Central bank digital currency (CBDC) 101- A primer

https://medium.com/m2p-yap-fintech/central-bank-digital-currency-cbdc-101-a-p-d6f9a2759c84

M2P Fintech, May 2022

Central Bank Digital Currencies (CBDC) have gained immense traction in recent years. Though the concept is new to India, several countries have successfully seized this opportunity to power their economy. In 2020, over 80% of the banks were researching the latent qualities of CBDC. But now, over 90% of countries are on the CBDC trail.

Why the spotlight on CBDC? Here are a few contributory factors.

· Surge in cryptocurrencies such as Bitcoins, Stablecoins, and Libra

· Shift in customer preference towards contact-free payment options (due to COVID-19)

· Sharp incline in tech-savvy population and ecommerce

· Need for trustworthy, stable, regulated digital currencies to manage threats from risky cryptos

Central banks worldwide are adopting digital currencies to gain deeper insight into money movement and prevent financial crimes. Financial institutions, monetary policy advisors, and tech enthusiasts are analyzing the economic and technical viability of digital currencies and their impact on fiscal policies.

What is CBDC?

The Central Bank Digital Currency (CBDC) is traditional money in electronic form, issued and regulated by a country’s central bank. Businesses, households, and financial institutions can use CBDCs to manage payments and savings. A nation’s monetary policies, central bank, and trade surpluses determine the supply and value of CBDC. The use of distributed ledger or blockchain technologies in CBDC is based on the requirement.

