Do veTokens deliver on their promise?

https://medium.com/flipside-governance/to-ve-or-not-to-ve-9e3d14d4ccc5

Raphael Spannocchi, Jun 2022

To ve or not to ve

Any DAO that has token-based voting faces the same inherent issue: that votes can be bought — and sold — quickly if those tokens are traded on exchanges. This has led to predatory voting attacks, where enough tokens to ram a proposal through were bought solely for voting and sold quickly afterwards. (You can read our blog post explaining the Beanstalk hack for an extreme version of this behavior)

Yet since its inception, DAO governance has been looking for a way to align the behavior of token holders with the long-term.

One emerging way is requiring holders to lock tokens in escrow before they are eligible to vote and allot more votes the longer tokens are locked. In theory this should mean that token holders want to see the protocol flourish, because their tokens are locked up there. This scheme is called voted escrow tokens — or veTokens.

Well, we want to know: does it work? To find out, we’re going to dive deep into the concept and then analyze some data. At Flipside we have access to very detailed databases filled with Ethereum and Solana transactions (among others) that give us unique insights into what’s actually happening on-chain. So we asked our analysts to tell us if veTokens do what they say on the tin. TL;DR: they don’t! At least not in the long term. But they do other things that you, dear reader, can profit from.

Let’s dive in.

The History of ve

veTokens were pioneered at Curve Finance. Curve’s main use case is as an extremely efficient trading engine that minimizes stable coin swap slippage. This has propelled the decentralized exchange to a place in DeFi heaven.

veToken explanation courtesy of Bowtied Effer

Curve also has its own token, $CRV, that gets distributed as a reward to depositors of its liquidity pools, and which has a rather unique use case. Owners of $CRV can direct emission by voting on which pool they should go to. More emissions mean higher yield, of course, and we all know that DeFi is awash in mercenary capital. More yield attracts liquidity, and more liquidity results in a tighter peg & less slippage. A win-win-win. More CRV emissions, more liquidity, less slippage. This triple whammy makes owning tons of CRV almost mandatory for stable coin issuers, who want to incentivize liquidity of their pools.

Curve developers’ artistic touch shines through in the Windows 3 style interface on top of the most sophisticated technology in DeFi.

Wanting to “align token holders’ interests with the long-term success of the project”, Curve introduced veCRV, given out in proportion to how long you locked your tokens up. You can also boost your earnings by up to a 2.5x if you lock your tokens for the maximum duration of four years. So not only do you get voting power by locking up your tokens, but you also get more rewards! But veCRV cannot be transferred. You need to HODL yourself.

If a protocol or a stablecoin issuer wants to control CRV emissions, they are now likely choosing to buy and lock CRV for the full four years. Remember: more voting power means directing more CRV emissions to your pool, attracting more liquidity. This voting is sometimes called gauge voting, because the number of votes is gauged and rewards adjusted according to the votes plus the size of the pool. Bigger pools (meaning more liquidity deposited), need more CRV to get to the same rewards multiple.

Curve profits from this model because sell pressure is reduced. Token holders and the DAO are aligned. To up the ante, veCRV voting power decreases over time, incentivizing users to top up their stash so they stay relevant. Pretty smart, right?

Let’s hold here for a second and review what we just learned from a 30,000ft perspective. So what happened? Pools get CRV emissions, CRV’s utility lies in directing CRV emissions, and locking them up means more power to direct. I see a circle-j@@k forming, but I digress. Let’s see what happened next.

Meme source: @CurveCap on Twitter.com

Enter Convex (sound of war drums in the background)

From a customer perspective the veCRV model created a new pain point. Locking up tokens for four years feels like burying them and losing the map with the location. Will Curve even be around in four years? Will CRV be worth anything? You’d be hard pressed to answer these questions with anything but hot air.

Curve’s tokenomics also have a Catch-22: more veCRV mean more rewards from your staking pool. But as more funds are locked in that pool, even more veCRV are needed to get the maximum boost.

What if there was an opportunity to have voting power and rewards boosts on CRV without locking your tokens for what feels like eternity? If that sounds attractive, this is just what Convex Finance built.

