Stablecoin primer - Pt 1

https://medium.com/coinmonks/stablecoin-primer-section-1-path-to-stablecoins-8bcdb39c73e1

Fiat money’s inflation, bitcoin’s volatility bug, and stablecoins’ prowess

Osman Sarman, Mar 2022

Path to stablecoins by diedamla

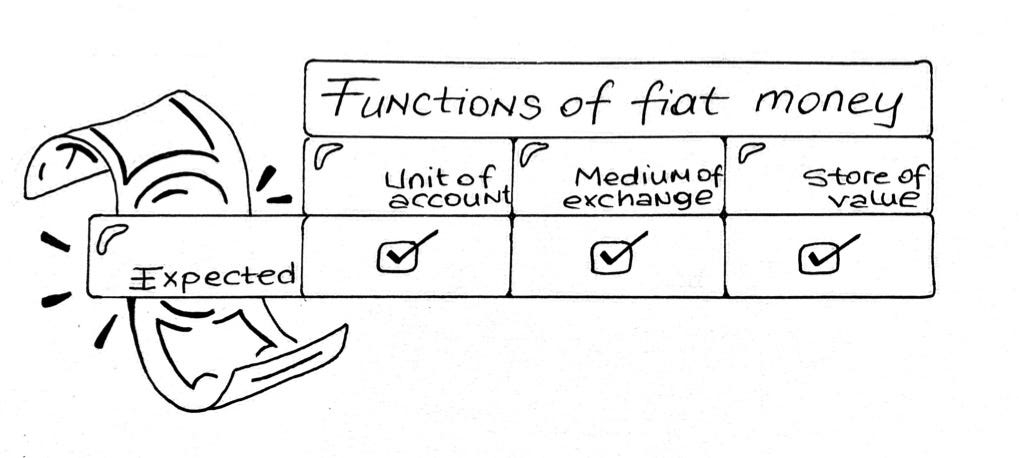

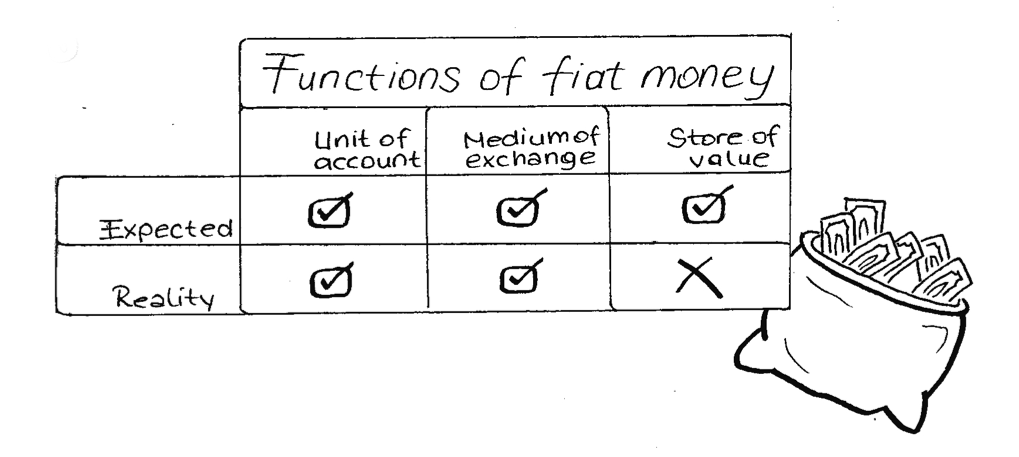

Functions of fiat money

Let’s start by looking at why we need money and how fiat money (e.g., US Dollar or Turkish Lira) lacks some of the features we desire from money. When I ask myself what I would like to accomplish with money, say $1k, my initial answer is: “To buy the things I want.” As decisive as that may sound, it doesn’t give the full picture. For example, why do I sometimes keep some cash in the drawer of my bedside table? So to really understand why I need money, I find myself going one level deeper and observing what I really do with money. Restating the question accordingly:

What do I use money for?