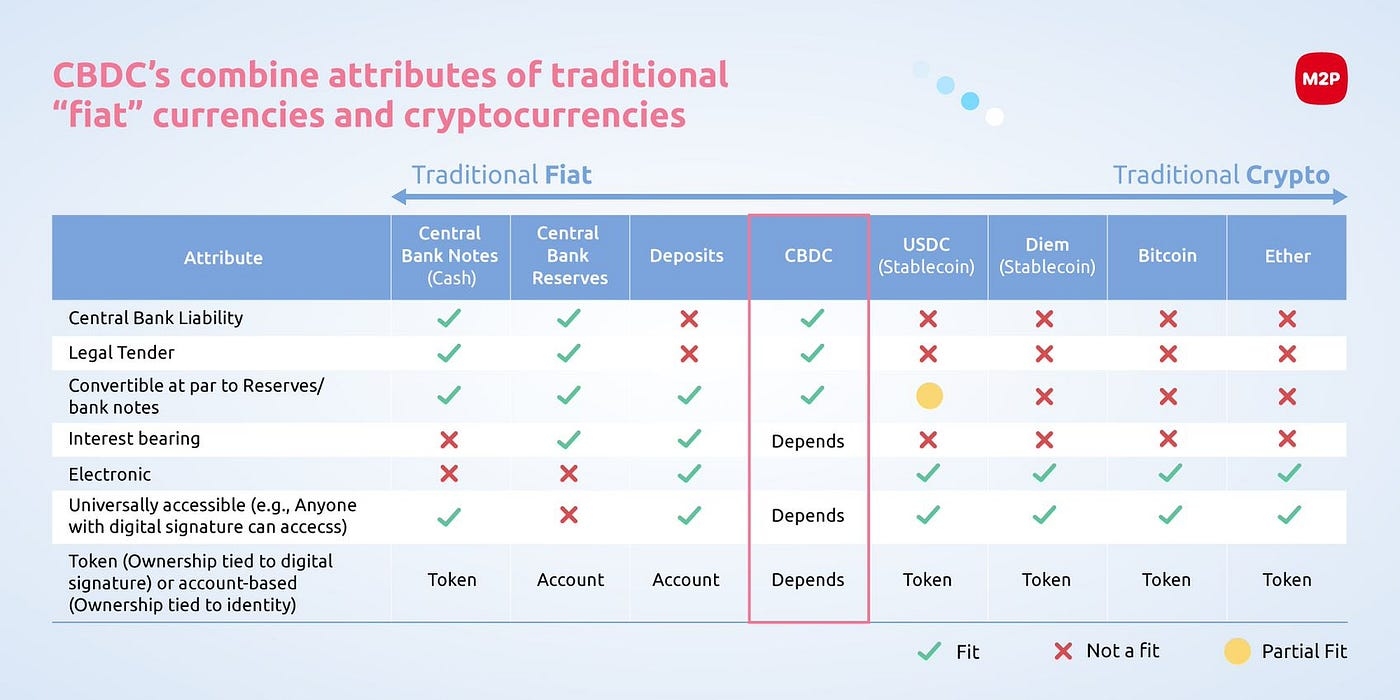

CBDCs are neither cryptocurrencies nor equivalent to electronic cash. Instead, they exhibit features of both fiat currencies and cryptocurrencies.

Fiat currencies

Fiat currency is physical money issued, circulated, and backed by a country’s government for everyday use. Its value depends on the governance factors, Gross Domestic Product (GDP), and the relationship between demand and supply. Examples of Fiat currencies include US Dollar, Euro, Japanese Yen, British Pound, Indian Rupee, and Mexican Peso.

More secure, less volatile

Like physical currency, CBDCs are expected to have a legal tender status whose value can be stored on central ledgers associated with the national bank. This process makes CBDCs more secure and less volatile than other digital currencies.

The below table compares the features of CBDC against the spectrum of other digital currencies. (Source: Ernst & Young 2021)

