Liquid staking primer

https://medium.com/@MindWorksCap/liquid-staking-jostling-for-position-in-a-post-shanghai-ethereum-8e522c1841e6

MindWorks Capital, 12-Jan-23

The battle for staked Ether intensifies as withdrawals are slated to open in March after the Shanghai upgrade

Introduction

Ethereum’s successful transition into Proof of Stake last year bid farewell to the Proof of Work miners and replaced them with Ether stakers who now secures the blockchain.

Participating in Ethereum’s proof of stake would normally require a user to deposit 32 ETH to activate validator software which then stores data, process transactions and add new blocks to the blockchain.

However, this could create a lot of barriers for ordinary users to participate in proof of stake as it requires a high upfront cost (32 ETH is currently ~$42,000 as of Jan 9th, 2023), high hardware requirements to run the software as well as the technical know-how to run the validator nodes.

Traditional staking is also hugely illiquid, as staked coins cannot be withdrawn immediately, even after the Shanghai upgrade. Instead, validators have to queue to exit the staking chain in order to preserve network security.

Because of the high barrier to entry and lack of convenience, liquid staking has become a hugely popular method for users to stake their ETH without having to run any software while maintaining liquidity. Lido, the largest Ethereum liquid staking provider, has over 4.6 million Ether staked on its platform accounting for 29% of all ETH staked.

Ethereum staking landscape is also poised to undergo a huge transformation after the Shanghai upgrade, which would be the next time developers upgrade the Ethereum network. Shanghai will be highly impactful for ETH staking as it would introduce the long-awaited feature -withdrawals. Before this upgrade, all ETH deposited onto the beacon chain to particpate in proof of stake has no way to be withdrawn back to the mainnet.

How Liquid Staking Works

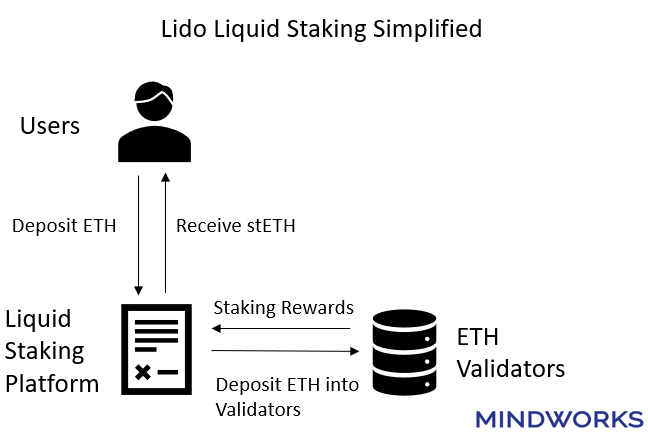

Liquid staking’s process is actually pretty simple. Users deposit tokens into a smart contract, which then are deposited into affiliated validators. Users will receive a token that represents the amount they have deposited into the liquid staking platforms.

Let’s use Lido as an example. Users deposit ETH into Lido and receive stETH in return. The stETH token represents the ETH that the user has deposited into Lido. The stETH token will automatically rebase and increase according to the rate of rewards earned by Lido affiliated validators. Users can also freely trade and transfer their stETH without being subjected to lockups.

You might be questioning at this point how liquid staking has seemingly solved all the problems that traditional staking has, with no upfront costs (besides purchasing the ETH), no hardware and software involved as well as preserving liquidity over the ETH. Liquid staking, in reality, has solved most of these problems although it does have several problems.

Firstly, liquid staking is not trustless. By participating in liquid staking, you are trusting the validators chosen by your liquid staking platform not to act maliciously as it could then be subjected to slashing, which would result in the ETH deposited being permanently lost.

Secondly, the token you received in return for depositing, such as stETH, will not necessarily maintain its monetary value as you cannot currently withdraw it back into ETH and will need to trade it on the secondary market in order to convert it. In fact, stETH has consistently traded below peg since launch, so traders that have to exit quickly usually would face a small loss in terms of ETH.

Lastly, by overly relying on liquid staking platforms, Ethereum could become more centralized as one platform could reach a critical share of the overall validators. Some in the Ethereum community has already spoken out towards Lido’s dominance and whether it could potentially cause danger to Ethereum.

Ethereum Liquid Staking Landscape

While liquid staking is available on most proof-of-stake blockchains, we want to focus on Ethereum as it is the largest proof-of-stake blockchain by market capitalization as well as with withdrawals opening as soon as March.