To calculate: In order to be a part of society and a complex economy, I need to know how to value my productive output and what I can get in return for it. For example, without money, say I am an apple producer, I would need to know the relative price of everything in terms of apples. But what if the thing I want to buy (e.g., pears) has no value in apples simply because their producer does not want apples. Money is a common denominator that allows me to easily evaluate my apple’s relative worth to pears and many other goods and services. We can think of it as an S.I. unit, such as Meters, to measure the worth of things instead of length or weight. As such, this function of money is usually referred to as the unit of account.

To transact: Consider again the scenario where I’m an apple producer looking for pears, but this time I already know that the pear producer does not want my produce. So I go to a tomato producer who wants my apples and exchange my apples for tomatoes, which I intend to exchange for pears. Unfortunately, once again the pear producer rejects my offer because she doesn’t want my tomatoes. With money however, I could go to the tomato producer, exchange my apples for money, and buy pears with that money. A more efficient process thanks to money acting as a medium of exchange for apples, pears, tomatoes, and many other goods and services.

To save: Sometimes our productivity exceeds our current needs and we want to save the “fruits” of our work for later enjoyment. For example, as an apple producer, I may have produced more apples than my needs. So instead of wasting my excess apples by having them rot, I need to exchange them for something that will preserve its value the next week and/or month. Without money, I end up having to go through the burdensome process of knocking on the door of many producers, hoping that one with durable goods would buy my excess apples. With money however, I wouldn’t have to go through the tedious task of finding producers of durable goods specifically looking for apples. I could simply sell my apples to anyone that wants apples and keep the money from this sale in my safe as a store of value.

So elementary, right!? I think that because money is such an ingrained part of our lives, we don’t often explicitly think about the various ways we use it. These three functions of money make up a good framework that allows us to elaborate on what we really need and use money for.

So why is it that we can use pieces of paper as money but not apples or pebbles? As simple as the above three functions may sound, for a material to be used as money, it has to have many characteristics at once. There are many pieces written on the topic of characteristics ofhard money, but for the purpose of this Primer I will try to summarize them in one sentence. Essentially, for a material to function as money, it needs to be widely accepted and portable across the globe, durable and scarce enough to preserve its value over time, and uniform and granular so that it can be used as a base unit. Luckily, fiat money has all these characteristics. But does it really?

Expected functions of fiat money by diedamla

Non-scarce fiat money

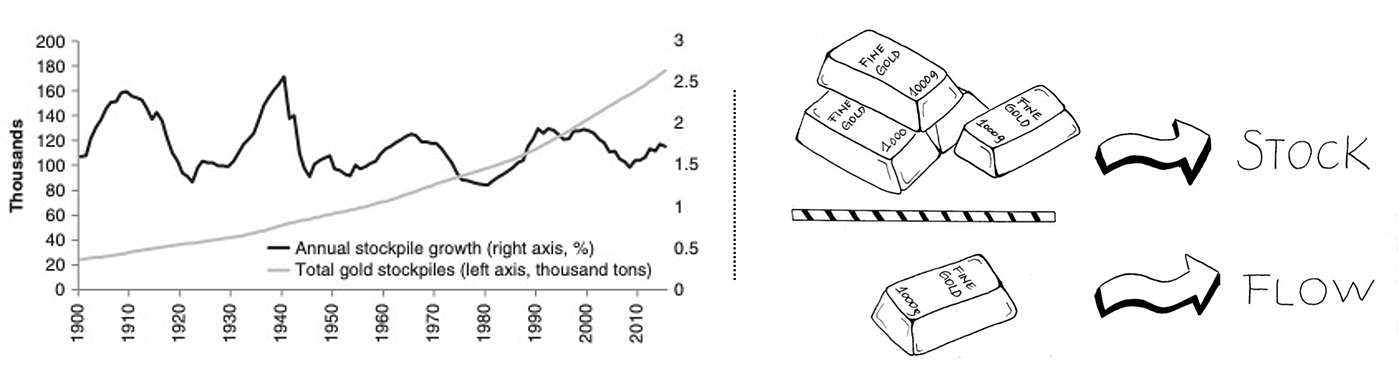

Of the characteristics I have summarized above, almost all but one can not be fully achieved by fiat money: scarcity. Scarcity is actually a pretty straightforward concept — anything that has short supply in the World is scarce, harder to obtain, and thus usually valuable in our eyes. To measure money’s scarcity, a good metric to be used is the Stock-to-Flow ratio. This ratio is calculated by dividing the amount of a resource (e.g., money) that already exists (e.g., in reserves) by the amount of that resource produced annually. Basically, Stock divided by Flow. If a material has a high stock-to-flow ratio, this means that a lot of that material already exists and not so much can be produced if wanted.