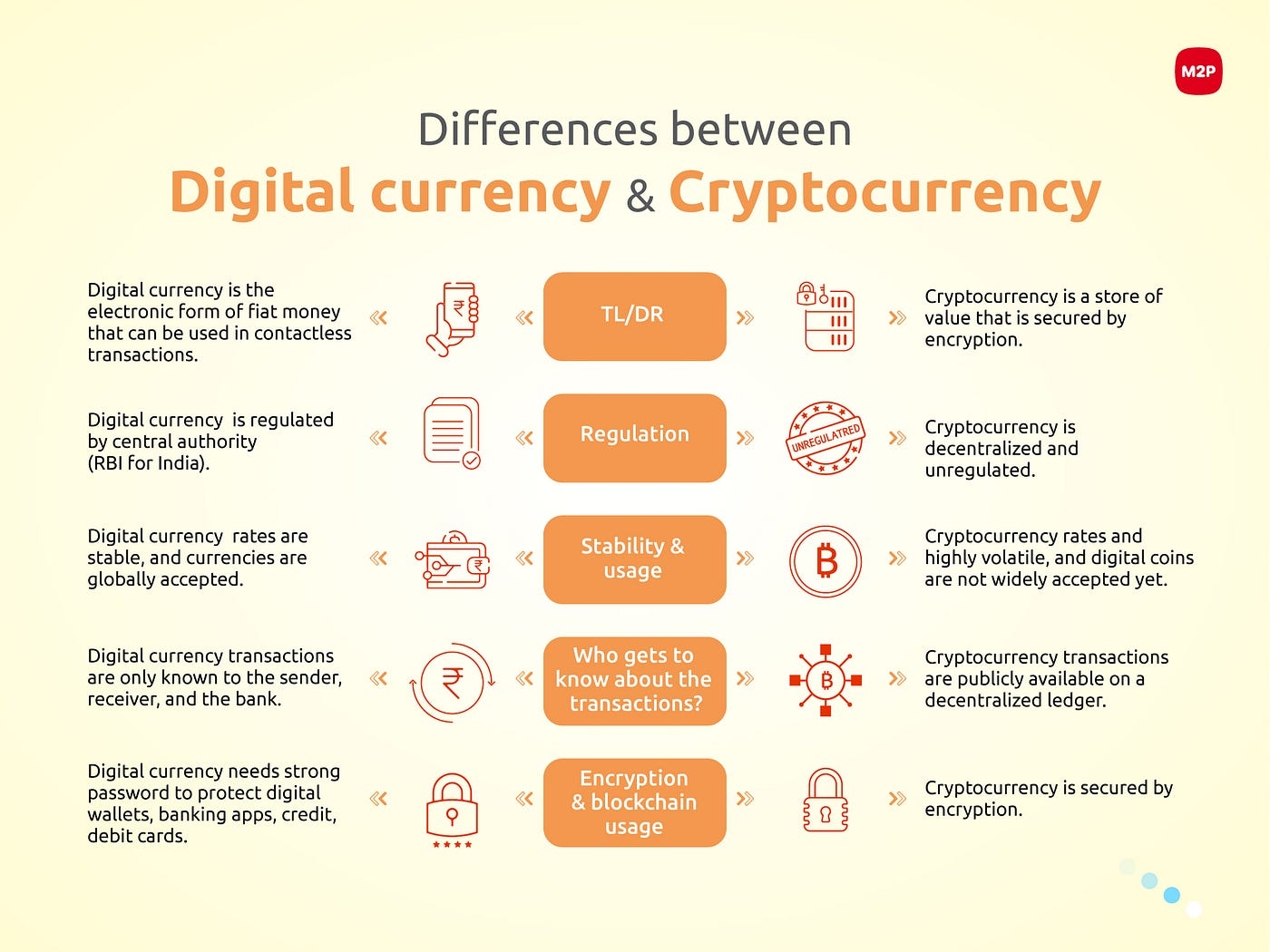

CBDC Vs Cryptocurrency

The following are the core differences between a CBDC and a Cryptocurrency.

· Type of blockchain network

· Anonymity factor

· Use cases

CBDC is a centralized structure as it is operated by central banks’ blockchain networks. It can be accessed only by financial institutions with privileges.

On the other hand, Cryptocurrency is decentralized. It is hosted by the public in a permission-less/open blockchain network that anyone can access. With cryptocurrency, users enjoy anonymity, but CBDC promotes transparency and accountability.

CBDC can only be used for retail payments and other financial transactions; however, any form of hoarding or investment activity is forbidden. Cryptocurrency has no such limitations and can be used for both speculative purposes and payments.

CBDC Models

CBDCs are highly versatile and customizable. They endow central banks and governments, with the liberty to evaluate and develop CBDC models to suit their requirements.

For instance, the Monetary Authority of Singapore launched a payment system that improved the speed and reduced the cost of cross-border transactions and foreign currency exchange. And England is evaluating a model that would enable people to use digital currencies alongside cash and bank deposits rather than replacing them.

CBDC models can be broadly classified into two broad categories.

· Wholesale

· Retail

Wholesale CBDC Model

The wholesale CBDC model is the most popular digital currency proposal. It gives financial institutions and banks a robust platform for payment and settlement transactions. Although banks already have direct access to central bank money, this model provides additional efficiency to the existing wholesale financial systems.

This digital currency model does not apply only to money transactions but could also be used in asset transfers between two banks. For example, if two parties are involved in an asset transaction, the wholesale CBDC helps in instantaneous payment and delivery of the asset. Such interbank asset transactions come with a counterparty risk, which could be augmented in the RTGS payment system. Banks believe implementing this model would simplify cross-border transactions, which are usually complex and expensive, as payments are routed through diverse countries, regulations, standards, and technical infrastructures.

Retail CBDC Model

The retail CBDC model will enable households and businesses to own digital currencies and make payments from a wallet or smartphone account. It aims to make financial services easy for the population without access to private banking facilities. Implementation of retail CBDC could decline the circulation of hard cash since it promotes the use of digital money on a daily basis. It eliminates third-party/intermediary risk and retrenches the cost involved in printing and managing cash flow.

Retail CBDC comes in two variants based on access possibilities.

· Account-based access

· Token-based access

Account-based access

In the account-based variant, the transaction between the originator and beneficiary is approved based on the verification of the user identity. Then, the central bank would process the transaction, and funds would instantly transfer from the payer’s CBDC account to the payee’s account. In this model, the central bank would need to create an account for each user with an integrated digital identity system.

