX has a floor value that is determined by the CR. If CR is 80%, arbitrage incentives ensure that the peg doesn’t deviate below $0.8 for an extended period of time.

Source of Price Information

Oracles - Frax combines Chainlink’s ETH-USD TWAP with Uniswap’s FRAX-WETH pool balance data to derive the FRAX-USD price.

Risks / Limitations

Calling FRAX a fractional stablecoin is in my view a misnomer. What FRAX does to stablecoin holders is partially take away hard value (USDC) and give speculative value in return (FXS). The hard value is then transferred to FXS holders and adds zero value to the protocol. The ‘fractional’ portion of backing could instead be deployed for Market Operations and generate yields. To draw a parallel to tradfi banking, merely increasing deposits of a bank doesn’t increase its valuation, it must happen through value creation. Similarly, increase in FRAX supply shouldn’t increase FXS valuation through value extraction from FRAX holders.

Another erroneous claim by FRAX is that it is capital efficient. Something can be considered capital efficient only when it requires less capital inflow to provide the same level of security/guarantee, which isn’t true since the protocol collects $1 from FRAX minters. Replacing a stable asset for a volatile & questionable IOU (FXS) not only doesn’t improve capital efficiency but it degrades the quality of the stablecoin itself.

Fractional reserve models similar to FRAX (unlike Sogur) are directly in conflict with the interests of stablecoin holders. The approach is in stark contrast to Fei which seeks to incentivize its governance token holders only for being over-collateralized, promoting risk management. Instead, FRAX takes the opposite route and rewards FXS holders through under-collateralization.

Rating

Stability - 3 - While it is prone to bank runs, FRAX will have a floor value that prevents it from going to zero. The CR is currently ~85%, which gives FRAX a floor price of $0.85.