Gold has a high-stock-to-flow ratio because a lot of gold already exists and its annual production remains relatively stable. Graph source: The Bitcoin Standard, Chapter 3; Stock-to-flow by diedamla

During its early years, fiat money was scarce because it was tied to the Gold Standard, which required money to be fully backed by gold. In simple terms, this meant that there was only as much money as gold available. Given gold is a naturally scarce commodity that is technologically impossible to replicate and a lot of it already exists, fiat money was bound by gold’s scarcity or high stock-to-flow ratio.

However, with the detachment from the Gold Standard, fiat money’s scarcity was not bound by gold’s availability any longer but was controlled by governments’ (central government and central bank combined) monetary policies. The issue here is that long-term thinking is rare and each political administration wants to be remembered well regarding how much money they put in their citizens’ pockets. This brings us to:

Incentive to print

The seeds of abandoning the Gold Standard were sowed following WWI. Prior to this War, each country’s fighting power was limited to how much gold they had in their war chests. During the War however, it was decided that lasting long beats all other survival options. So the ease at which governments could print more paper currency to fund their wartime needs and post-war deficits became too tempting, and far easier than demanding taxation from citizens.

So for the next century, the world’s major powers departed from the solidity of the Gold Standard to utilize inflationism as a solution to economic problems. And when the reserve currencies detached from the Gold Standard, non-reserve currencies did nothing else but follow suit. What this meant was, administration after administration, fiat money’s scarcity and thus stability was put to peril.