Convex offers 50% yield for the CRV you deposit. That’s more than double what Curve offers. Plus the cvxCRV you get are liquid and can be used for further DeFi shenanigans. “How’s that possible?”, you might ask. Here’s the magic:

Convex takes your CRV and gives you liquid cvxCRV instead

It locks your CRV on Curve for the max of four years and farms yields

In addition to those yields it gives you CVX tokens.

As you might expect, you can then lock the CVX to get slightly better yield and voting rights on Convex

Just below the staking interface (sceenshot above) is a sweet little caveat telling you that “Converting CRV to cvxCRV is irreversible. You may stake and unstake cvxCRV tokens, but not convert them back to CRV. Secondary markets however exist to allow the exchange of cvxCRV for CRV at varying market rates.” Remember the four-year lock up? That’s why. Once you give your CRV to Convex, they’re theirs.

So Convex gets CRV deposits which they get yield from, plus they accrue CRV voting power. As you can imagine Convex becomes a massive Curve whale after some time. Read on in the next chapter to find out exactly what happened.

The Curve Wars, aka the fight for control and yield

Just how big of a CRV whale Convex has become is a sight to behold. Look at what Flipside Analysts found out: Convex is just scooping up CRV non-stop and is currently hodling 47% of all circulating tokens. That’s more than eight times the amount of the number two, yearn.finance. This means that Convex is in charge of Curve emissions.

Percentage of CRV tokens owned by other protocols. Data: Flipside Crypto

Now, what does that mean for CRV’s price? Do protocols still need to buy a metric ton of CRV to direct yields their way? Quite frankly, the answer is No! Convex is so dominant that even the largest buyers of CRV would have no way to direct yields in other directions than those that Convex chooses.

So instead of buying CRV to influence emissions, protocols started to buy CVX to influence what Convex did on Curve and on Convex. Two birds with one stone. Amazing, right?

We mentioned that Convex also had a token, CVX. Well, Convex enablestheir token holders to vote on how they should put their CRV to work, but of course only token holders who lock up their CVX to get vlCVX (vote locked CVX) can vote. Don’t let the ‘l’ fool you, this is another veToken. Every CVX controls about six CRV making CVX holdings an efficient way to direct Curve yields, as advertised.

Convex pays very modest yields for locking up CVX, usually between 2% to 3%. But the lock duration is just 16 weeks plus seven days, or around five months.

The second round of the Curve wars — Convex and [Redacted] Cartel

If you look at Convex as a way to make voting on Curve more efficient, you can probably see where this is going. A couple of clever developers had the idea that they could make voting on Convex more efficient, by aggregating CVX liquidity and yields. This became [Redacted] Cartel, which quickly turned into a DeFi powerhouse.

[Redacted] offered an Olympus like rebasing strategy with insanely high yield, paid out in BTRFLY tokens. Bonding CRV or CVX offers the highest BTRFLY yields, and these two tokens currently make up almost 70% of their treasury. Soon [Redacted] became a powerful Convex whale and could also control a good portion of Curve yields that way.

Apart from the yields of locking CRV and CVX, [Redacted] actively pursued bribing incomes on behalf of their depositors. Let’s see how that works.

The Vote Bribing Economy: Llama Airforce and Votium

Protocols pay CVX holders to vote for them. This is called bribing. They do so because it’s cheaper to bribe holders than to buy CVX themselves. How much a protocol needs to pay to convince CVX holders depends on the competition, so bribes change semi-weekly. They usually range between $0.40 to $0.80 per CVX vote. One CVX costs $9 at the time of this writing, May 2022, which makes bribing a great way to maximize votes to your pools!

Convex holders profit, too. Instead of earning ~3% from locking they can earn 58% in bribes. Pretty neat! But voting takes time and transaction fees.