Token-based access

The token-based model is similar to regular cash transactions. It entails approval from the originator and beneficiary to transfer the funds successfully. But the transaction would be established by dint of public-private key pairs and digital signatures. This model ensures a high level of privacy as it does not require access to the user identity. On the other hand, there is a potential risk of losing access to the funds if the user forgets the private key.

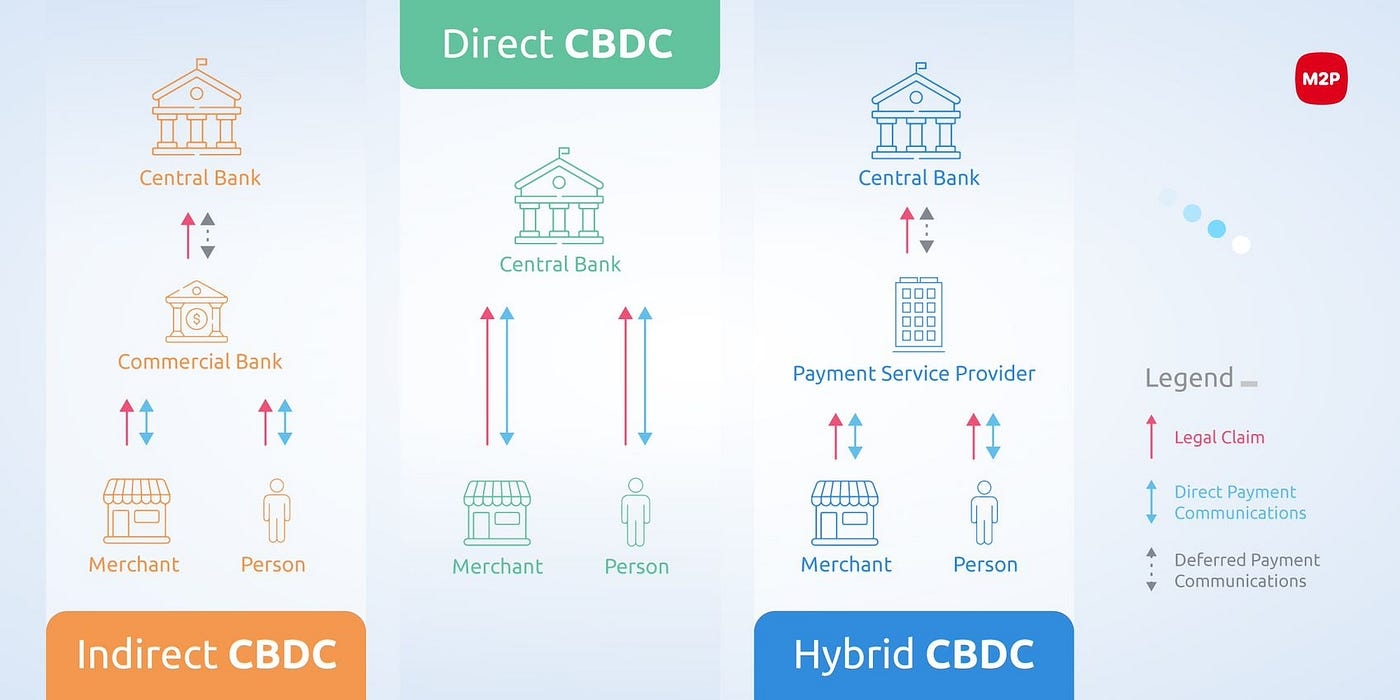

Architectures of retail CBDC

Retail digital currency architecture plays a vital role in tailoring the design according to functionalities. The legal framework of claims and payments operation of the central bank/private institutions are fundamental components of the architecture. They are the foundation of three different retail CBDC architectures.

· Direct

· Indirect

· Hybrid

In all architectures, the central bank oversees the issuance and redeeming process. Variations can be seen in the records kept by legal claims and central banks. As a result, it has the potential to function on a variety of infrastructures with minimal effort.