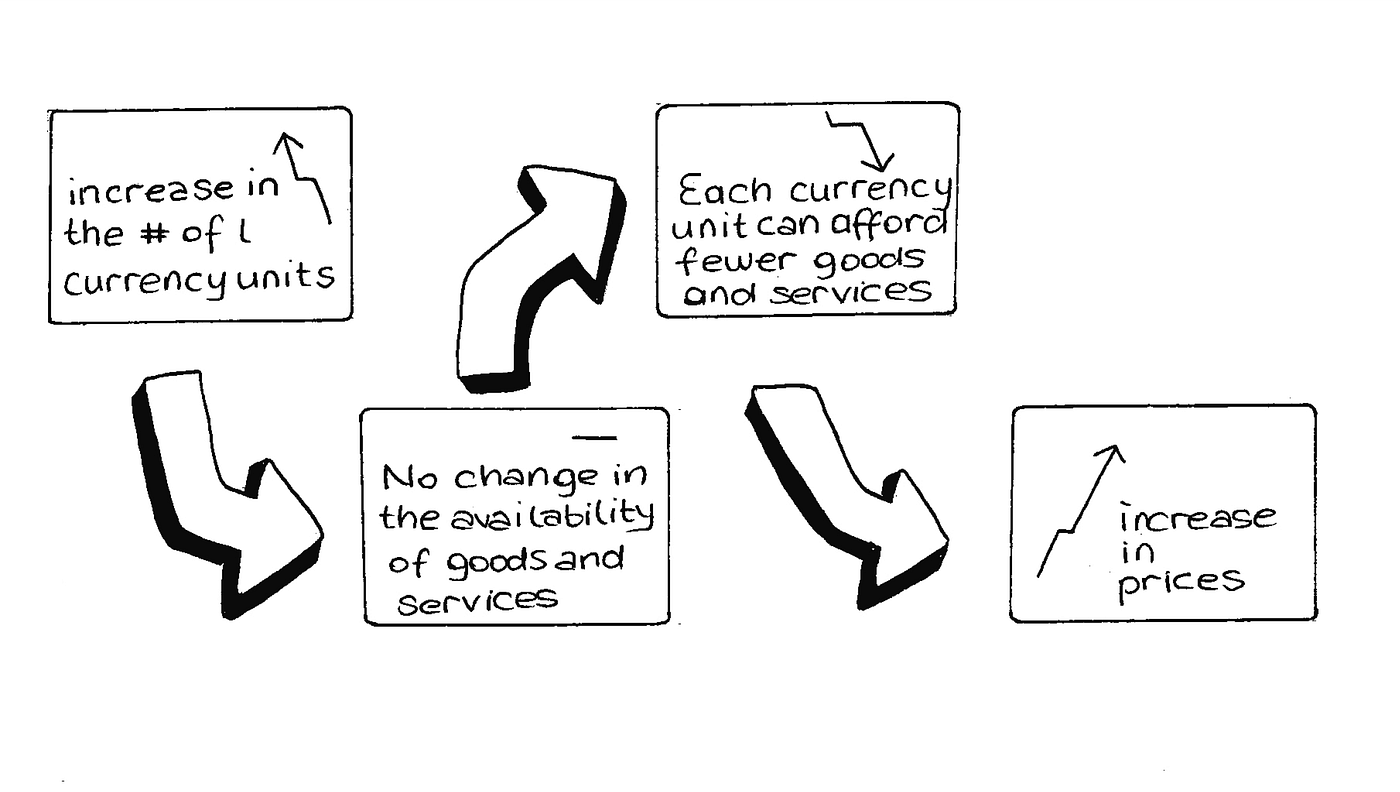

Inflation = -Scarcity

As Jim Bianco stated in the Bankless podcast, “inflation is a monster that we don’t really totally understand”. He is right. There are different schools of thought in the economic community when it comes to explaining what causes inflation. I will go with the Consumer Price Inflation (CPI) perspective simply because I think it is easier for me to understand as consumers of the economy. (For a more comprehensive perspective, I highly suggest this piece from Ray Dalio.)

CPI refers to the price of the majority of goods and services in an economy going up. The key here is that it is the purchasing power of money that decreases and not the price of goods that increases. Think about it, from one year to the next, the same number of apples grow from the same number of trees. If there is more money in the economy as a result of inflation, money’s relative value to apples becomes less because more people have money but the apple availability remains constant. Below diagram works well for me as a reminder when I think about CPI.

CPI diagram by diedamla

Take a caveat here that measuring CPI is a tricky subject leading to questions like: Which basket of goods and services should be tracked? Are there any inherent performance upgrades in these goods that justify price increases? How often should the basket of goods change? And more. Thankfully, there are great resources out there that aim to address these questions such as Lyn Alden’s The Ultimate Guide to Inflation — this Primer won’t be touching on these areas. For now we are concerned with what causes fiat money’s buying power to decrease.

So what causes consumer prices to inflate?

If money supply grows (blue line), we would expect consumer prices to inflate (orange line). That’s why throughout the accounting history, the orange line and blue line have been closely linked — with a few exceptions. The period from 1995-now is one of these exceptions. During this period, tech advancements in the US made goods and services more accessible and cheaper, meaning the growth in money supply was successfully used in increased production. However, with the recent reports suggesting that CPI is at an historically high level, we may finally be at a point where growth in money supply does not translate to growth in production but in consumer prices. Source

While there are many variables such as political regime change or climate change that may impact consumer prices, per capita money supply growth is one that is most closely linked. Going back to the detachment from the Gold Standard, we have established that the major fiat currencies are kind of free floating. This means they are not backed by some material that has a high stock-to-flow ratio, but are backed by policies and decisions that are malleable and prone to human error. That is the reason why, in instances like WWI, or more recently the Covid-19 pandemic, quick-result oriented governments had all the freedom to “save” their economies by printing more currencies (e.g., Fed’s 2020 Money and Credit Creation Program). This does save the day by allowing short-term debts to be paid. However, in the long term, money supply growth ends up causing people’s wealth accumulated in fiat currencies to run out. With that in mind, it is best to expect that the $20 bill that you put in your bedside table 5 years ago will afford you a few less apples now because the government printed lots of money during that time.

This begs the question: can fiat money really function as a store of value?

Expected vs. Real functions of fiat money by diedamla

Enters Bitcoin

History of moving value over the internet shows that the questions and issues regarding fiat money have been a riddle to be solved for a long time. Since the 80s, there have been many iterations over fiat money using different methods. For example, while Chaum’s Ecash prioritized anonymity using advanced cryptographic techniques, Jackson and Downey’s E-Gold prioritized stability and portability by centrally storing and digitally fractionalizing gold. Similarly, bitcoin is one of these iterations, except the fact that it became immensely successful thanks to the fine-tuned set of features it was designed for.