Enter Votium! From their website: “Delegating to votium.eth automates voting for the best $ / vlCVX possible.” Votium makes it easy for CVX holders: instead of voting on the weekly allocations yourself, you simply delegate to Votium, and they’ll maximize rewards on your behalf. Since protocols pay bribes in their native tokens, users could end up with a plethora of miniscule rewards that are more expensive to claim, than they’re worth. Gas fees for claiming them are often higher than the amounts. Don’t despair, there’s another aggregator.

Llama Airforce Union manages your Votium rewards by aggregating them and buying even more cvxCRV to stake.

Is your head spinning by now? Let’s break it down step by step:

Convex controls Curve emissions by owning so much veCRV

vlCVX control Convex

Protocols bribe vlCVX holders to make them vote their way

Votium automates the voting process for maximum bribes

Llama Airforce Union aggregates bribe rewards for users

[Redacted] Cartel aggregates bribing and staking yields for users

As you can see veTokens used for emissions and voting power gave birth to a whole ecosystem, an entire economy. But what did they do for the price of CRV?

veTokens and Prices

Let’s look at what the Curve wars did for the price of CRV and CVX, as well as the interplay with Tokemak’s TOKE and [Redacted] Cartel’s BTRFLY token. Tokemak is another yield and bribe aggregator that covers multiple protocols, not just Convex, like Votium does.

Convex’s launch depressed CRV price significantly. The chart above has a logarthmic scale on the y-axis, so the “tiny” drop in May 2021 is actually a precipitous fall from $3.78 to $1.32. CRV price recovered very slowly until it surpassed its former level more than half a year later. We can see very clearly that the value is accrued on Convex, not on Curve, in CVX’s price.

[Redacted] cartel’s BTRFLY token suffered the fate of many other ultra-high yield DeFi tokens inheriting from OHM: A short pump followed by a long, steep and painful decline. BTRFLY is currently down 99% from its all-time high.

You may ask if the veToken model is unique to Ethereum? Let’s look over to the Solana blockchain where there’s a highly liquid, low slippage stablecoin exchange with gauge voting too.

History repeats itself on Solana — Meet Saber and Sunny

Saber only operates pools of similar cryptocurrencies with little to no slippage. Thanks to its efficiency it became a Solana mainstay, with up to $4bn in TVL. Unfortunately, its SBR token had high inflation and little utility to start with. To dry up supply and boost use cases, the Saber team copied the veCRV model with a few small tweaks and launched veSBR.

Just as on Curve, veSBR wasn’t transferable and holders could use it to influence SBR emissions. And just like on Curve, another platform appeared that made locked SBR liquid and directing SBR emissions more efficient. Enter Sunny Aggregator and their SUNNY token.

Sunny Aggregator is the Convex of Solana. Sunny also allows user to earn more yields from their SBR tokens, by aggregating SBR and issuing SUNNY on top. Sunny also features a sophisticated bribe network where depositors can earn additional income.

Unfortunately for both Sunny and Saber, the tokenomics and especially the high inflation rates of SBR meant neither token ever took off. SBR is down 99% from its all-time high and Sunny even more. Saber and Sunny are a great example that veTokens are not tokenomics Valhalla. Without good underlying incentives design, tokens are doomed.

Which leads us to the question: What is the dark side of veTokens?

The dark side of ve-ing

So far, we have seen that veTokens drive demand, and that entire economies can be created on top of these illiquid and non-transferable tokens. But what about the downsides?

First, the long token lock periods are very prohibitive for many guppies. The more funds you have the easier it is to lock a portion of your portfolio for the maximum duration. And only the maximum duration gets the full benefits.

This allows whales to consolidate their control. Richer users or protocols usually need less liquidity. Protocols with large treasuries who can justify large deposits as market making can make it hard for smaller protocols and especially for retail investors to gain any influence.

Then, there’s a lot of rug-pull, hack, and fraud potential when tokens are locked and illiquid.

Four year lock-ups on a protocol with a large TVL gives hackers a lot of time and incentive to find flaws to exploit.

Of course, hacks and rug-pulls happen on protocols without voted escrow as well, but the long lock-up periods make this especially painful, because you can’t get your funds out, even if a flaw is discovered and you’d want to withdraw as a precaution. Many crypto projects fail to be maintained for four years, and if users cannot move their funds out, they will be dragged down alongside it.