Direct (1-Tier) Model

The 1- tier architecture facilitates the end-users to directly hold an account with a central bank, eliminating the need for intermediaries. From community banks to informal gig workers, everyone would have access to central bank services. Here the central bank runs the centralized retail ledger and thus, maintains the records of all balances and transactions. As the central bank server is involved in all payments, this model is a single-tier design.

Indirect (2-Tier) Model

In the 2- tier model, commercial banks act as intermediaries between the central bank and the end customers. The CBDC claim is on the commercial banks (backed by the central bank). They would hold their reserves with the central banks and are obliged to offer CBDC to consumers on demand. The banks onboard customers and handle the retail payments while the central bank controls wholesale payments. The intermediaries take care of the KYC and regulate the retail payments.

Hybrid Model

Hybrid design is an amalgamation of both direct and indirect architectures. It gives an intermediate solution that facilitates direct claims on central banks collaborating with the private sector. This model allows financial institutions to segregate the CBDC from their balance sheet, which enhances portability. The legal framework helps the segregation of claims from the balance sheets of payment providers. This model gives the payment interface/service provider (or the intermediary) the responsibility of onboarding the customer, making KYC checks, and managing retail transactions.

The hybrid CBDC model is more complex than the indirect model, as the central bank maintains retail balances. However, it has the potential to offer better resilience than the indirect model and is simpler to operate than a direct CBDC. Hence, it is considered the most realistic CBDC model.

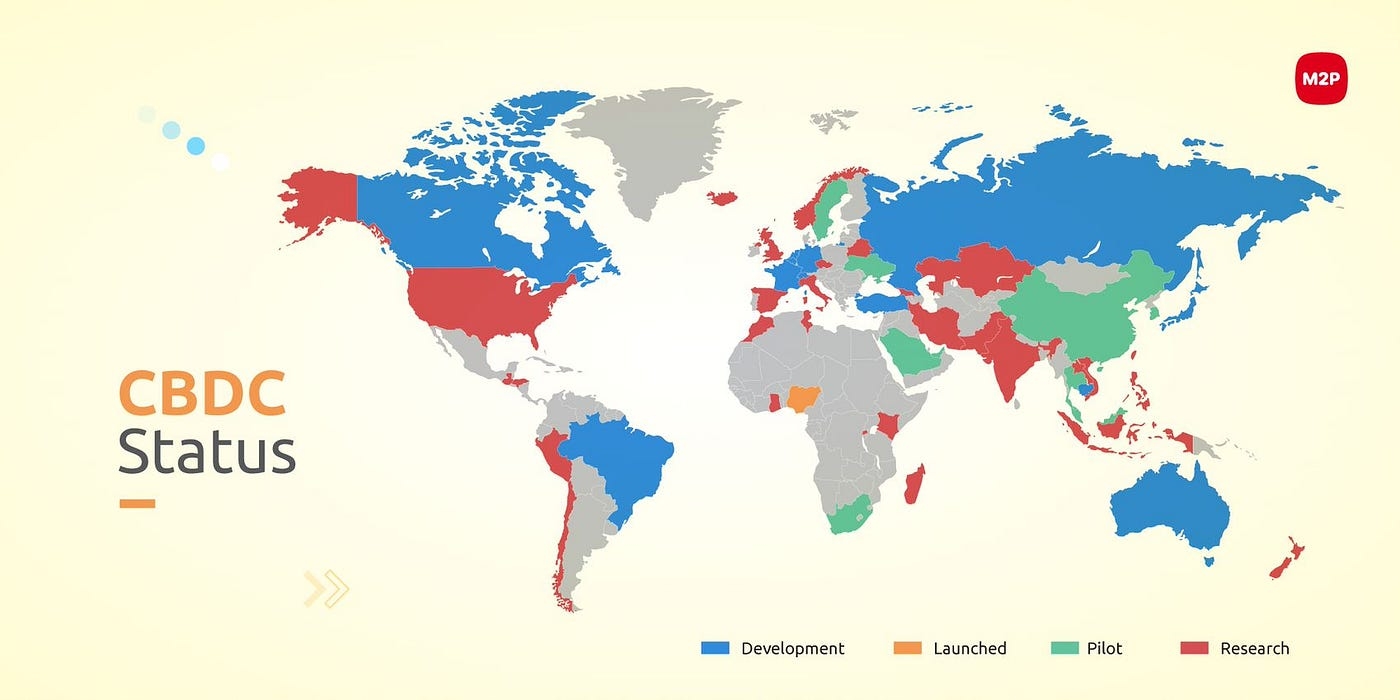

Where do countries stand on CBDC?