One of the most important features of bitcoin is its fixed supply schedule. This feature arguably drove its adoption to expand from the cypherpunk community to millions as a peer-to-peer electronic cash. Let’s quickly review bitcoin’s “deflationary” supply schedule:

Bitcoin’s decreasing supply schedule:

Bitcoin has a finite supply of 21 million units (vs. fiat money has infinite supply)

Bitcoin supply grows each time a miner (think a gold miner) discovers a new block on the blockchain

Bitcoin supply rate is fixed and decreases over time. Block discovery rate is adjusted every two weeks, and the number of bitcoins generated per block decreases geometrically. This means that every 210,000 blocks (~4 years), number of bitcoins created per block decreases by 50% (rate of increase of blue line decreases)

Bitcoin’s supply algorithm is cemented on the blockchain and agreed upon by all node operators. To change bitcoin’s supply schedule requires more than 50% of the decentralized set of node operators to agree — which is algorithmically disincentivized given it would be like shooting themselves on the foot for miners

The more bitcoin is extracted, the harder it becomes to extract new bitcoins. That’s why the rate of increase of new bitcoins (blue line) and thus bitcoin’s monetary inflation decreases (orange line) over time. This decreasing supply schedule is cool because it tries to mimic the rate at which new gold is mined and ensures a high stock-to-flow ratio for bitcoin. Source

What this translates to in plain language is that bitcoin’s scarcity is established, agreed upon, and cannot be changed by any person (e.g., president of a country) or persons (e.g., set of central banks). So in the long-run, as bitcoin’s adoption continues to grow from millions of people to billions of people, the 0.00052 BTC ($20 worth as of March 22) you forget in your crypto wallet now will most definitely buy you a few more apples in five years.