If you’re designing a veToken model, we advise you to choose shorter locking periods. That goes a long way to mitigate almost all the problems outlined in this chapter.

Do veTokens align holders with the long-term?

Let’s circle back to Curve and Convex, because these two are part of the longest running veToken experiment. We have seen that veTokens can create a whole economy of aggregator and bribing protocols. We have also seen that after an initial spike in prices the value of these tokens was falling rapidly.

This is not a surprise. veTokens create incentives to lock tokens up, but ongoing CRV emissions on a growing TVL result in a steadily growing supply. And a portion of users will want to swap CRV gains to more useful tokens or stablecoins, instead of locking them up, so selling pressure doesn’t go away. If the sole utility of a token is directing emissions and nothing else, the portion of users who wants to sell will always be substantial.

CRV circulating supply, Source: Messari

Let’s take a look at another smaller-scale experiment. Platypus Finance tried to implement the ve model in a different way. Platypus is a stablecoin savings protocol, where users can stake USDT, USDC and DAI and receive PTP rewards. You can lock PTP to generate vePTP, which is neither transferable nor tradable. One staked PTP generate 0.014 vePTP every hour, and the more vePTP you have, the more yield your deposit gets. You’re incentivised to lock up every PTP to get more and more yields, until your reach 100x the vePTP of your PTP staked, which happens after about ten month.

How did this experiment turn out?

PTP price in USD. Source: coinmarketcap.com

As you can see it worked for a few months before investors headed for the door. As soon as PTP’s price was tanking, yields shrank and the incentive to keep PTP locked went with it. That led to more PTP selling pressure, and even less yield, and so on. Negative network effects are setting in and the price is caught in a vicious cycle. You can read more about network effects in our blog post here.

veTokens have a strong financial component, and little other utility. In the long term this makes them hard to justify as part of a portfolio. CRV, CVX, SBR, and SUNNY are all emitted as yield. But yield in a token with no value except the ability to direct more yield simply has low fundamental value. This creates incentives to head for the door as long as the music is still playing and increases selling pressure.

Do veTokens mean more voting participation?

Snapshot is one of the most widely used tools for off-chain voting in the DAO space. We’ve covered the basics in our “DAO contributor toolkit”, so please make sure to read that if you want more information.