As of March 2022, around 87 countries are exploring CBDCs. Nations are either researching or testing the potential of official digital currencies.

Live CBDCs

Countries with live digital currencies are the Bahamas, Eastern Caribbean Union, and Nigeria. The names of the currencies are Bahamas Sand Dollar, DCash, and eNaira, respectively.

Pilot stage

Countries in the pilot stage are Jamaica, Uruguay, Sweden, Ukraine, Russia, South Africa, Saudi Arabia, United Arab Emirates, China, Thailand, Malaysia, and Singapore.

Research & development stage

Canada, Brazil, Switzerland, Turkey, Israel, Lebanon, India, Cambodia, Japan, and Australia are in the advanced research and development stage. The United States of America (Retail), Mexico, Peru, Chile, Kenya, and 40 other countries in Europe, South Asia, and Oceania are in the early research stage.

Effects of CBDC

“The motivation for introducing a central bank digital currency may change as policymakers explore the issue. Simply introducing a complement to cash for retail transactions may not make much of a difference in the economy. On the other hand, using wholesale CBDCs in cross-border transactions has the potential to raise efficiency. Employing new digital tools for policy purposes could really alter the macroeconomic playing field. The bigger the step, the more thought it’s likely to require. Expect that to take time.”

- Johanna Jeansson, Former Bloomberg Economist.

Benefits of CBDC

According to reports from global financial institutions, CBDC has tremendous potential to make financial services cost-efficient, accessible, and swift.

As the retail CBDC model allows consumers to have direct access to the central bank funds, it would resolve inclusion issues in countries with large underbanked and unbanked populations. Consumers can save/deposit their money in safe central banks and avoid risky propositions.

In addition, CBDC can help governments track money movement, as all transactions are recorded on the digital ledger. Detecting and avoiding illicit activities will be easier.