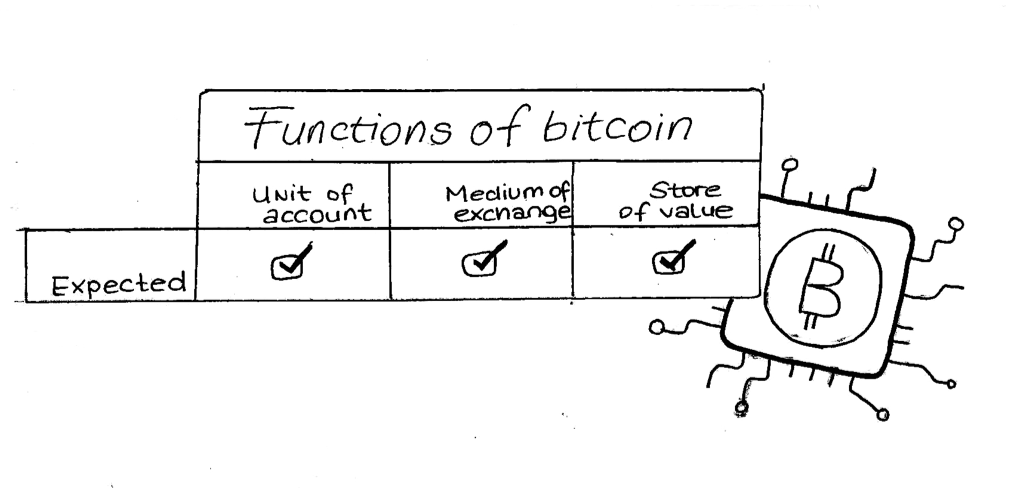

Expected functions of bitcoin by diedamla

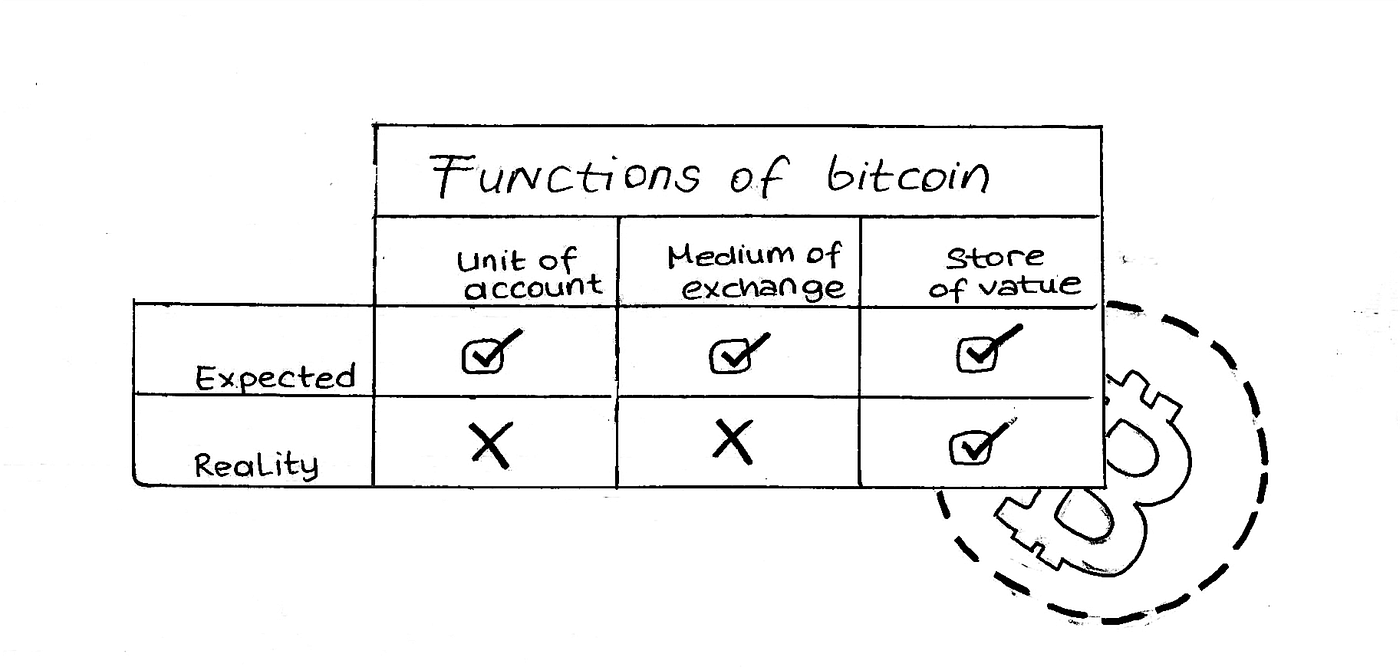

Bitcoin’s volatility bug

“In its (BTC) present state, it may not be convenient for transactions, not good enough to buy your decaffeinated espresso macchiato at your local virtue-signaling coffee chain. It may be too volatile to be a currency for now. But it is the first organic currency.”

Nassim Taleb’s 2018 quote from the foreword of The Bitcoin Standard still holds true. While there are some people and countries testing out using bitcoin in everyday transactions, I personally don’t use bitcoin when I am buying apples. And I am 99% sure that I am not an outlier. Like the whole crypto market, bitcoin remains to be a volatile coin, it even dies and rejuvenates a few times every year. It’s difficult to predict where bitcoin will stand in a few days because it fluctuates ~3% a day. On the other hand, we know one simple fact that, to be able to use something as a medium of exchange, we want it to have a stable value in the short-medium term. In that sense, while major fiat currencies like the US dollar lose purchasing power over a longer timeline, they function well as mediums of exchange. I can be reassured that, with a $20 bill, I can buy the same amount of apples this week and the next (if apple availability remains unchanged). Additionally, the volatility in bitcoin’s price undermines its functionality as a unit of account — just imagine what it would be like if 1 Meter meant a different length tomorrow.

So after 10 years of operation and a +$500 billion market cap, bitcoin is yet to achieve its full potential as the first organic peer-to-peer electronic cash. We just don’t use our valuable bitcoin investments as a medium of exchange nor a unit of account, yet.

Expected vs. Real functions of bitcoin by diedamla

This doesn’t mean that bitcoin is not revolutionary though. In addition to its fixed supply, bitcoin’s anonymity, decentralized governance, and fast & cheap settlement capabilities all make it an advanced form of money. However, for now, the last step in bitcoin’s quest to pose a real threat to fiat money seems to be stability. While whether this will ever be achieved remains to be a trillion dollar question, one thing we know is that bitcoin’s volatility lowered over the years with increased adoption. This perhaps makes trust and time two variables that the stability equation needs to be solved for any cryptocurrency. Given the urgency of solving this stability riddle (and astronomical returns that may come), the best minds in the crypto world are currently innovating on this front.