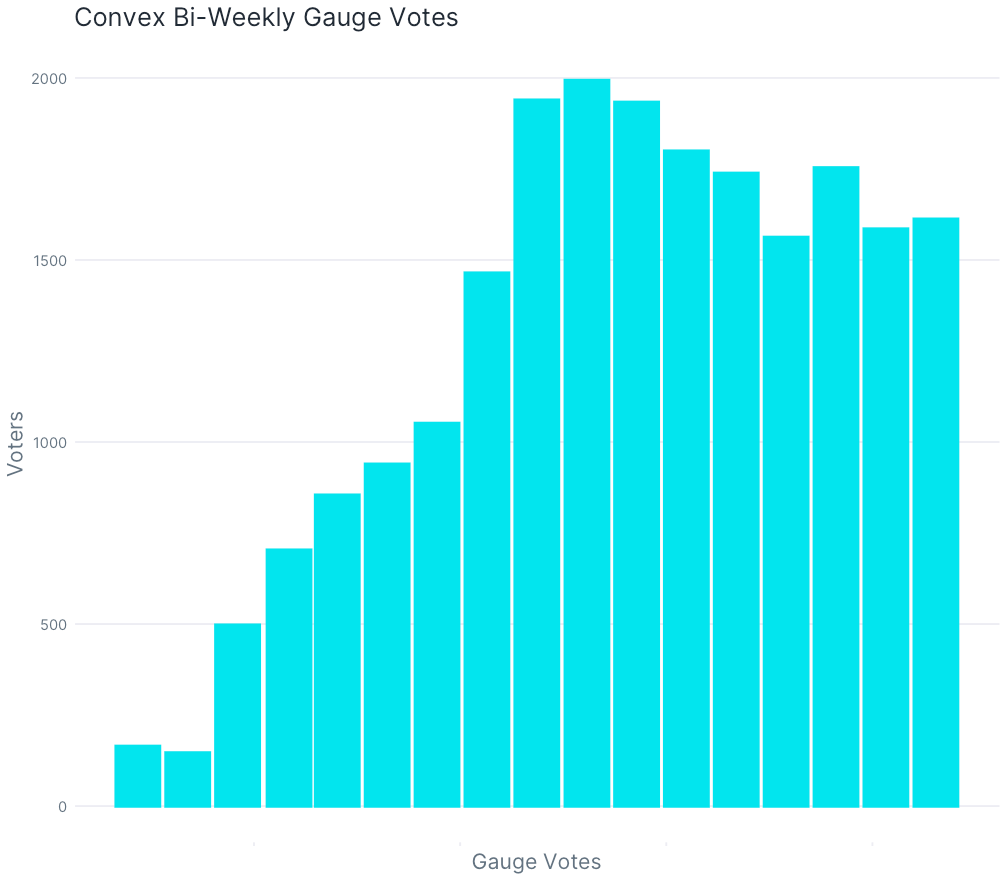

Snapshot.org allows analysts to access their data via REST APIs or a JavaScript library, and our analyst Nhat Nguyen took a closer look at what happened on Curve and Convex votes. Let’s look at Convex votes first. Convex upgraded its smart contracts to v2 in March 2021. We separated v1 and v2 voting behaviour.

You probably notice two things: First, weighted votes have at least an order of magnitude more participants than single-choice votes. Second: voting participation does increase over time.

Why is that? Weighted votes are gauge votes that govern emissions. Participation is extremely high because this is where the money is. Bribed voters have to participate to be eligible for payout and emissions are money in the bank.

Voting increased overtime, because only locked CVX can vote. A 17 weeks lock exposes users to volatility and if they don’t vote they can’t receive bribes and can’t have any influence. That would be like setting money on fire.

The same pattern repeats on Convex v2, as you can see in the chart below:

As time progresses and more and more tokens are locked up, voting increases to justify lock up and reap the rewards. The plateau in both charts coincides with a plateau in additional rewards that users could get via Votium or [Redacted] Cartel. DeFi capital is notorious for its mercenary nature and only stays as long as milk and honey flow, or until even juicier liquidity incentives are launched elsewhere. The amount of CVX locked also plateaued over time as investors started to sell their yield instead of locking it up.

We can see that requiring holders to lock their tokens in escrow does increase voter participation, but not as much as when holders actually get paid to vote. Paying for participation is a can of worms, because it introduces a sense of entitlement and a professional voting class that has substantial incentives to vote on ever larger voting remuneration. Convex gauge votes don’t have this problem because CVX emissions are integral to the protocol.

Conclusion

The question remains: To ve or not to ve?

But we have learned a lot in this blog post and this leads us to a better question: What’s the tokens utility? If it is only good for creating ve then the design is a circular conclusion and ultimately will not work. veTokens were brand new when Curve and Convex first duked it out in the interwebz. By now the token design is an old hat and will not get investors excited to jump on board, just by itself.

Imbuing a token with actual utility and good tokenomics is the first step. Only after you figured that out can you apply the ve model to create further demand.

How else could you align users and the long-term success of a project?

We want to give a short outlook on Soulbound tokens.

You’ve probably heard the proverb “those who most want to rule are those least suited to do it”. When you follow this line of thinking you can see that tokens that represent influence should not be transferable. Transferable and financialized influence means accumulation in the hands of those most versed in finance, which aren’t necessarily those aligned with your long-term success.

Souldbound NFTs are tokens that are rewarded to individuals as recognition for their contributions. They are not transferable and cannot be sold. Individuals might still be open to bribes, though, but we think they represent something more profound, more oriented towards the transcendent good.

veTokens are here to stay, in the meantime. We hope this blog post equips you with the necessary background to use and design them well.

Last updated