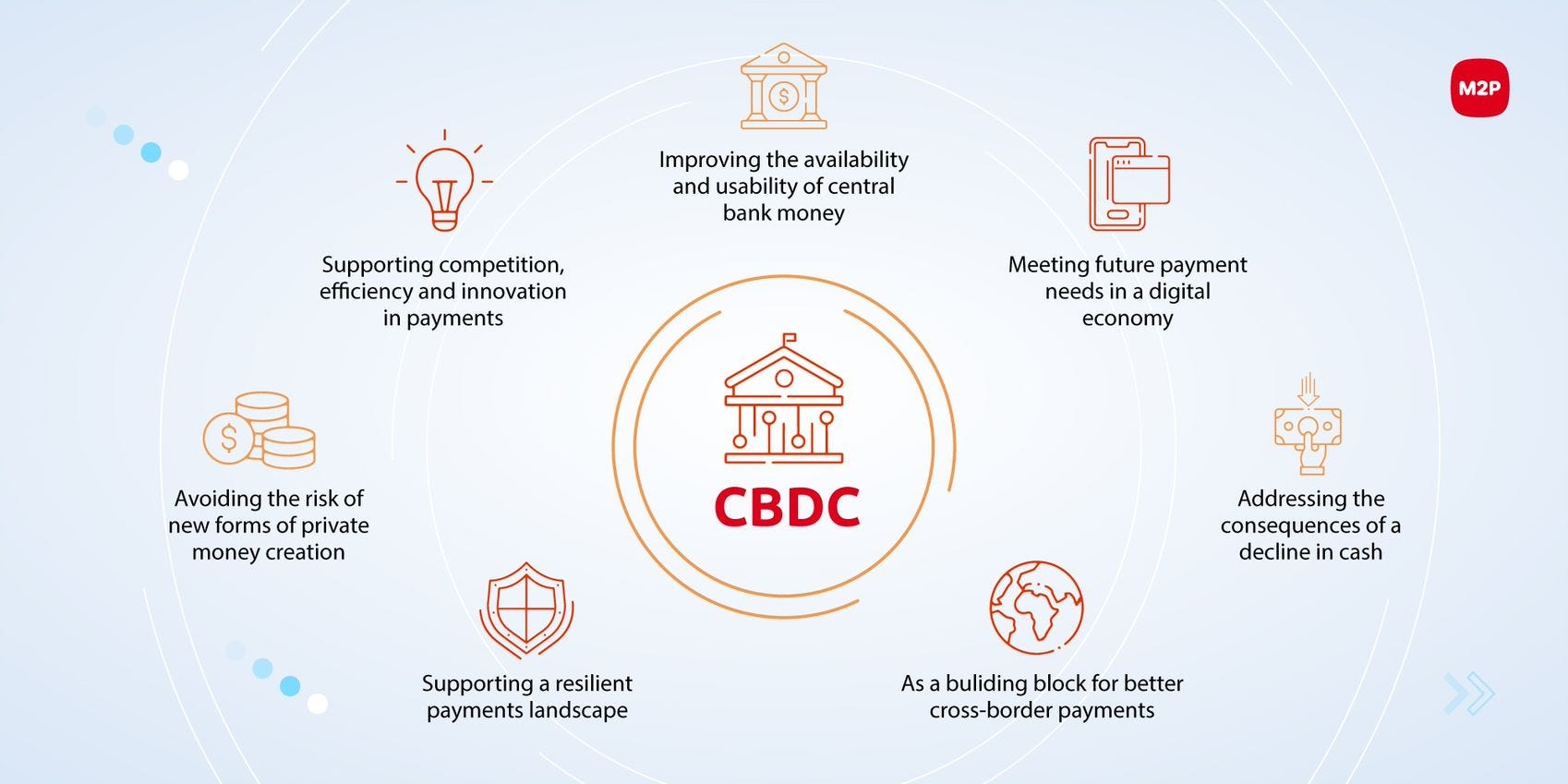

In March 2020, the Bank of England released a discussion paper summarizing how adopting CBDC models could help banks maintain monetary and financial stability. According to the report, CBDCs pave the way for innovation and resiliency in payments apart from improving the availability and usability of central bank money.

Drawbacks

First off, CBDC will give central banks extensive authority over the money flow and transactions. The banks could place restrictions on the types of transactions. Secondly, as the central bank could access user data and transaction information, privacy issues may arise. As an enormous number of public users will possess retail CBDCs, the model could be vulnerable to cyberattacks. Deposits and commercial loan issuance could shrink and banks may lose an appreciable slice of their business. This could lead to a drop in commercial bank revenues and can impact the stock market and financial instability.

Implication in India

The latest budget session shed light on India’s approach toward CBDCs. The Reserve Bank of India (RBI) is developing a retail CBDC model using blockchain technology and aims to launch the digital currency by 2023. With the introduction of CBDC, the government aims to boost the digital economy, curb Money Laundering or illicit activities, expand the horizons of international commerce, and more. CBDC has the potential to streamline currency management, curtail cash printing and logistical concerns, impel new opportunities, and simplify digital payments.

India, the third-largest fintech ecosystem holds colossal growth potential for digital transactions. The underbanked and unbanked market with low penetration of financial services needs to be tapped into, besides the tech-savvy population. CBDC together with banks and Fintechs can drive inclusion, transform customer experience, and enable seamless digital transactions.

Game-changing potential

CBDC will certainly be a game-changer in tomorrow’s economy. Several countries have ascertained that this concept promotes an efficient and transparent financial system. Given the attention and time that governments have dedicated to the research and development, it is just a matter of time before the models become live products and change the dynamics of economics and geopolitics.

Last updated