Path leading to stablecoins

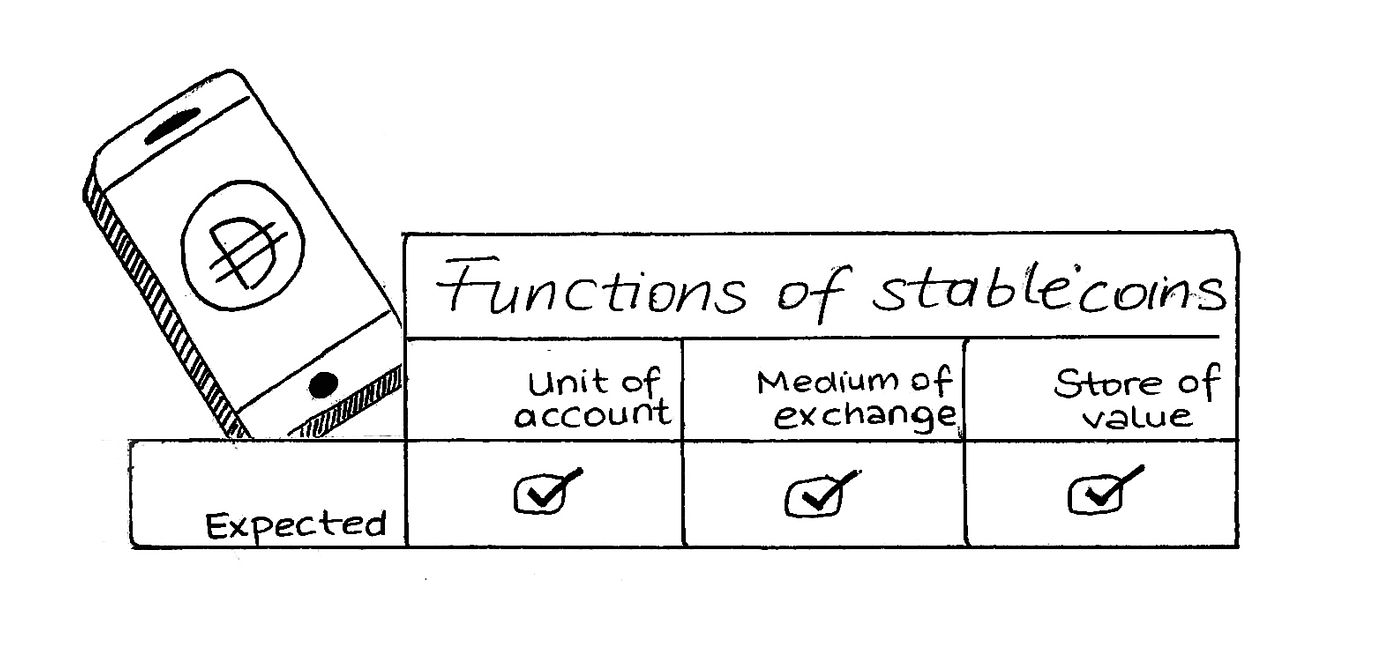

Above I mentioned “Like the whole crypto market” when I was ranting about bitcoin’s volatility. Volatility actually does not fully apply to all types of cryptocurrencies, with the exception being stablecoins.

Before defining what stablecoins are, let’s consider this. If we want to use any cryptocurrency as a transactional base money, we want it to preserve its value over a long enough time horizon and be stable in the short-medium term. For example, if I receive my salary in bitcoins, while one day my salary offers me 20 apples, the next day it may offer me 14 apples. Since this would be awfully confusing, I would naturally seek for an alternative currency that’s more stable and thus less confusing.

This is the logical path that leads us to stablecoins, which are crypto native non-volatile assets that enable global transfer of value.

So how do stablecoins achieve stability? Peg — they peg their value to a currency (e.g., Turkish Lira in BiLira’s TRYB) or a certain price (e.g., based on a basket of goods) by leveraging a variety of mechanisms that ensure minimum variance around this peg. To this day, there have been many stablecoin experiments testing the most optimal pegging mechanism. With each experiment acting as a feature update over the previous, these experiments optimize for a set of parameters while trading off for others, and thus experiments continue.