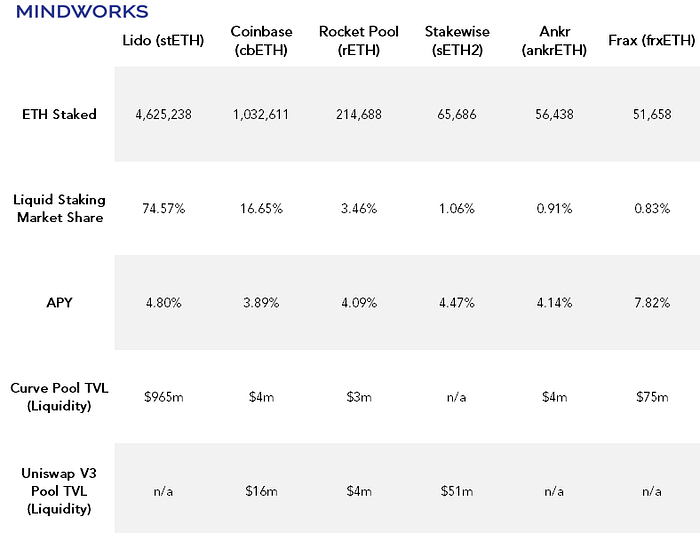

As we can see in the chart above, Lido currently dominates the Ethereum liquid staking market with 75% market share. A big contributor to this dominance is due to its advantage being the first to market, as well as higher adoption from other DeFi applications such as Aave providing it with more use cases.

While Lido currently has a stranglehold over liquid staking on Ethereum, the market is about to enter a new phase of adoption as ETH that are staked on the beacon chain could soon be withdrew provided that withdrawals are enabled by the Shanghai upgrade.

This means that ALL ETH currently staked could potentially be withdrawn and staked elsewhere, whether or not they are currently in liquid staking pools or at home solo staking.

Given the advantages of liquid staking mentioned above, in all likelihood we should see the amount of Ether staked in liquid staking increase as withdrawals open due to its superior user experience when compared to other solutions such as home staking and permissioned staking pools.

Can anyone beat Lido?

To understand Lido’s dominance, we need to understand why stETH is by far the most popular liquid staking derivative (LSD) on Ethereum.

Firstly, stETH has the deepest liquidity out of all the LSDs. According to DefiLlama, one could trade $500 million worth of ETH and still suffer less than 1% of slippage on its trade. Compared to cbETH, the second largest LSD by deposits, a trade of $10m to cbETH would likely suffer from a slippage larger than 1%. So, for large whales or crypto funds who is concerned about liquidity, stETH would likely be your only viable choice.

Secondly, use cases are key for LSDs. One of the key use cases stETH has that others doesn’t is leveraged staking. Leveraged staking is a process in which you use your LSD as collateral to borrow ETH, converting that into a LSD so that you could multiply the yield through leverage. Aave, the largest lending platform on Ethereum, only accepts stETH as the sole LSD on its platform. Meaning if you would like to do leverage staking on the most liquid lending platform, stETH is again your only viable option.

To answer the question, it is currently difficult to forecast anyone taking significant market share from Lido due to the aforementioned advantages.

That said, some of the competing protocols are innovating to attract stakers onto their platform. For example, RocketPool is putting decentralization onto the heart of their messaging, allowing anyone to run a validator on its protocol with 16ETH. Another competitor, Frax Finance, is leveraging its stablecoin protocol and innovative LSD token design to attract liquidity and increase staking APY for holders.

Conclusion

The Stakes are high for liquid staking protocols in a post Shanghai upgrade world, but the heightened competition should result in an overall better user experience and new use cases that will further enrich the DeFi landscape.

An innovation we would like to see is the enabling of leveraged staking on L2 networks. This would simultaneously increase the adoption for the L2 network and the liquid staking protocol, as well as enabling retail users to participate without being subject to high fees on the mainnet.

As we count down towards to Shanghai upgrade, we cannot wait to see the battle unfolds in a new chapter of the staking landscape on Ethereum.

Disclaimer: MindWorks Capital has not invested in any liquid staking platforms. Our team members hold ETH, cbETH, stETH and FXS. These statements are intended to disclose any conflict of interest and should not be misconstrued as a recommendation to purchase any token. This content is for informational purposes only, and you should not make decisions based solely on it. This is not investment advice.

Last updated