You may ask, “As an end-user, why do I have to be concerned about the pegging mechanism of a stablecoin as long as it guarantees me stability and allows me to transact conveniently?” The answer is, we are still in the early days of these crypto experiments, and given these experiments tend to require participation and commitment from users for bootstrapping purposes, we need to have informed theses around what needs to be true for these experiments to succeed.

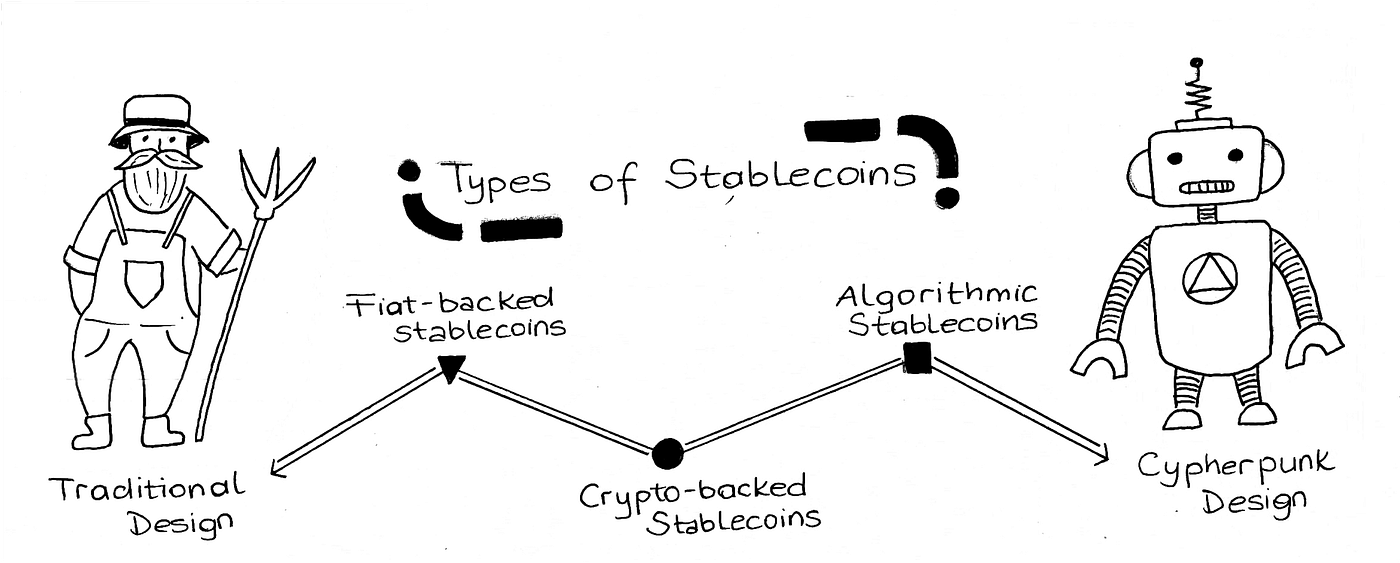

Ultimately, the pegging mechanism of choice is what leads to the existence of different types of stablecoins. And with no pegging mechanism proven to have a clear product-market fit, different types of stablecoins optimize for different parameters including stability, decentralization, and capital efficiency. As a result of fine-tuning for these parameters, three broad types of stablecoins emerge:

1) Fiat-backed stablecoins, 2) Crypto-backed stablecoins, and 3) Algorithmic stablecoins. While fiat-backed stablecoins rely on a widely used reserve mechanism, algorithmic stablecoins depend on game theoretic coordination of their backers. Types of stablecoins by diedamla

Before we further dive into the design principles and types of stablecoins in the upcoming sections of the Primer, let’s pause and quickly summarize our progress up to this point. So far, we have established that fiat money’s inflation and bitcoin’s volatility are leading the way for stablecoin innovation. For any stablecoin to successfully reach mainstream adoption (i.e., used as a replacement of fiat money), regardless of their mechanism, they need to achieve stability by developing trust and exist for a long enough time. As we make the case for stablecoin’s mass adoption, in Section 2 let’s look at where the market is at and if there are any early signs of mass adoption.

Last updated